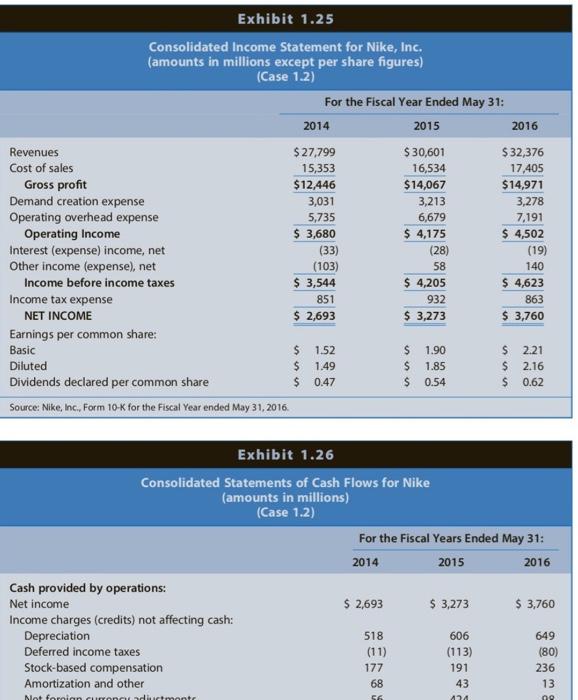

1-Using number from 5/31/2021, compute cash collected from customers:

Sales Revenue 32,376

Decrease in Accounts Receivable

Cash Collected from Customers

2-Using the numbers from 2016, compute cash paid for purchase of inventory:

