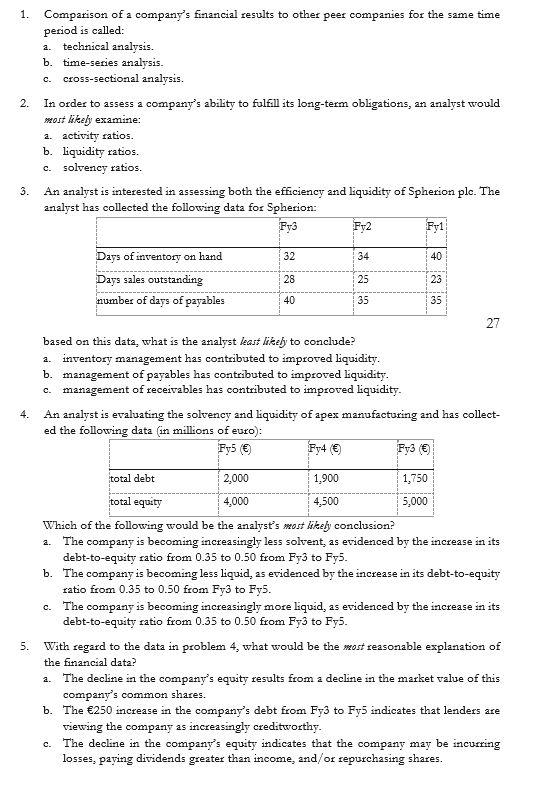

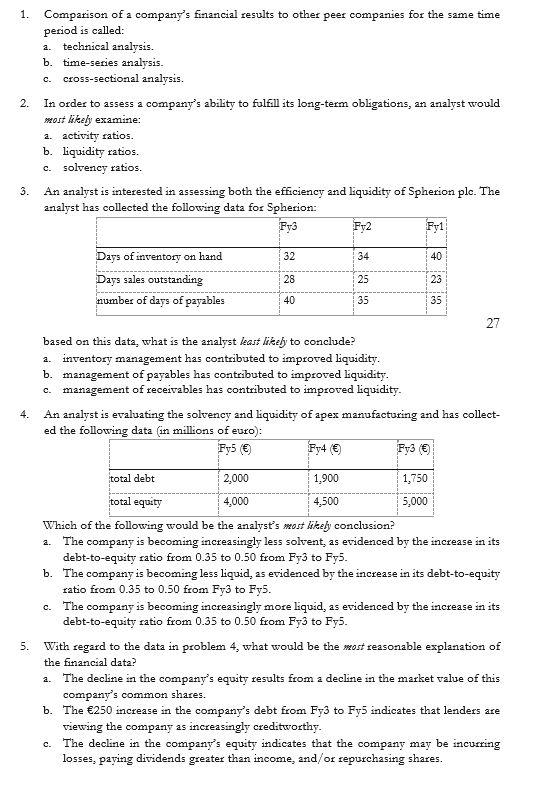

2. 1. Comparison of a company's financial results to other peer companies for the same time period is called: 2. technical analysis. b. time-series analysis. c. cross-sectional analysis. In order to assess a company's ability to fulfill its long-term obligations, an analyst would most likely examine: 2. activity ratios. b. liquidity ratios. c. solvency ratios. An analyst is interested in assessing both the efficiency and liquidity of Spherion ple. The analyst has collected the following data for Spherion: Fy3 Fy2 Fy1 3. 32 34 40 25 23 40 35 Days of inventory on hand Days sales outstanding 28 number of days of payables 35 27 based on this data, what is the analyst least likely to conclude? 2. inventory management has contributed to improved liquidity. b. management of payables has contributed to improved liquidity. c. management of receivables has contributed to improved liquidity. An analyst is evaluating the solvency and liquidity of apex manufacturing and has collect- ed the following data (in millions of euro): Fy5 Fy4 Fy3 4. total debt 2,000 1,900 4,500 1,750 5,000 total equity 4,000 2. 5. Which of the following would be the analyst's most likely conclusion? The company is becoming increasingly less solvent, as evidenced by the increase in its debt-to-equity ratio from 0.35 to 0.50 from Fy3 to Fys. b. The company is becoming less liquid, as evidenced by the increase in its debt-to-equity ratio from 0.35 to 0.50 from Fy3 to Fy5. c. The company is becoming increasingly more liquid, as evidenced by the increase in its debt-to-equity ratio from 0.35 to 0.50 from Fy3 to Fy5. With regard to the data in problem 4, what would be the most reasonable explanation of the financial data? 2. The decline in the company's equity results from a decline in the market value of this company's common shares. b. The 250 increase in the company's debt from Fy3 to Fy5 indicates that lenders are viewing the company as increasingly creditworthy. The decline in the company's equity indicates that the company may be incurring losses, paying dividends greater than income, and/or repurchasing shares. c