Answered step by step

Verified Expert Solution

Question

1 Approved Answer

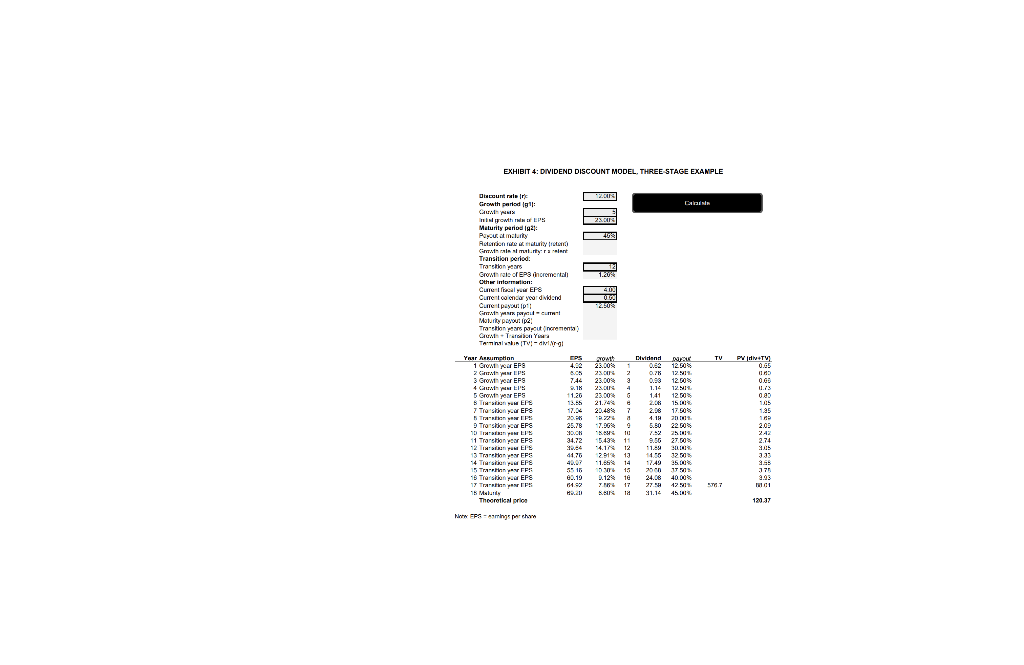

1.What is the stock value based on the three-state dividend discount model? 2.What is the stock value based on the constant dividend growth model? In

1.What is the stock value based on the three-state dividend discount model?

2.What is the stock value based on the constant dividend growth model?

