Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( 2 0 ) Suppose you purchase a new car today for $ 2 5 , 0 0 0 , using $ 5 , 0

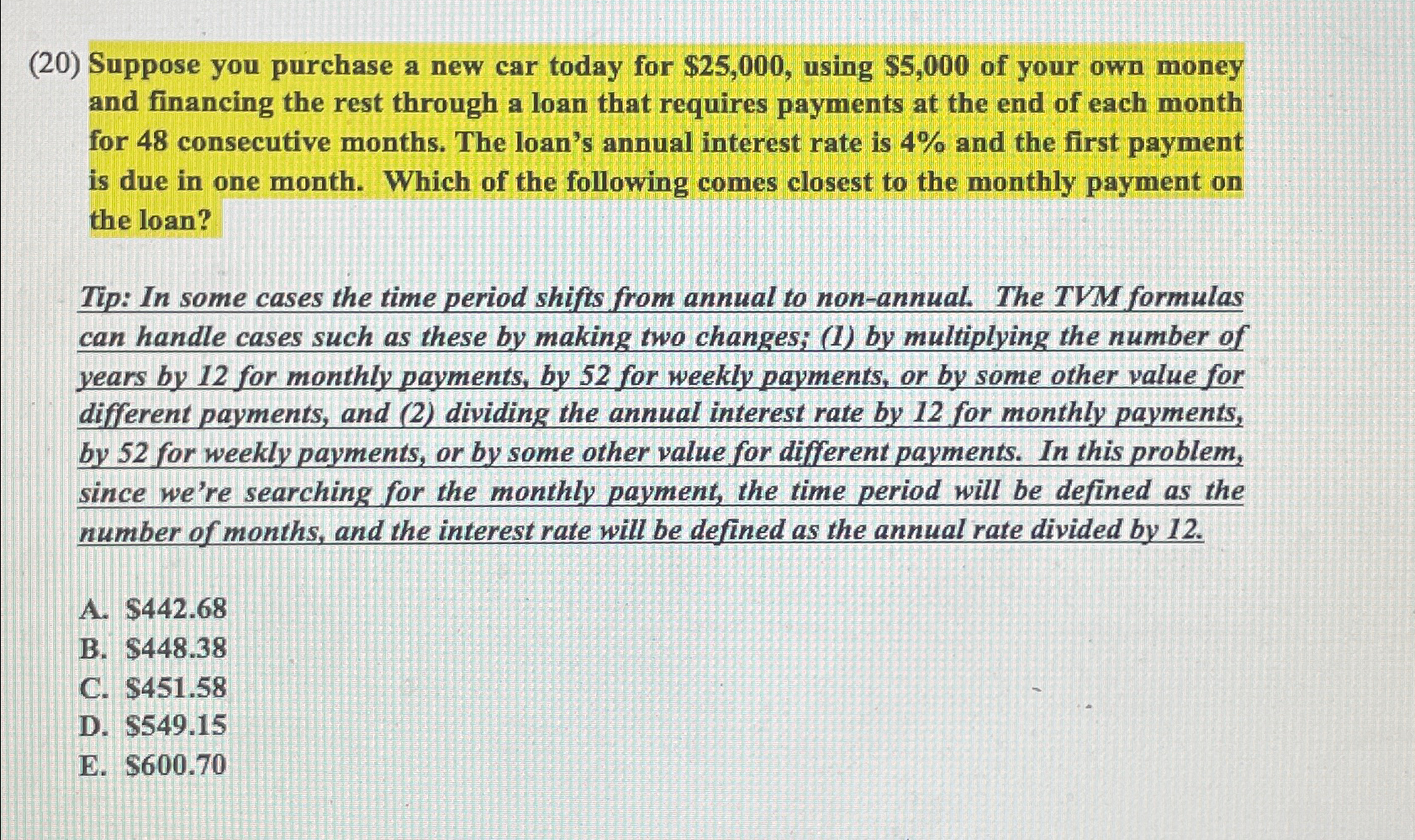

Suppose you purchase a new car today for $ using $ of your own money and financing the rest through a loan that requires payments at the end of each month for consecutive months. The loan's annual interest rate is and the first payment is due in one month. Which of the following comes closest to the monthly payment on the loan?

Tip: In some cases the time period shifts from annual to nonannual. The TVM formulas can handle cases such as these by making two changes; by multiplying the number of years by for monthly payments, by for weekly payments, or by some other value for different payments, and dividing the annual interest rate by for monthly payments, by for weekly payments, or by some other value for different payments. In this problem, since we're searching for the monthly payment, the time period will be defined as the number of months, and the interest rate will be defined as the annual rate divided by

A $

B $

C $

D $

E $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started