1.What is and describe the five question approach to using financial ratios. (15pts) 2. What is liquidity, and what is the rationale for its measurement?

1.What is and describe the “five question approach” to using financial ratios. (15pts)

2. What is liquidity, and what is the rationale for its measurement? (15pts)

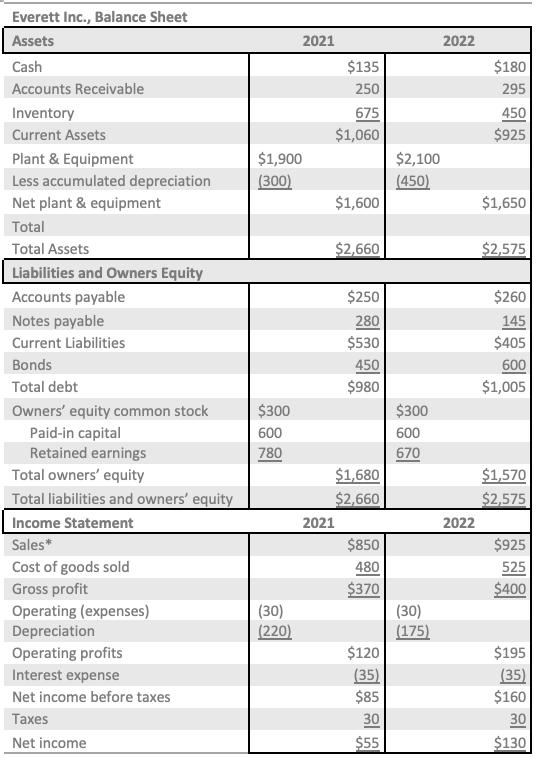

3. The financial statements and industry norms are shown below for Everett, Inc.: (70pts)

a. Compute the 7 financial ratios for Everett Inc for 2021 and 2022 and compare against the industry norms (better/worse). (42pts, 6pts per ratio) ANSWERED IN EXCEL

b. How liquid is the firm? (7pts)

c. Are its managers generating an adequate operating profit on the firm’s assets? (7pts)

d. How is the firm financing its assets? (7pts)

e. Are its managers generating a good return on equity? (7pts)

Choose 7 from here to compare | Norms |

Current Ratio | 5.00 |

Acid Test (quick) ratio | 3.00 |

Inventory Turnover | 2.20 |

Average collection period | 90.00 |

Debt Ratio | 0.33 |

Times Interest earned | 7.00 |

Fixed-asset turnover | 1.00 |

Operating profit margin | 20% |

Return on common equity | 9% |

You can copy and paste this into Excel

*20% of sales are cash sales, with the remaining 80% being credit sales |

Everett Inc., Balance Sheet Assets Cash Accounts Receivable Inventory Current Assets Plant & Equipment Less accumulated depreciation Net plant & equipment Total Total Assets Liabilities and Owners Equity Accounts payable Notes payable Current Liabilities Bonds Total debt Owners' equity common stock Paid-in capital Retained earnings Total owners' equity Total liabilities and owners' equity Income Statement Sales* Cost of goods sold Gross profit Operating (expenses) Depreciation Operating profits Interest expense Net income before taxes Taxes Net income $1,900 (300) $300 600 780 2021 (30) (220) $135 250 675 $1,060 $1,600 $2,660 $250 280 $530 450 $980 $1,680 $2,660 2021 $850 480 $370 $120 (35) $85 30 $55 $2,100 (450) $300 600 670 (30) (175) 2022 2022 $180 295 450 $925 $1,650 $2,575 $260 145 $405 600 $1,005 $1,570 $2,575 $925 525 $400 $195 (35) $160 30 $130

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Here are the calculations for each question based on the given financial statements and industry norms a Compute the 7 financial ratios for Everett Inc for 2021 and 2022 and compare against ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started