Answered step by step

Verified Expert Solution

Question

1 Approved Answer

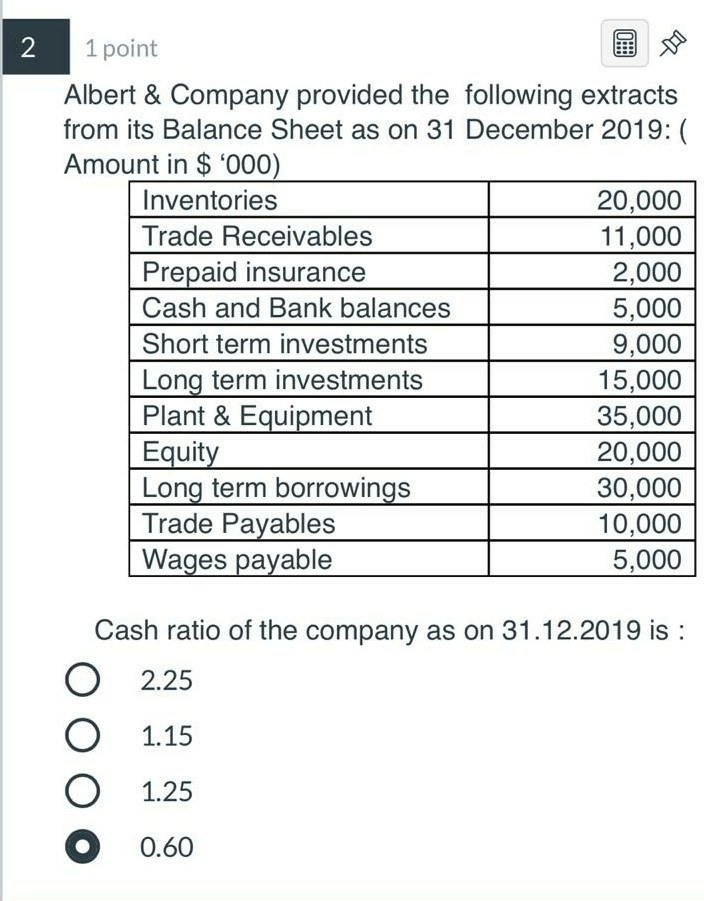

2 1 point Albert & Company provided the following extracts from its Balance Sheet as on 31 December 2019:( Amount in $ '000) Inventories 20,000

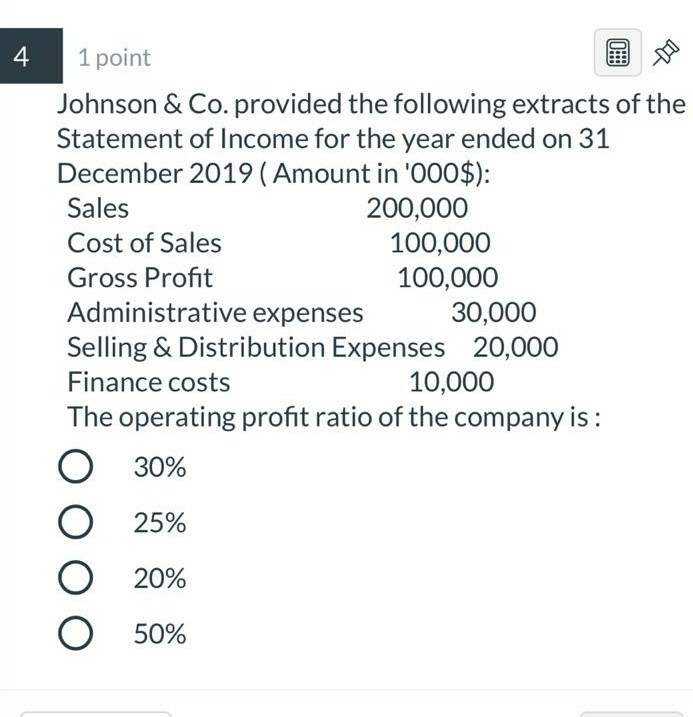

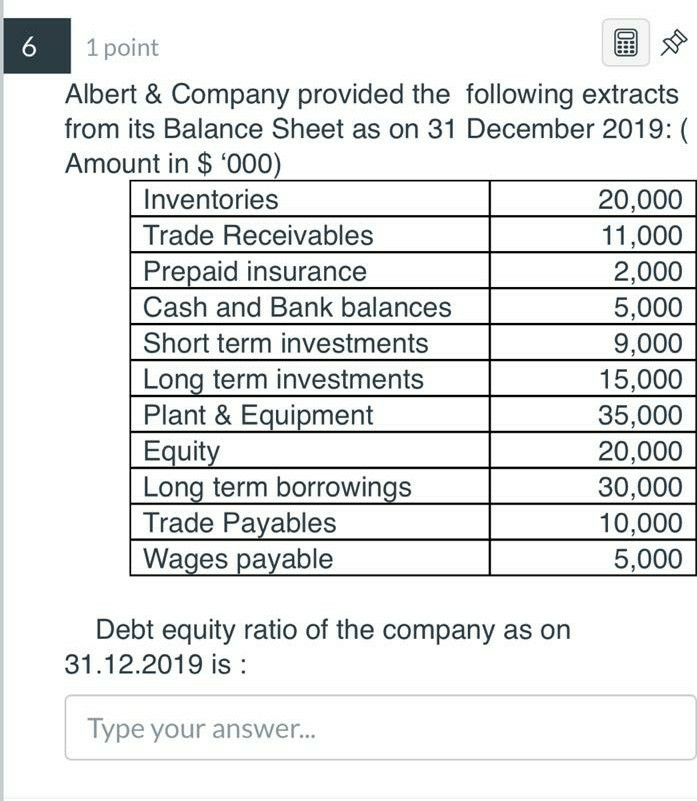

2 1 point Albert & Company provided the following extracts from its Balance Sheet as on 31 December 2019:( Amount in $ '000) Inventories 20,000 Trade Receivables 11,000 Prepaid insurance 2,000 Cash and Bank balances 5,000 Short term investments 9,000 Long term investments 15.000 Plant & Equipment 35,000 Equity 20,000 Long term borrowings | 30,000 Trade Payables 10,000 Wages payable 5,000 Cash ratio of the company as on 31.12.2019 is : 0 2.25 o 1.15 1.25 O 0.60 1 point Johnson & Co. provided the following extracts of the Statement of Income for the year ended on 31 December 2019 ( Amount in '000$): Sales 200,000 Cost of Sales 100,000 Gross Profit 100,000 Administrative expenses 30,000 Selling & Distribution Expenses 20,000 Finance costs 10,000 The operating profit ratio of the company is : O 30% 25% 20% 50% 6 1 point Albert & Company provided the following extracts from its Balance Sheet as on 31 December 2019:( Amount in $ '000) Inventories 20,000 Trade Receivables 11.000 Prepaid insurance 2.000 Cash and Bank balances 5,000 Short term investments 9.000 Long term investments | 15,000 Plant & Equipment 35.000 Equity 20,000 Long term borrowings | 30,000 Trade Payables 10.000 Wages payable 5,000 Debt equity ratio of the company as on 31.12.2019 is : Type your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started