Cost of Sales

$ 17,405

Increase in Inventories*

590

Cost of Inventories Purchased

Increase in Accounts Payable**

Cash Paid for Purchases of Inventory

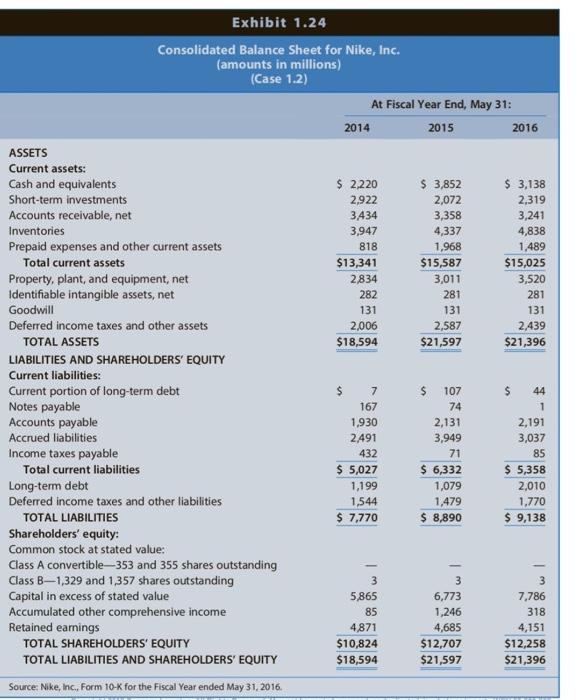

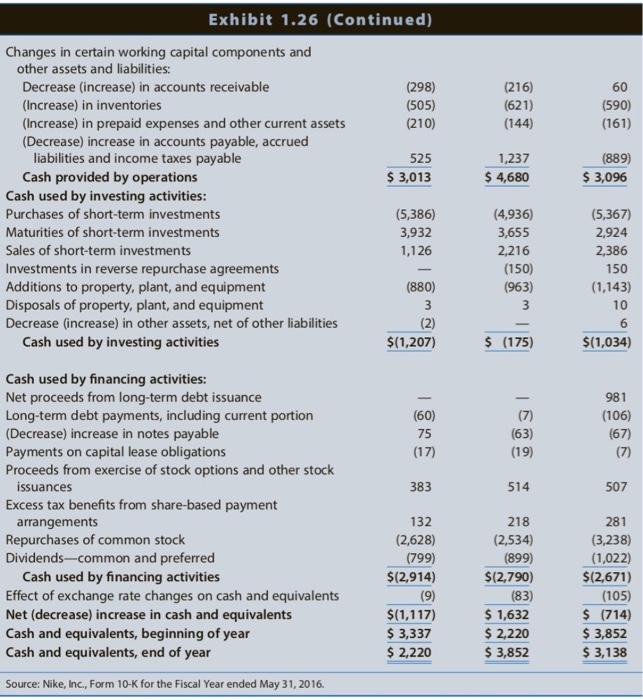

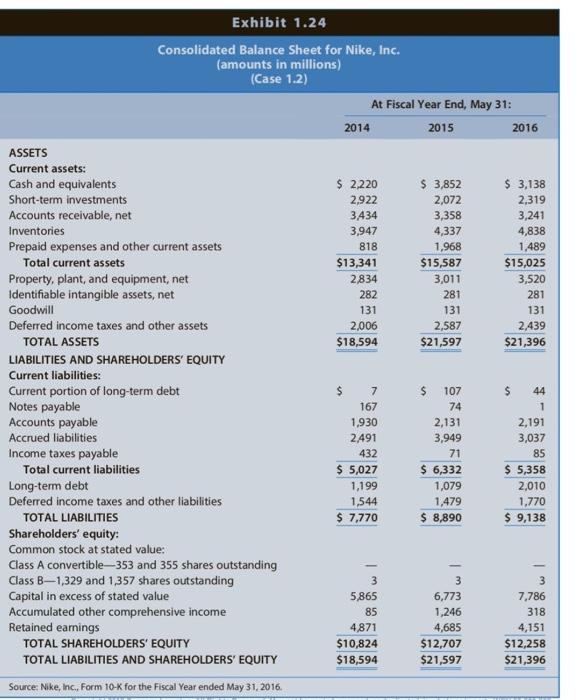

Exhibit 1.24 Consolidated Balance Sheet for Nike, Inc. (amounts in millions) (Case 1.2) At Fiscal Year End, May 31: ASSETS Current assets: Cash and equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net Identifiable intangible assets, net Goodwill Deferred income taxes and other assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-tem debt Deferred income taxes and other liabilities TOTAL LIABILITIES Shareholders' equity: Common stock at stated value: Class A convertible-353 and 355 shares outstanding Class B-1,329 and 1,357 shares outstanding Capital in excess of stated value Accumulated other comprehensive income Retained earnings TOTAL SHAREHOLDERS' EQUITY TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY \begin{tabular}{rrr} $2,220 & $3,852 & $3,138 \\ 2,922 & 2,072 & 2,319 \\ 3,434 & 3,358 & 3,241 \\ 3,947 & 4,337 & 4,838 \\ 818 & 1,968 & 1,489 \\ \hline$13,341 & $15,587 & $15,025 \\ \hline 2,834 & 3,011 & 3,520 \\ 282 & 281 & 281 \\ 131 & 131 & 131 \\ 2,006 & 2,587 & 2,439 \\ \hline$18,594 & $21,597 & $21,396 \\ \hline \end{tabular} Source: Nike, inc., Form 10-K for the Fiscal Year ended May 31, 2016. Exhibit 1.25 Consolidated Income Statement for Nike, Inc. (amounts in millions except per share figures) (Case 1.2) Exhibit 1.26 Consolidated Statements of Cash Flows for Nike (amounts in millions) (Case 1.2) Cash provided by operations: Net income Income charges (credits) not affecting cash: Depreciation Deferred income taxes Stock-based compensation Amortization and other Exhibit 1.26 (Continued) Changes in certain working capital components and other assets and liabilities: Decrease (increase) in accounts receivable (Increase) in inventories (Increase) in prepaid expenses and other current assets (Decrease) increase in accounts payable, accrued liabilities and income taxes payable Cash provided by operations Cash used by investing activities: Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Investments in reverse repurchase agreements Additions to property, plant, and equipment Disposals of property, plant, and equipment Decrease (increase) in other assets, net of other liabilities Cash used by investing activities \begin{tabular}{rrr} (298) & (216) & 60 \\ (505) & (621) & (590) \\ (210) & (144) & (161) \\ 525 & 1,237 & (889) \\ \hline$3,013 & $4,680 & $3,096 \\ \hline \end{tabular} Cash used by financing activities: Net proceeds from long-term debt issuance Long-term debt payments, including current portion (Decrease) increase in notes payable Payments on capital lease obligations Proceeds from exercise of stock options and other stock issuances Excess tax benefits from share-based payment arrangements Repurchases of common stock Dividends-common and preferred Cash used by financing activities Effect of exchange rate changes on cash and equivalents Net (decrease) increase in cash and equivalents Cash and equivalents, beginning of year Cash and equivalents, end of year \begin{tabular}{rrr} (5,386) & (4,936) & (5,367) \\ 3,932 & 3,655 & 2,924 \\ 1,126 & 2,216 & 2,386 \\ & (150) & 150 \\ (880) & (963) & (1,143) \\ 3 & 3 & 10 \\ (2) & & 6 \\ \hline$(1,207) & $(175) & $(1,034) \end{tabular} Source: Nike, Inc., Form 10-K for the Fiscal Year ended May 31, 2016