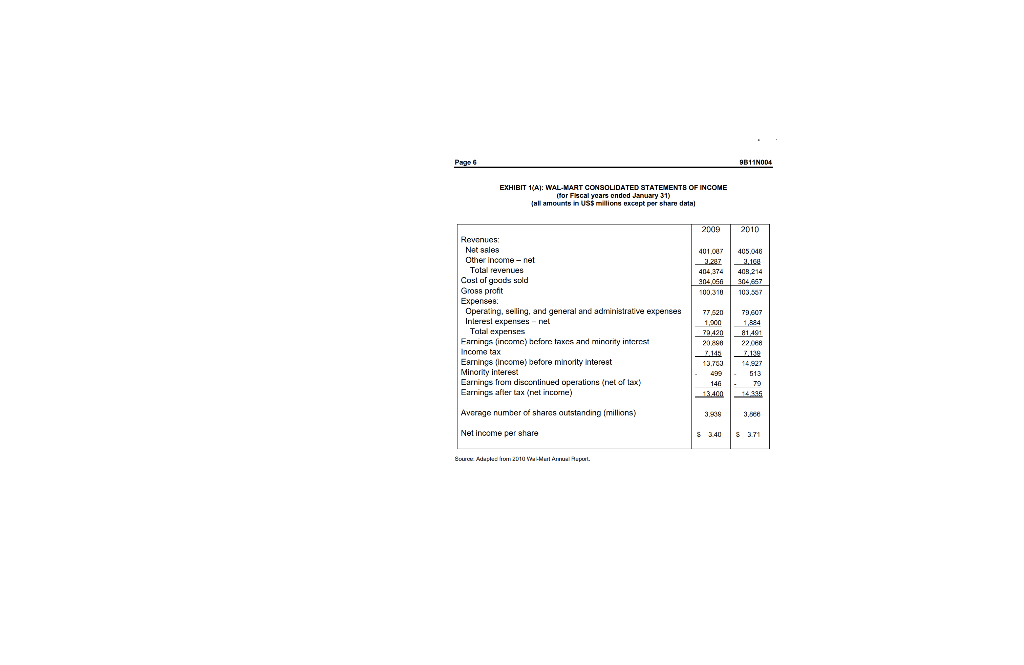

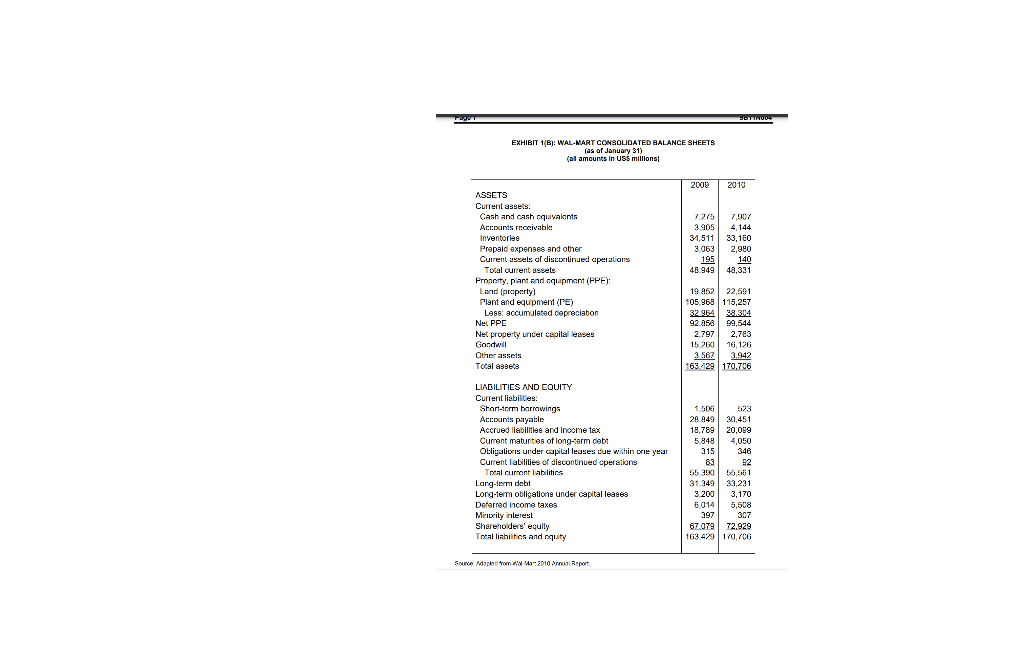

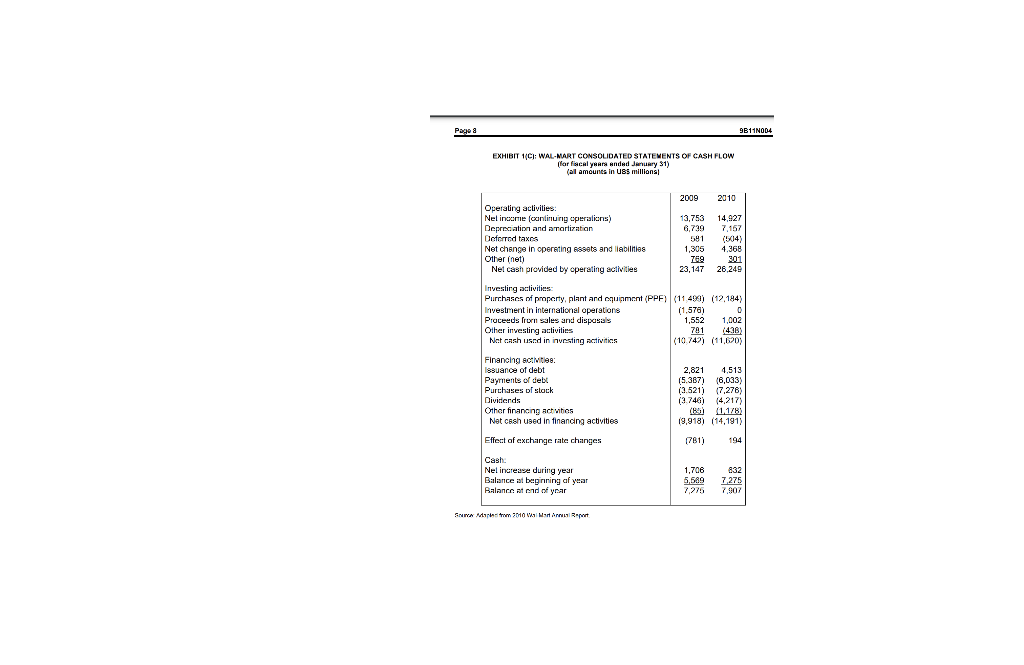

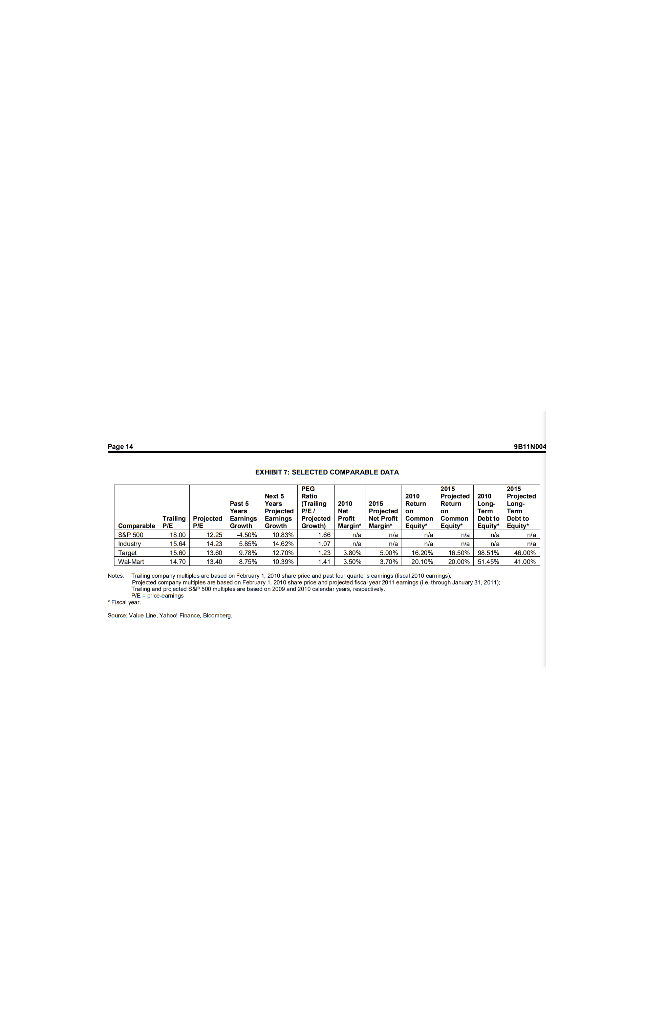

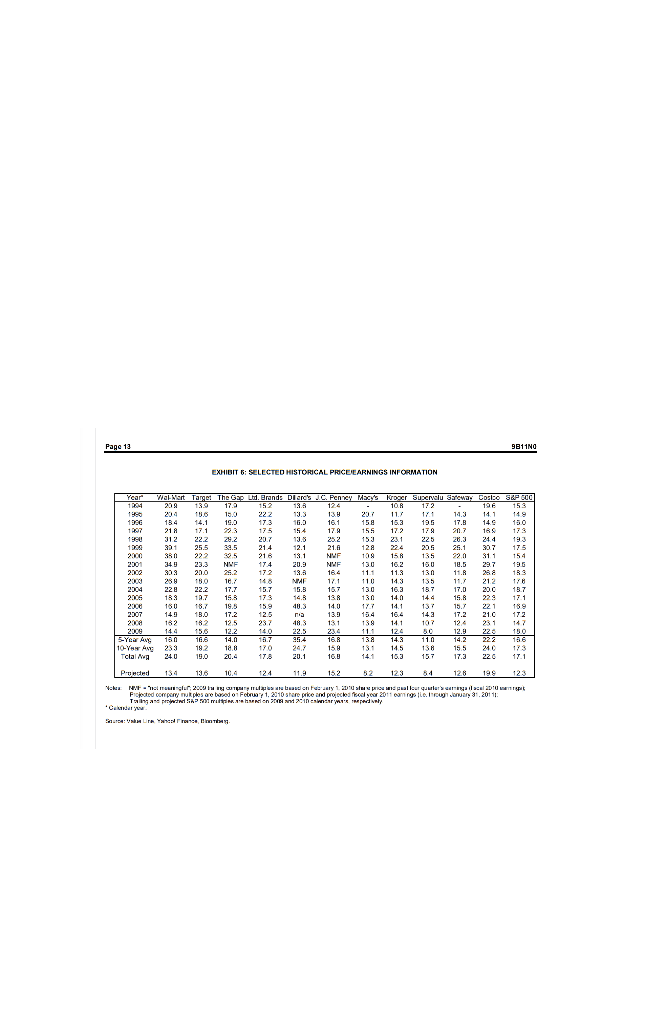

In early Eetrsacy 2010 , Satrina Gupas, an investment sdveer with a majoc beobenge finm, u7s exnaining purfivine. GACKGRDUND DF WAL-MART STDRES, INC. stores in Argentins, Desz Consds, Germany, Mexicc, Presto Rico, Sosth Korea. the Lnited Kingdom: subeecuently, in karch 19y, ceclared ss tist weh dowdend ot suso per share inter rmo rmo for oue 12 monthe by 20 analyss, "holds" by i acabyes and "sells" by zone of the analyss. Toese ankinzs (which was 55501 pers shaned and the 52-wek loo was $16.42 per shre. diviseed acd cunsent stock pricel of 2.0 per cent. Lxhib. 2 presents 2 proph of Wal Wart's stock paice for 10 sears, and Exhbit 3 prowides hisiocical dividend dna. In decennining whethe Wal-kfast was foirly GIVIDEND DISCDUNT MODELS Dividends in Porpetulty lsedr. expecred perpetnal divident anowth oste \{a\} H1D11ZZ stozk grisel plus the expectsd futue gresth in dividends. KsD1PLg diviseed eorth (in se-petuity) at zpproxi-aselv 2.0 per cent. Qe the other hand. If soeve of the enrnings are recoined (i.e., the dividend poyorr ano e 1 , the aesec of the unce these cicumsiances, 2 mottied version of the model can be reed, is shown selow. In this example. p2ya ratio (p). of equity. e{1p}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started