Answered step by step

Verified Expert Solution

Question

1 Approved Answer

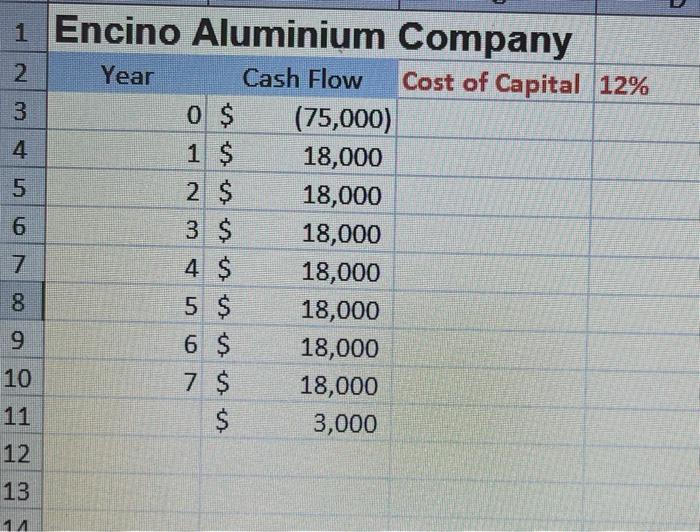

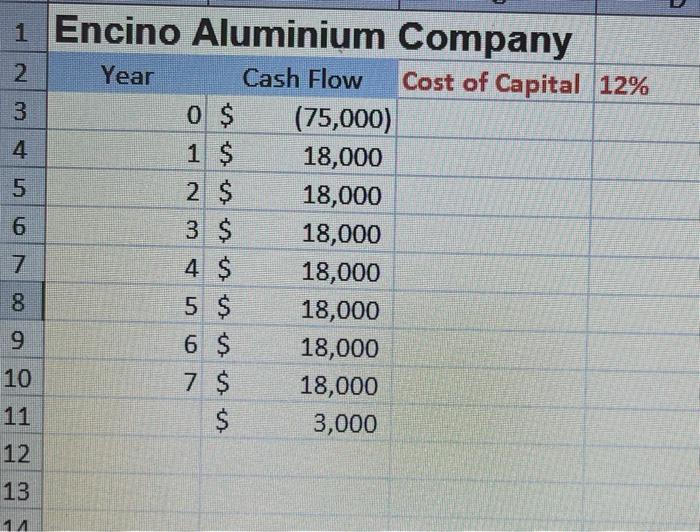

2 1 Encino Aluminium Company Year Cash Flow Cost of Capital 12% 3 0 $ (75,000) 4 1 $ 18,000 5 2 $ 18,000 6

