Question

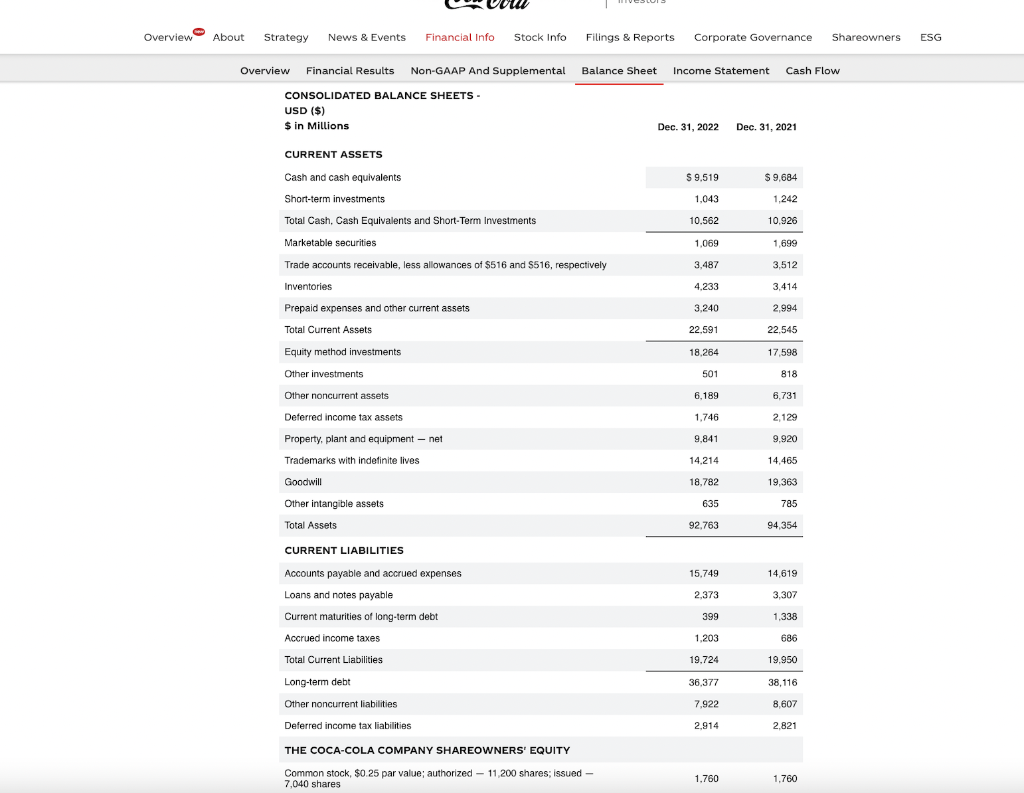

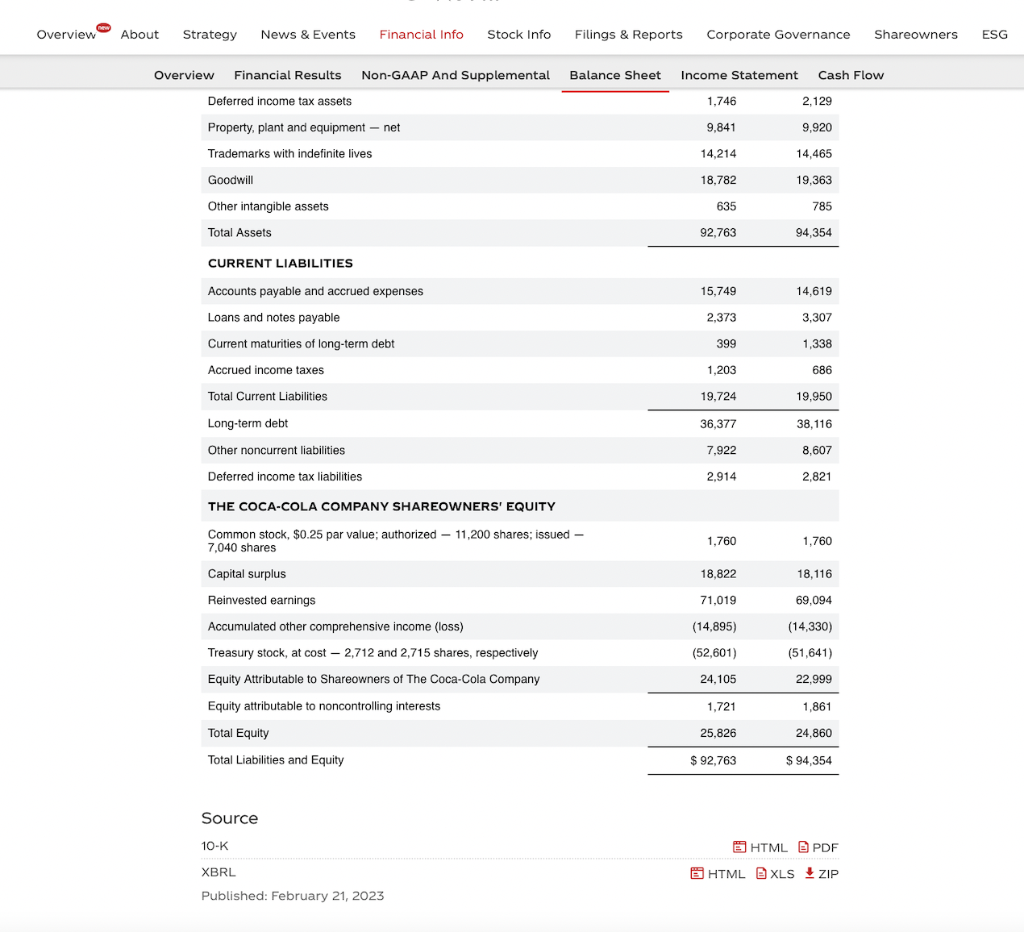

1)What is the working capital position of the company for 2022 and 2021? Has it improved and 2022? What assets and/or liabilities were had the

1)What is the working capital position of the company for 2022 and 2021? Has it improved and 2022? What assets and/or liabilities were had the most impact on the change?

2)Focusing on the non-current and long-term assets e.g. property, plant, and equipment (tangible assets), trademarks, and good will (intangible assets), in what categories is most of the asset value? What does that tell you about Coca-Cola?

3)Focusing on the liability section of the balance sheet, are most of the liabilities in short-term or long-term liability section? Based on your analysis, what does this tell you about Coca-Colas liabilities i.e. is it debt, money due suppliers, or other factors?

4)Focusing on the equity section, does it appear Coca-Cola has been profitable? Would you say Coca-Cola has done a good job building value in the company?

5)Based on the comparative business models we have discussed, what industry type would you say Coca-Cola falls into e.g. professional services, retail, or manufacturing?

