Answered step by step

Verified Expert Solution

Question

1 Approved Answer

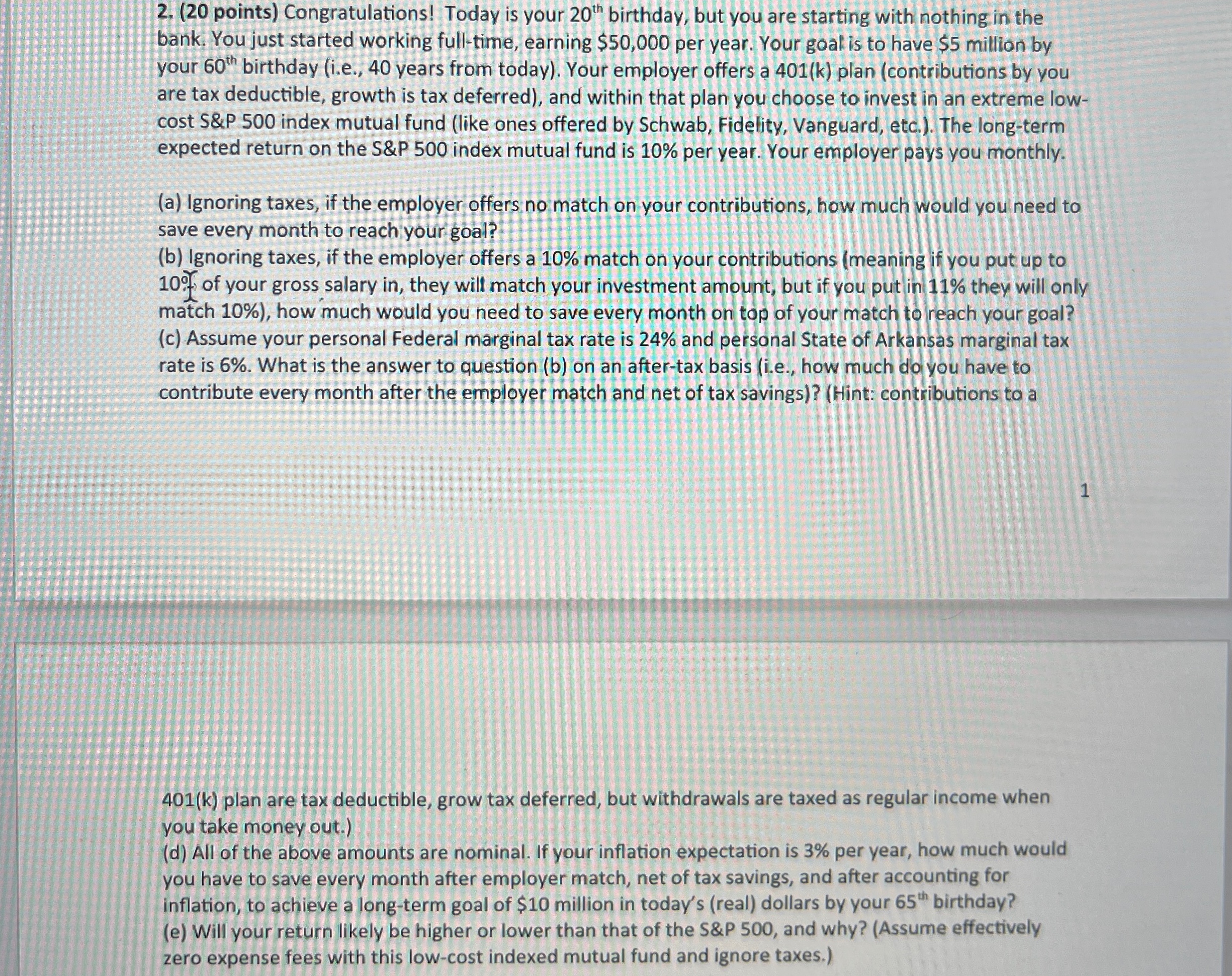

( 2 0 points ) Congratulations! Today is your 2 0 t h birthday, but you are starting with nothing in the bank. You just

points Congratulations! Today is your birthday, but you are starting with nothing in the bank. You just started working fulltime, earning $ per year. Your goal is to have $ million by your birthday ie years from today Your employer offers a plan contributions by you are tax deductible, growth is tax deferred and within that plan you choose to invest in an extreme lowcost S&P index mutual fund like ones offered by Schwab, Fidelity, Vanguard, etc. The longterm expected return on the S&P index mutual fund is per year. Your employer pays you monthly.

a Ignoring taxes, if the employer offers no match on your contributions, how much would you need to save every month to reach your goal?

b Ignoring taxes, if the employer offers a match on your contributions meaning if you put up to of your gross salary in they will match your investment amount, but if you put in they will only match how much would you need to save every month on top of your match to reach your goal? c Assume your personal Federal marginal tax rate is and personal State of Arkansas marginal tax rate is What is the answer to question b on an aftertax basis ie how much do you have to contribute every month after the employer match and net of tax savingsHint: contributions to a

k plan are tax deductible, grow tax deferred, but withdrawals are taxed as regular income when you take money out.

d All of the above amounts are nominal. If your inflation expectation is per year, how much would you have to save every month after employer match, net of tax savings, and after accounting for inflation, to achieve a longterm goal of $ million in today's real dollars by your birthday?

e Will your return likely be higher or lower than that of the S&P and why? Assume effectively zero expense fees with this lowcost indexed mutual fund and ignore taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started