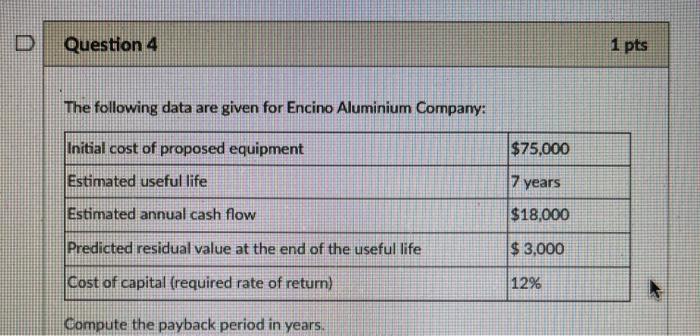

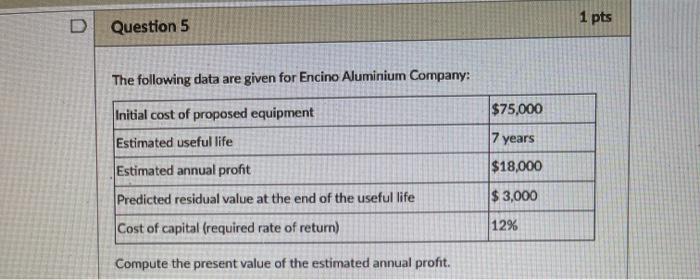

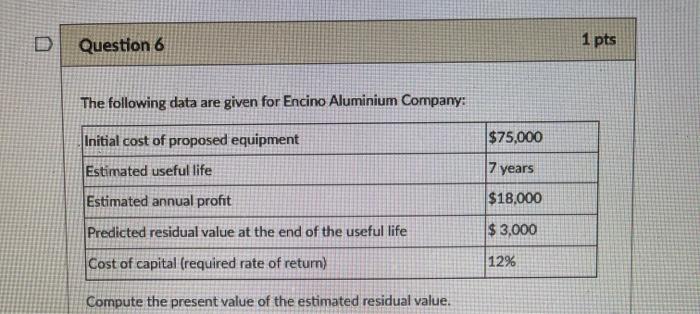

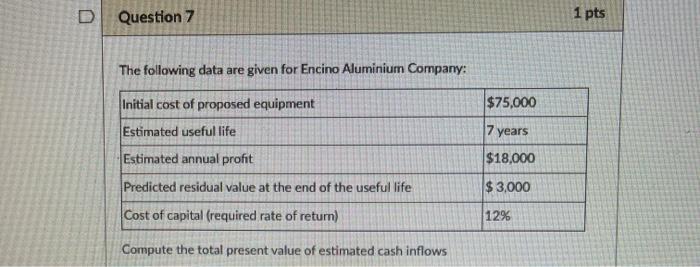

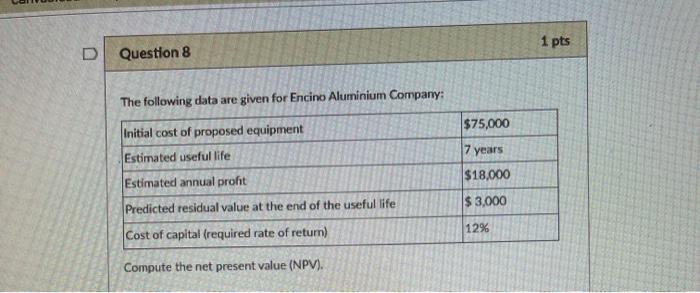

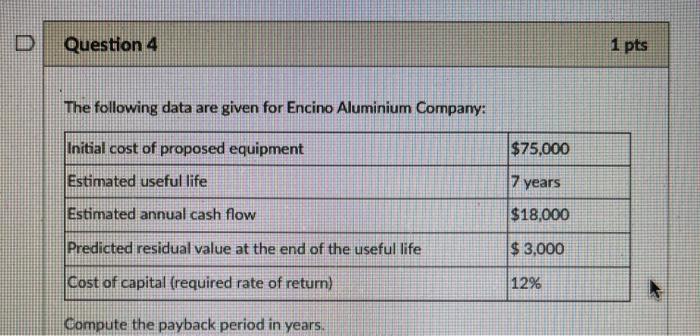

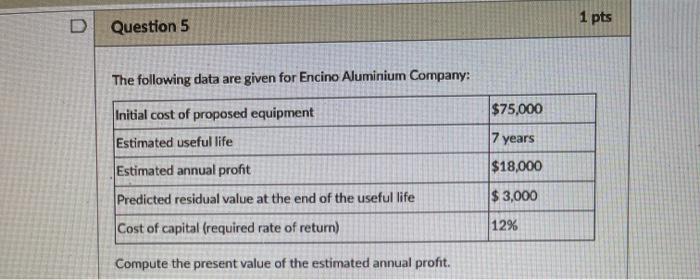

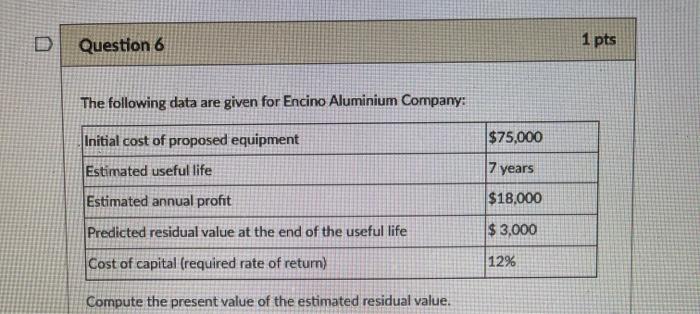

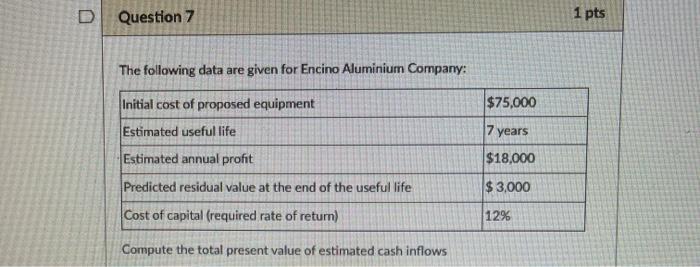

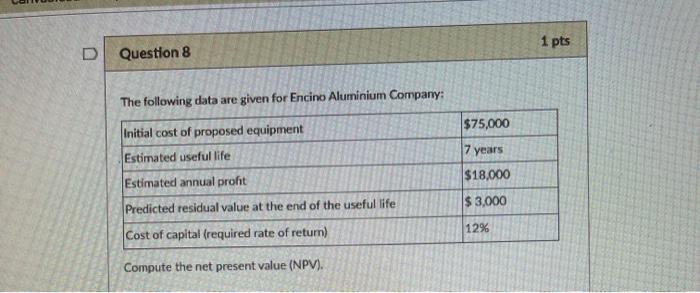

2 1 Encino Aluminium Company Year Cash Flow Cost of Capital 12% 3 0 $ (75,000) 4 1 $ 18,000 5 2 $ 18,000 6 3 $ 18,000 7 4 $ 18,000 8 5 $ 18,000 6 $ 18,000 10 7 $ 18,000 $ 3,000 12 13 11 Question 4 1 pts The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 17 years Estimated annual cash flow $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the payback period in years. 1 pts Question 5 The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 7 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $3,000 Cost of capital (required rate of return) 12% Compute the present value of the estimated annual profit. D Question 6 1 pts The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 17 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the present value of the estimated residual value. D Question 7 1 pts The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 7 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the total present value of estimated cash inflows 1 pts Question 8 The following data are given for Encino Aluminium Company: $75,000 Initial cost of proposed equipment Estimated useful life 7 years $18,000 Estimated annual proht $3,000 Predicted residual value at the end of the useful life 12% Cost of capital (required rate of retum) Compute the net present value (NPV)

2 1 Encino Aluminium Company Year Cash Flow Cost of Capital 12% 3 0 $ (75,000) 4 1 $ 18,000 5 2 $ 18,000 6 3 $ 18,000 7 4 $ 18,000 8 5 $ 18,000 6 $ 18,000 10 7 $ 18,000 $ 3,000 12 13 11 Question 4 1 pts The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 17 years Estimated annual cash flow $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the payback period in years. 1 pts Question 5 The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 7 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $3,000 Cost of capital (required rate of return) 12% Compute the present value of the estimated annual profit. D Question 6 1 pts The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 17 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the present value of the estimated residual value. D Question 7 1 pts The following data are given for Encino Aluminium Company: Initial cost of proposed equipment $75,000 Estimated useful life 7 years Estimated annual profit $18,000 Predicted residual value at the end of the useful life $ 3,000 Cost of capital (required rate of return) 12% Compute the total present value of estimated cash inflows 1 pts Question 8 The following data are given for Encino Aluminium Company: $75,000 Initial cost of proposed equipment Estimated useful life 7 years $18,000 Estimated annual proht $3,000 Predicted residual value at the end of the useful life 12% Cost of capital (required rate of retum) Compute the net present value (NPV)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started