Overview About Strategy News \& Events Financial Info Stock Info Filings \& Reports Corporate Governance Shareowners ESG Overview Financial Results Non-GAAP And Supplemental Balance Sheet Income Statement Cash Flow CONSOLIDATED BALANCE SHEETS - USD (\$) $ in Millions Dec. 31, 2022 Dec. 31, 2021 CURRENT ASSETS Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $516 and $516, respectively Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments Other investments Other noncurrent assets Deferred income tax assets Property, plant and equipment - net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets \begin{tabular}{rr} $9,519 & $9,684 \\ 1,043 & 1,242 \\ 10,562 & 10,926 \\ \hline 1,069 & 1,699 \\ 3,487 & 3,512 \\ 4,233 & 3,414 \\ 3,240 & 2,994 \\ 22,591 & 22,545 \\ \hline 18,264 & 17,598 \\ 501 & 818 \\ 6,189 & 6,731 \\ 1,746 & 2,129 \\ 9,841 & 9,920 \\ 14,214 & 14,465 \\ 18,782 & 19,363 \\ 635 & 785 \\ 92,763 & 94,354 \\ \hline \end{tabular} CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other noncurrent liabilities Deferred income tax liabilities \begin{tabular}{rr} 15,749 & 14,619 \\ 2,373 & 3,307 \\ 399 & 1,338 \\ 1,203 & 686 \\ 19,724 & 19,950 \\ \hline 36,377 & 38,116 \\ 7,922 & 8,607 \\ 2,914 & 2,821 \end{tabular} THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, \$0.25 par value; authorized - 11,200 shares; issued - 7,040 shares Overview About Strategy News \& Events Financial Info Stock Info Filings \& Reports Corporate Governance Shareown Overview Financial Results Non-GAAP And Supplemental Balance Sheet Income Statement Cash Flow \begin{tabular}{lrrr} Deferred income tax assets & r & 2,129 \\ Property, plant and equipment - net & 1,746 & 9,920 \\ Trademarks with indefinite lives & 9,841 & 14,465 \\ Goodwill & 14,214 & 19,363 \\ Other intangible assets & 18,782 & 785 \\ Total Assets & 935 & 94,354 \\ \hline \end{tabular} CURRENT LIABILITIES AccountspayableandaccruedexpensesLoansandnotespayableCurrentmaturitiesoflong-termdebtAccruedincometaxesTotalCurrentLiabilitiesdebtOthernoncurrentliabilitiesDeferredincometaxliabilities15,7492,3733996861,20319,72436,3777,92214,6193,3071,33819,95038,1168,6072,821 THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; authorized - 11,200 shares; issued 7,040 shares \begin{tabular}{rr} 1,760 & 1,760 \\ 18,822 & 18,116 \\ 71,019 & 69,094 \\ (14,895) & (14,330) \\ (52,601) & (51,641) \\ 24,105 & 22,999 \\ \hline 1,721 & 1,861 \\ 25,826 & 24,860 \\ \hline$92,763 & $94,354 \\ \hline \end{tabular} Source 10K HTML PF XBRL HTML BCLSZIP Published: February 21, 2023 Overview About Strategy News \& Events Financial Info Stock Info Filings \& Reports Corporate Governance Shareowners ESG Overview Financial Results Non-GAAP And Supplemental Balance Sheet Income Statement Cash Flow CONSOLIDATED BALANCE SHEETS - USD (\$) $ in Millions Dec. 31, 2022 Dec. 31, 2021 CURRENT ASSETS Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of $516 and $516, respectively Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments Other investments Other noncurrent assets Deferred income tax assets Property, plant and equipment - net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets \begin{tabular}{rr} $9,519 & $9,684 \\ 1,043 & 1,242 \\ 10,562 & 10,926 \\ \hline 1,069 & 1,699 \\ 3,487 & 3,512 \\ 4,233 & 3,414 \\ 3,240 & 2,994 \\ 22,591 & 22,545 \\ \hline 18,264 & 17,598 \\ 501 & 818 \\ 6,189 & 6,731 \\ 1,746 & 2,129 \\ 9,841 & 9,920 \\ 14,214 & 14,465 \\ 18,782 & 19,363 \\ 635 & 785 \\ 92,763 & 94,354 \\ \hline \end{tabular} CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other noncurrent liabilities Deferred income tax liabilities \begin{tabular}{rr} 15,749 & 14,619 \\ 2,373 & 3,307 \\ 399 & 1,338 \\ 1,203 & 686 \\ 19,724 & 19,950 \\ \hline 36,377 & 38,116 \\ 7,922 & 8,607 \\ 2,914 & 2,821 \end{tabular} THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, \$0.25 par value; authorized - 11,200 shares; issued - 7,040 shares Overview About Strategy News \& Events Financial Info Stock Info Filings \& Reports Corporate Governance Shareown Overview Financial Results Non-GAAP And Supplemental Balance Sheet Income Statement Cash Flow \begin{tabular}{lrrr} Deferred income tax assets & r & 2,129 \\ Property, plant and equipment - net & 1,746 & 9,920 \\ Trademarks with indefinite lives & 9,841 & 14,465 \\ Goodwill & 14,214 & 19,363 \\ Other intangible assets & 18,782 & 785 \\ Total Assets & 935 & 94,354 \\ \hline \end{tabular} CURRENT LIABILITIES AccountspayableandaccruedexpensesLoansandnotespayableCurrentmaturitiesoflong-termdebtAccruedincometaxesTotalCurrentLiabilitiesdebtOthernoncurrentliabilitiesDeferredincometaxliabilities15,7492,3733996861,20319,72436,3777,92214,6193,3071,33819,95038,1168,6072,821 THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; authorized - 11,200 shares; issued 7,040 shares \begin{tabular}{rr} 1,760 & 1,760 \\ 18,822 & 18,116 \\ 71,019 & 69,094 \\ (14,895) & (14,330) \\ (52,601) & (51,641) \\ 24,105 & 22,999 \\ \hline 1,721 & 1,861 \\ 25,826 & 24,860 \\ \hline$92,763 & $94,354 \\ \hline \end{tabular} Source 10K HTML PF XBRL HTML BCLSZIP Published: February 21, 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started