Question

1.What is the present value of the interest tax shields created by the new subordinated notes? Assume a 34% tax rate and that the notes

1.What is the present value of the interest tax shields created by the new subordinated notes? Assume a 34% tax rate and that the notes require annual interest payments. Your answer should be in millions rounded to 2 decimals/

2.How much value did Sealed Air's leveraged recapitalization create for shareholders? To answer this question compute the change the Sealed Air's market value of equity from 4/27/1989 to 4/28/1989. Your answer should be in millions, rounded to 2 decimals.

3.What is the present.value of the tax shields created by the new bank loan? Assume that the end of year 1989 is "year 0." The tax rate is 34%. Your answer should be in millions rounded to 2 decimals.

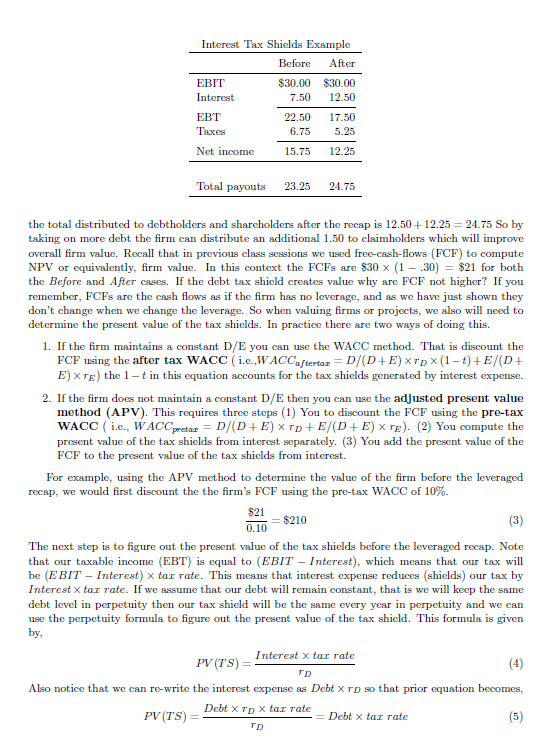

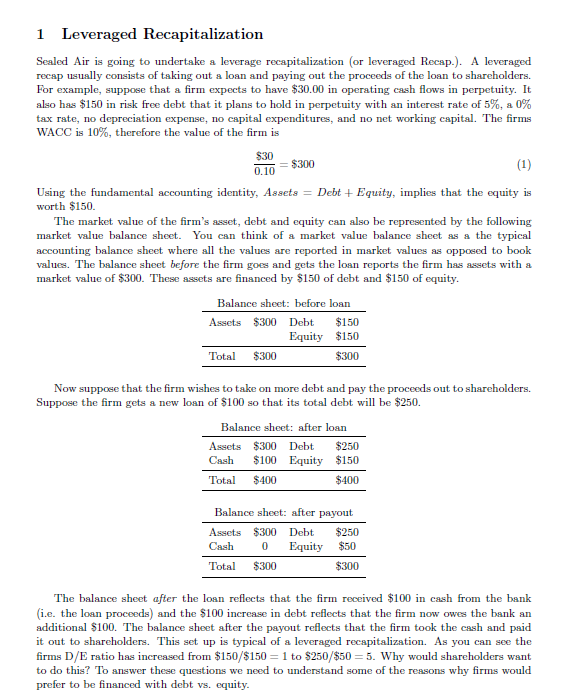

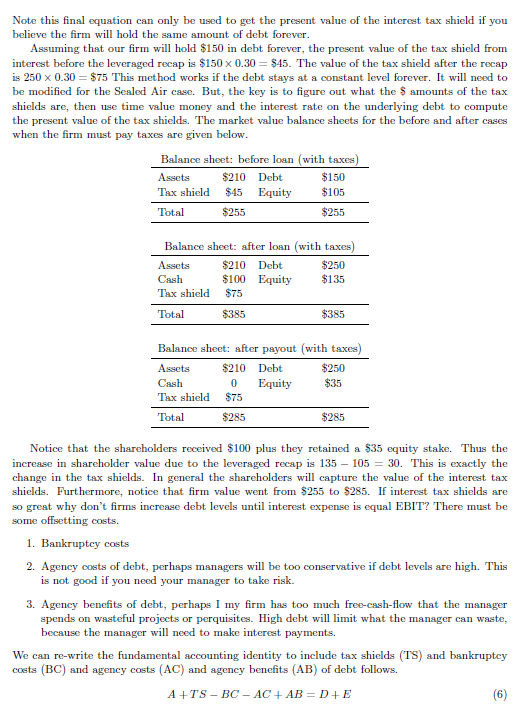

1.1 Some observations This example includes several important insights. 1. The market value of the firm assets did not depend on how they were financed. When D/E 1 or D/E 5 the value of the firms assets are still $300. This should not be surprising. Thoe assets did not change at all why would their value change? 2. Before the new loan we can solve for the expected return to equityholders using the WACC formula D+E D+E D+E TA TA -TD TE In our context this means that before the leveraged recap the expected return on equity, TE was 10% + (10%-5%) x 1 15%. After the recap rE-10% (10%-5%) x 5-35%. A you can see adding debt increases shareholders' required return. Why? there is greater likelihood of bankruptcy resulting in shareholders will get nothing 3. While adding debt makes equity riskier it does not change the risk of the assets. The assets did not change at all, thus rA does not change. So while adding debt makes equity riskier, it does not affect the risk of the assets. 2 Valuation and capital structure The term capital structure refers to the mix of the firm's financing. For the example firm in the prior section before the loan the firms capital structure was 1 part debt and 1 part equity. After the leveraged recapitalization the capital structure was 5 parts debt and 1 part equity. One important point from the prior example is that the value of the firm after the leveraged recapitalization is the same as it was before the leveraged recapitalization. This insight is usually referred to the the irrelevance principle of capital structure. The irrelevance principle states that in perfect capital markets the value of the firm does not depend on its capital structure. Note this property only holds in perfect capital markets, i.e. markets with no frictions, such as taxes, bankruptcy costs, or agency costs. These frictions will determine why shareholders may prefer a certain capital structure over another. Because interest expense is not taxed at the corporate level firms may prefer to finance