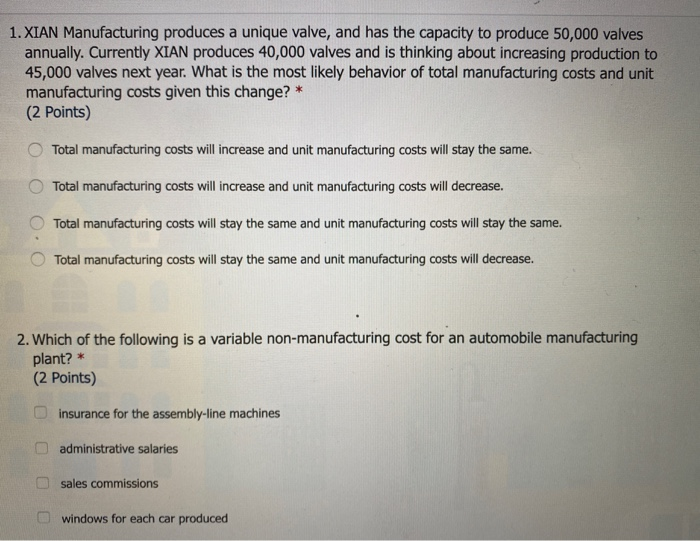

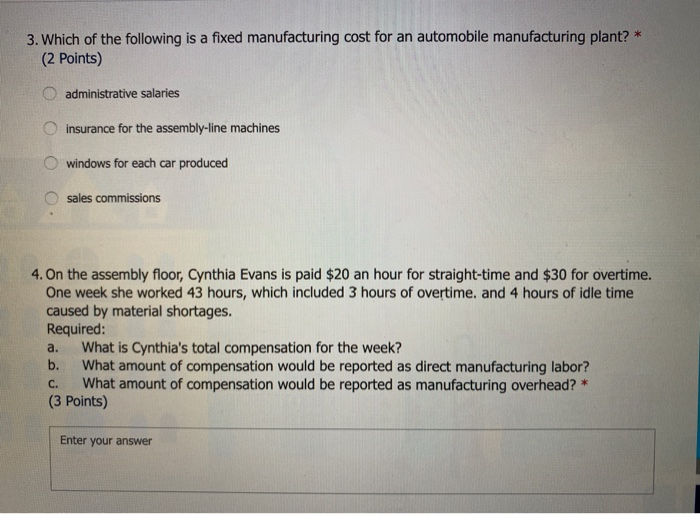

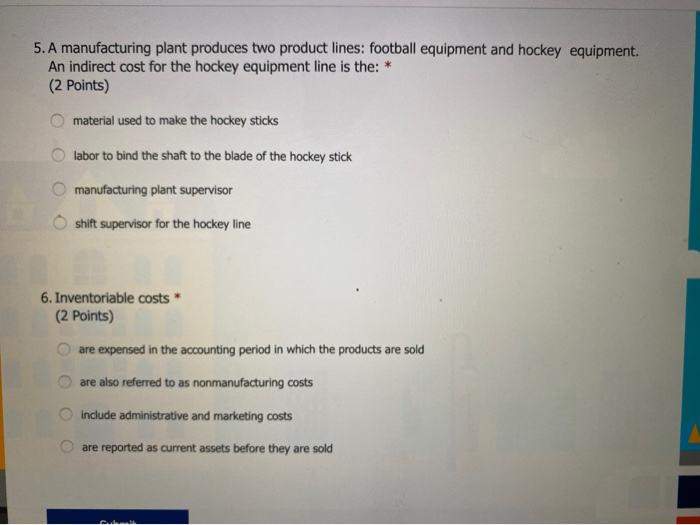

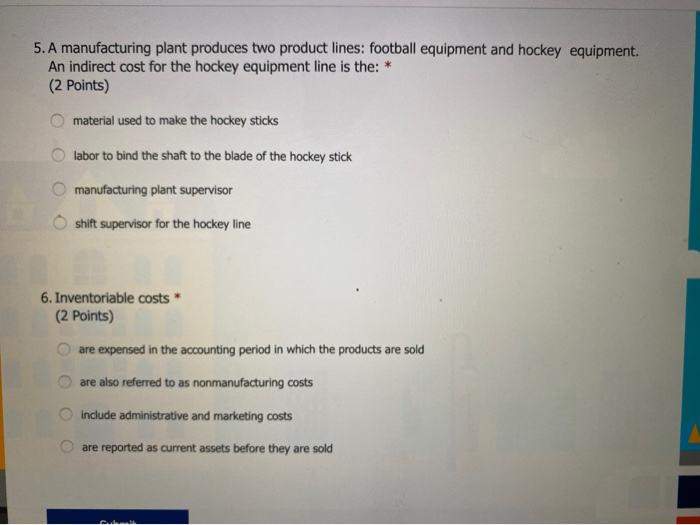

1.XIAN Manufacturing produces a unique valve, and has the capacity to produce 50,000 valves annually. Currently XIAN produces 40,000 valves and is thinking about increasing production to 45,000 valves next year. What is the most likely behavior of total manufacturing costs and unit manufacturing costs given this change? (2 points) Total manufacturing costs will increase and unit manufacturing costs will stay the same. * O Total manufacturing costs will increase and unit manufacturing costs will decrease. Total manufacturing costs will stay the same and unit manufacturing costs will stay the same. Total manufacturing costs will stay the same and unit manufacturing costs will decrease. 2. Which of the following is a variable non-manufacturing cost for an automobile manufacturing plant? * (2 points) insurance for the assembly-line machines administrative salaries sales commissions windows for each car produced 3. Which of the following is a fixed manufacturing cost for an automobile manufacturing plant? * (2 points) administrative salaries insurance for the assembly-line machines windows for each car produced sales commissions 4. On the assembly floor, Cynthia Evans is paid $20 an hour for straight-time and $30 for overtime. One week she worked 43 hours, which included 3 hours of overtime, and 4 hours of idle time caused by material shortages. Required: What is Cynthia's total compensation for the week? b. What amount of compensation would be reported as direct manufacturing labor? What amount of compensation would be reported as manufacturing overhead? * (3 Points) a. C. Enter your answer 5. A manufacturing plant produces two product lines: football equipment and hockey equipment. An indirect cost for the hockey equipment line is the: * (2 points) material used to make the hockey sticks labor to bind the shaft to the blade of the hockey stick manufacturing plant supervisor shift supervisor for the hockey line 6. Inventoriable costs* (2 points) are expensed in the accounting period in which the products are sold are also referred to as nonmanufacturing costs include administrative and marketing costs are reported as current assets before they are sold