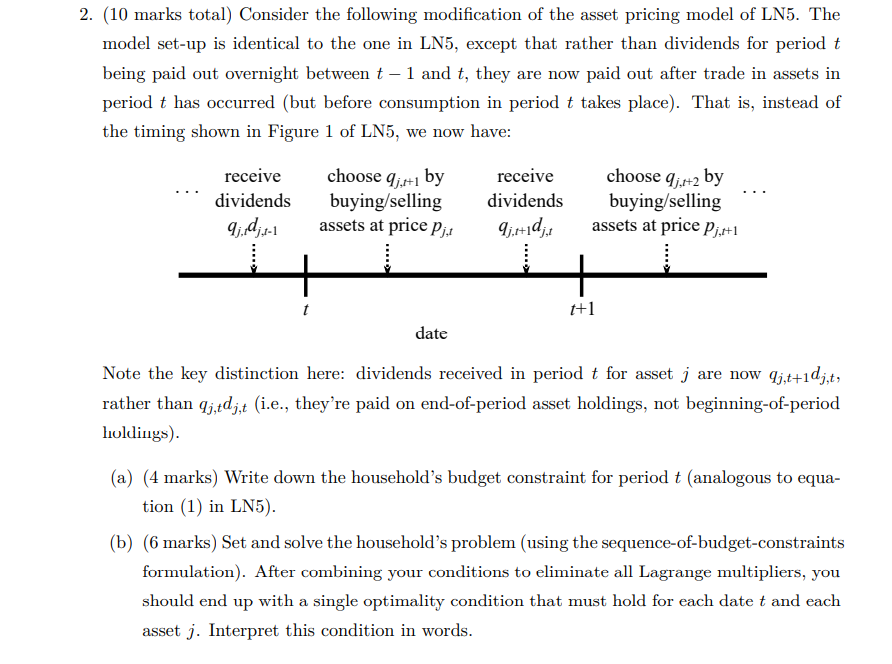

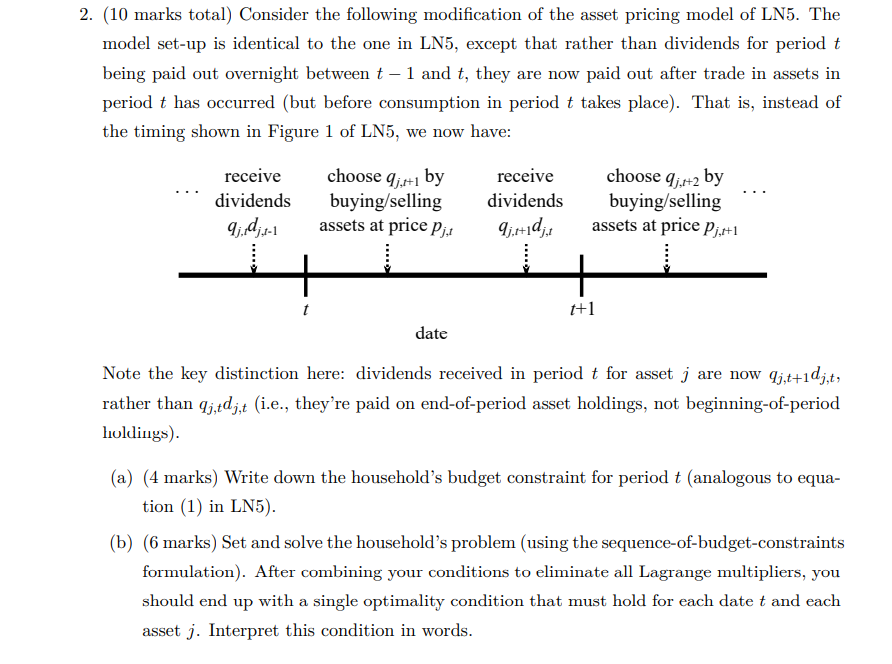

2. (10 marks total) Consider the following modification of the asset pricing model of LN5. The model set-up is identical to the one in LN5, except that rather than dividends for period t being paid out overnight between t 1 and t, they are now paid out after trade in assets in period t has occurred (but before consumption in period t takes place). That is, instead of the timing shown in Figure 1 of LN5, we now have: receive dividends 9;.d.-1 choose 9j.+1 by buying/selling assets at price Pj1 receive dividends 9j.1+1d; choose qj:+2 by buying/selling assets at price Pjir+1 t+1 date Note the key distinction here: dividends received in period t for asset j are now qj;t+1djt, rather than 9j,tdj,t (i.e., they're paid on end-of-period asset holdings, not beginning-of-period Holdings). (a) (4 marks) Write down the household's budget constraint for period t (analogous to equa- tion (1) in LN5). (b) (6 marks) Set and solve the household's problem (using the sequence-of-budget-constraints formulation). After combining your conditions to eliminate all Lagrange multipliers, you should end up with a single optimality condition that must hold for each date t and each asset j. Interpret this condition in words. 2. (10 marks total) Consider the following modification of the asset pricing model of LN5. The model set-up is identical to the one in LN5, except that rather than dividends for period t being paid out overnight between t 1 and t, they are now paid out after trade in assets in period t has occurred (but before consumption in period t takes place). That is, instead of the timing shown in Figure 1 of LN5, we now have: receive dividends 9;.d.-1 choose 9j.+1 by buying/selling assets at price Pj1 receive dividends 9j.1+1d; choose qj:+2 by buying/selling assets at price Pjir+1 t+1 date Note the key distinction here: dividends received in period t for asset j are now qj;t+1djt, rather than 9j,tdj,t (i.e., they're paid on end-of-period asset holdings, not beginning-of-period Holdings). (a) (4 marks) Write down the household's budget constraint for period t (analogous to equa- tion (1) in LN5). (b) (6 marks) Set and solve the household's problem (using the sequence-of-budget-constraints formulation). After combining your conditions to eliminate all Lagrange multipliers, you should end up with a single optimality condition that must hold for each date t and each asset j. Interpret this condition in words