assets with debt to take advantage of the interest tax shields. For example, Suppose that our firm in the prior example now faces a tax rate of 30% how much cash can be distributed to debtholders and shareholders before and after the leveraged recap. The interest expense will be $150 x 0.05 $7.5 before the recap and $250 x 0.05 12.5 after the recap. Thus the total distributed to debtholders and shareholder before the recap is 15.75 +7.50 23.25 1.1 Some observations This example includes several important insights. 1. The market value of the firm assets did not depend on how they were financed. When D/E 1 or D/E 5 the value of the firms assets are still $300. This should not be surprising. Thoe assets did not change at all why would their value change? 2. Before the new loan we can solve for the expected return to equityholders using the WACC formula D+E D+E D+E TA TA -TD TE In our context this means that before the leveraged recap the expected return on equity, TE was 10% + (10%-5%) x 1 15%. After the recap rE-10% (10%-5%) x 5-35%. A you can see adding debt increases shareholders' required return. Why? there is greater likelihood of bankruptcy resulting in shareholders will get nothing 3. While adding debt makes equity riskier it does not change the risk of the assets. The assets did not change at all, thus rA does not change. So while adding debt makes equity riskier, it does not affect the risk of the assets. 2 Valuation and capital structure The term capital structure refers to the mix of the firm's financing. For the example firm in the prior section before the loan the firms capital structure was 1 part debt and 1 part equity. After the leveraged recapitalization the capital structure was 5 parts debt and 1 part equity. One important point from the prior example is that the value of the firm after the leveraged recapitalization is the same as it was before the leveraged recapitalization. This insight is usually referred to the the irrelevance principle of capital structure. The irrelevance principle states that in perfect capital markets the value of the firm does not depend on its capital structure. Note this property only holds in perfect capital markets, i.e. markets with no frictions, such as taxes, bankruptcy costs, or agency costs. These frictions will determine why shareholders may prefer a certain capital structure over another. Because interest expense is not taxed at the corporate level firms may prefer to finance assets with debt to take advantage of the interest tax shields. For example, Suppose that our firm in the prior example now faces a tax rate of 30% how much cash can be distributed to debtholders and shareholders before and after the leveraged recap. The interest expense will be $150 x 0.05 $7.5 before the recap and $250 x 0.05 12.5 after the recap. Thus the total distributed to debtholders and shareholder before the recap is 15.75 +7.50 23.25

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started