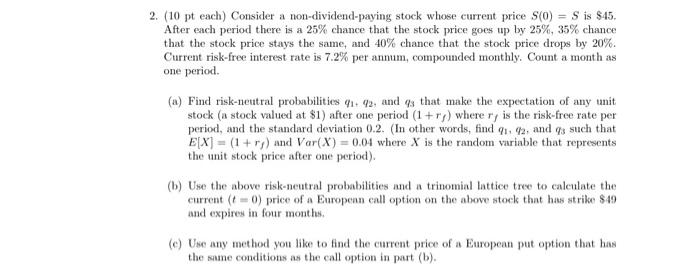

2. (10 pt each) Consider a non-dividend-paying stock whose current price $(0) = S is $45. After each period there is a 25% chance that the stock price goes up by 25%, 35% chance that the stock price stays the same, and 40% chance that the stock price drops by 20%. Current risk-free interest rate is 7.2% per annum, compounded monthly. Count a month as one period. (a) Find risk-neutral probabilities 492, and qs that make the expectation of any unit stock (a stock valued at $1) after one period (1+r) where ry is the risk-free rate per period, and the standard deviation 0.2. (In other words, find 21: (2, and ( such that E[X] = (1 + r) and Var(X) = 0.04 where X is the random variable that represents the unit stock price after one period). (b) Use the above risk-neutral probabilities and a trinomial lattice tree to calculate the current (t = 0) price of a European call option on the above stock thnt has strike $49 and expires in four months. (e) Use any method you like to find the current price of a European put option that has the same conditions as the call option in part (b). 2. (10 pt each) Consider a non-dividend-paying stock whose current price $(0) = S is $45. After each period there is a 25% chance that the stock price goes up by 25%, 35% chance that the stock price stays the same, and 40% chance that the stock price drops by 20%. Current risk-free interest rate is 7.2% per annum, compounded monthly. Count a month as one period. (a) Find risk-neutral probabilities 492, and qs that make the expectation of any unit stock (a stock valued at $1) after one period (1+r) where ry is the risk-free rate per period, and the standard deviation 0.2. (In other words, find 21: (2, and ( such that E[X] = (1 + r) and Var(X) = 0.04 where X is the random variable that represents the unit stock price after one period). (b) Use the above risk-neutral probabilities and a trinomial lattice tree to calculate the current (t = 0) price of a European call option on the above stock thnt has strike $49 and expires in four months. (e) Use any method you like to find the current price of a European put option that has the same conditions as the call option in part (b)