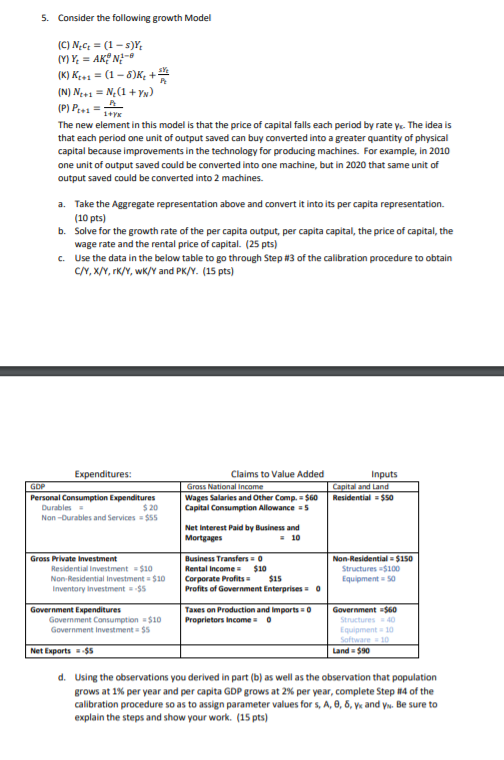

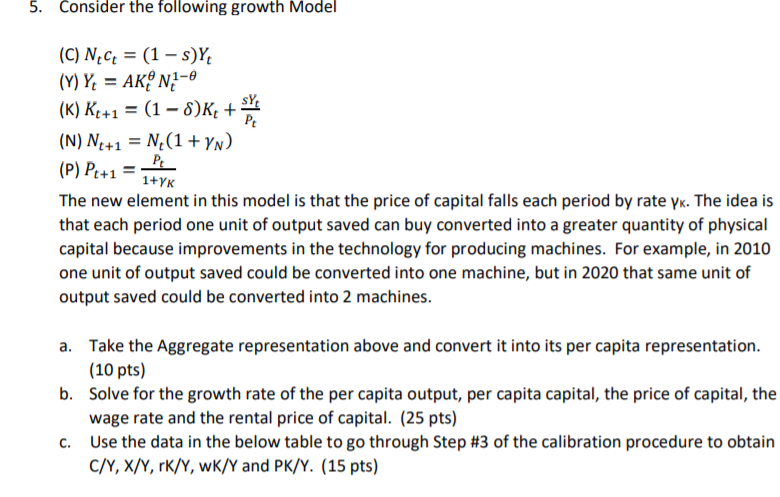

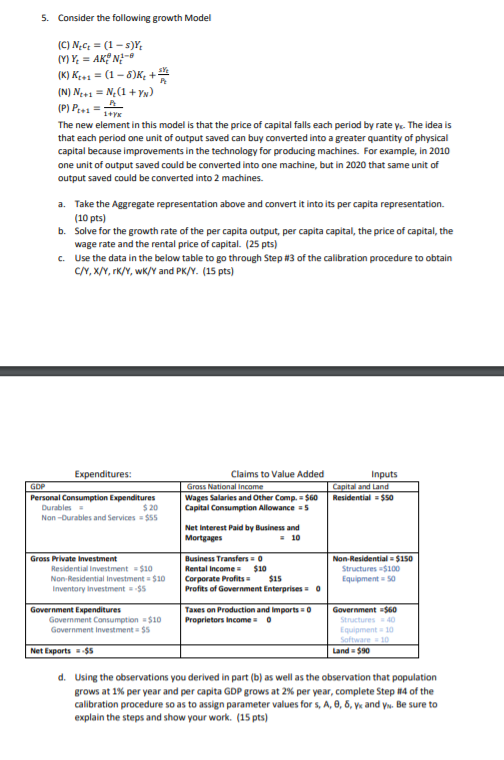

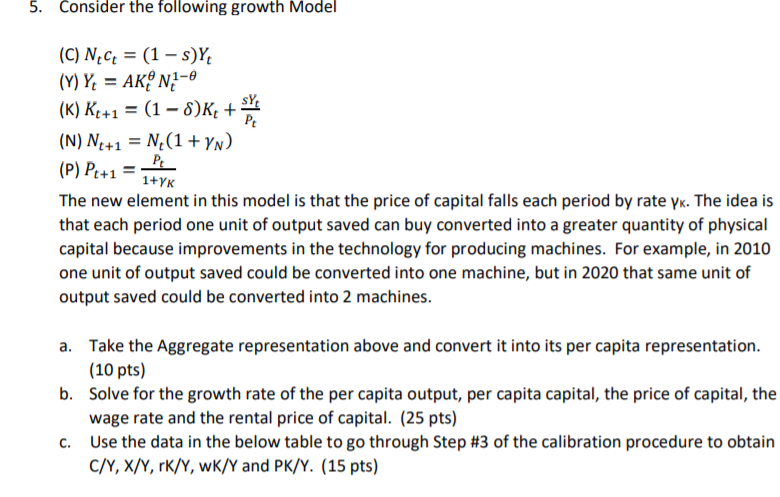

1+Yx 5. Consider the following growth Model (C) N.C = (1 - s): MY = AKN -- (K) KE+1 = (1 - 8)K4+ (N) Nc+1 = N (1 + Y) (P) Pro The new element in this model is that the price of capital falls each period by rate y. The idea is that each period one unit of output saved can buy converted into a greater quantity of physical capital because improvements in the technology for producing machines. For example, in 2010 one unit of output saved could be converted into one machine, but in 2020 that same unit of output saved could be converted into 2 machines. a. Take the Aggregate representation above and convert it into its per capita representation. (10 pts) b. Solve for the growth rate of the per capita output, per capita capital, the price of capital, the wage rate and the rental price of capital. (25 pts) c. Use the data in the below table to go through Step #3 of the calibration procedure to obtain C/Y, X/Y,rK/Y, wk/Y and PK/V. (15 pts) Expenditures: GDP Personal Consumption Expenditures Durables - $20 Non-Durables and Services = $55 Inputs Capital and Land Residential = $50 Claims to Value Added Gross National income Wages Salaries and Other Comp. = $60 Capital Consumption Allowance = 5 Net Interest Paid by Business and Mortgages = 10 Business Transfers = 0 Rental Income - $10 Corporate Profits $15 Profits of Government Enterprises Gross Private Investment Residential investment = $10 Non-Residential Investment = $10 Inventory Investments Non-Residential = $150 Structures $100 Equipment Government Expenditures Government Consumption = $10 Government Investment = $5 Taxes on Production and imports Proprietors Income = 0 Government $60 Structures 40 Equipment 10 Software 10 Land $90 Net Exports = $5 d. Using the observations you derived in part (b) as well as the observation that population grows at 1% per year and per capita GDP grows at 2% per year, complete Step #4 of the calibration procedure so as to assign parameter values for S, A, 0,6, and you. Be sure to explain the steps and show your work. (15 pts) 5. Consider the following growth Model = (C) NC+ = (1 - s)Y (Y) Y = AKN1-6 (K) R4+1 = (1 - 8)K+ SY . (N) N4+1 = N(1 + Yn) = = (P) Pe+1 = po = 1+ YK The new element in this model is that the price of capital falls each period by rate Vk. The idea is that each period one unit of output saved can buy converted into a greater quantity of physical capital because improvements in the technology for producing machines. For example, in 2010 one unit of output saved could be converted into one machine, but in 2020 that same unit of output saved could be converted into 2 machines. a. Take the Aggregate representation above and convert it into its per capita representation. (10 pts) b. Solve for the growth rate of the per capita output, per capita capital, the price of capital, the wage rate and the rental price of capital. (25 pts) Use the data in the below table to go through Step #3 of the calibration procedure to obtain C/Y, X/Y, TK/Y, WK/Y and PK/Y. (15 pts) C. 1+Yx 5. Consider the following growth Model (C) N.C = (1 - s): MY = AKN -- (K) KE+1 = (1 - 8)K4+ (N) Nc+1 = N (1 + Y) (P) Pro The new element in this model is that the price of capital falls each period by rate y. The idea is that each period one unit of output saved can buy converted into a greater quantity of physical capital because improvements in the technology for producing machines. For example, in 2010 one unit of output saved could be converted into one machine, but in 2020 that same unit of output saved could be converted into 2 machines. a. Take the Aggregate representation above and convert it into its per capita representation. (10 pts) b. Solve for the growth rate of the per capita output, per capita capital, the price of capital, the wage rate and the rental price of capital. (25 pts) c. Use the data in the below table to go through Step #3 of the calibration procedure to obtain C/Y, X/Y,rK/Y, wk/Y and PK/V. (15 pts) Expenditures: GDP Personal Consumption Expenditures Durables - $20 Non-Durables and Services = $55 Inputs Capital and Land Residential = $50 Claims to Value Added Gross National income Wages Salaries and Other Comp. = $60 Capital Consumption Allowance = 5 Net Interest Paid by Business and Mortgages = 10 Business Transfers = 0 Rental Income - $10 Corporate Profits $15 Profits of Government Enterprises Gross Private Investment Residential investment = $10 Non-Residential Investment = $10 Inventory Investments Non-Residential = $150 Structures $100 Equipment Government Expenditures Government Consumption = $10 Government Investment = $5 Taxes on Production and imports Proprietors Income = 0 Government $60 Structures 40 Equipment 10 Software 10 Land $90 Net Exports = $5 d. Using the observations you derived in part (b) as well as the observation that population grows at 1% per year and per capita GDP grows at 2% per year, complete Step #4 of the calibration procedure so as to assign parameter values for S, A, 0,6, and you. Be sure to explain the steps and show your work. (15 pts) 5. Consider the following growth Model = (C) NC+ = (1 - s)Y (Y) Y = AKN1-6 (K) R4+1 = (1 - 8)K+ SY . (N) N4+1 = N(1 + Yn) = = (P) Pe+1 = po = 1+ YK The new element in this model is that the price of capital falls each period by rate Vk. The idea is that each period one unit of output saved can buy converted into a greater quantity of physical capital because improvements in the technology for producing machines. For example, in 2010 one unit of output saved could be converted into one machine, but in 2020 that same unit of output saved could be converted into 2 machines. a. Take the Aggregate representation above and convert it into its per capita representation. (10 pts) b. Solve for the growth rate of the per capita output, per capita capital, the price of capital, the wage rate and the rental price of capital. (25 pts) Use the data in the below table to go through Step #3 of the calibration procedure to obtain C/Y, X/Y, TK/Y, WK/Y and PK/Y. (15 pts) C