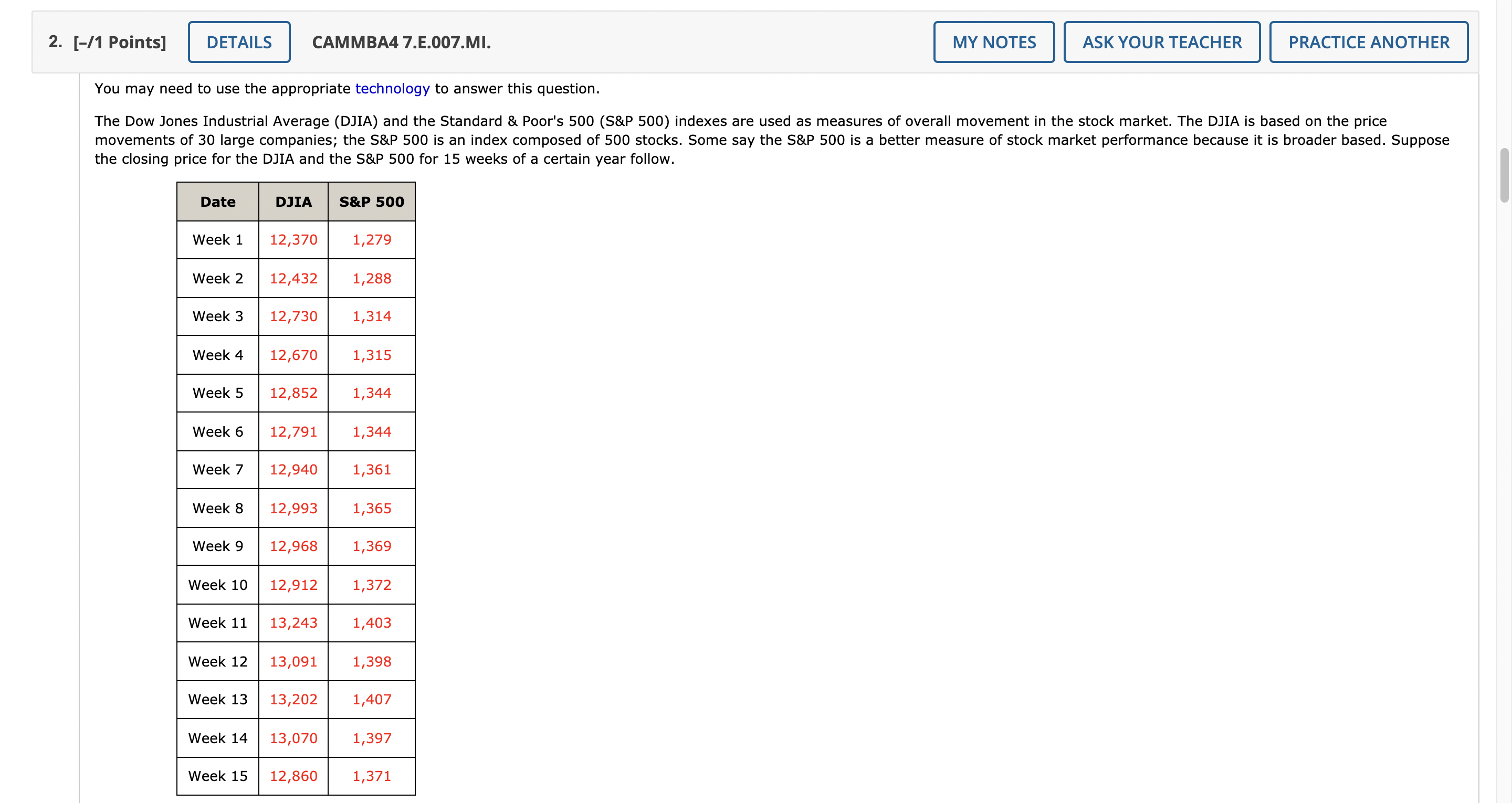

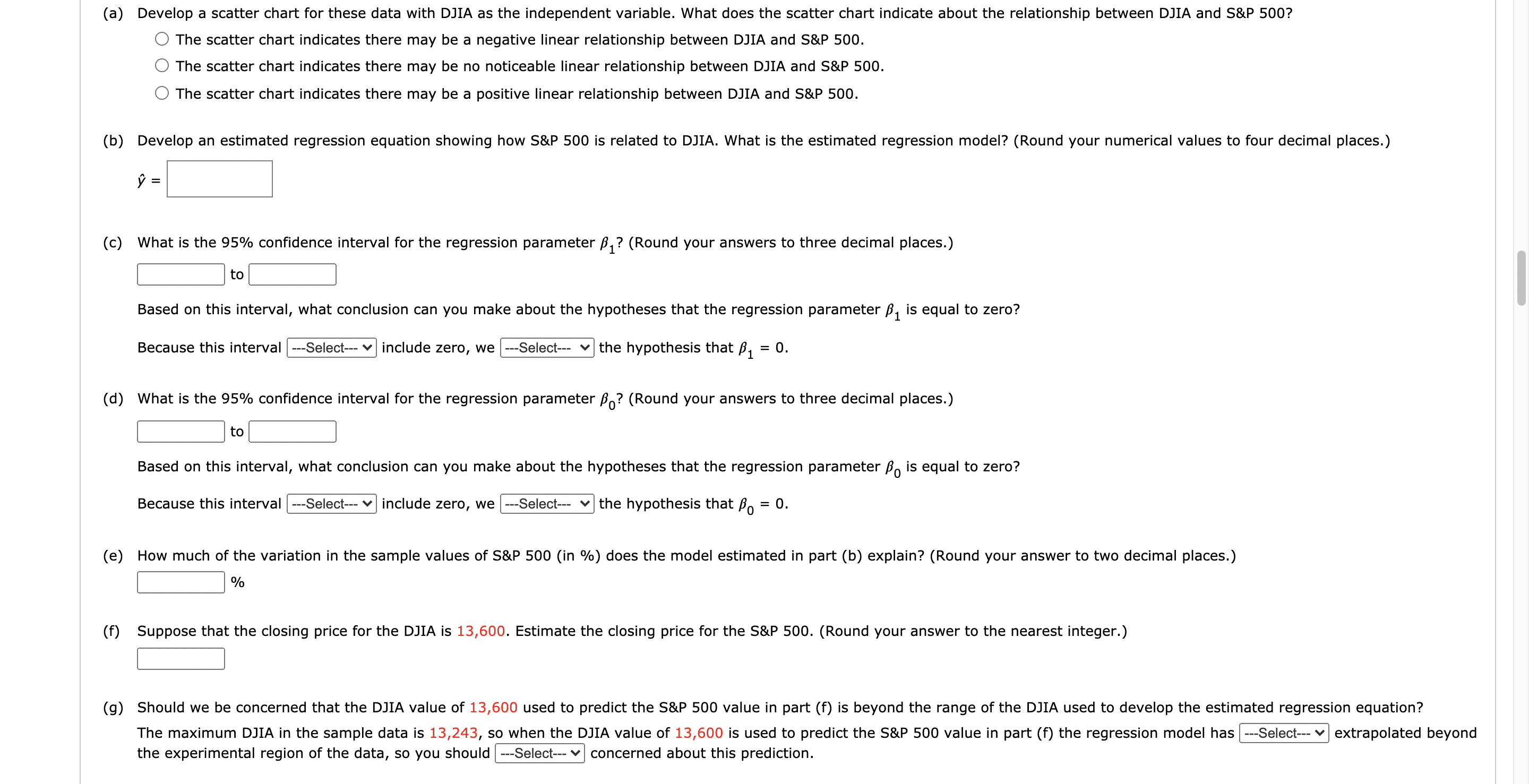

2. [-11 Points] CAMMBA4 7.E.007.Ml. You may need to use the appropriate technology to answer this question. Date DJIA S&P 500 Week 1 12,370 1,279 Week 2 12,432 1,288 Week 3 12,730 1,314 Week 4 12,670 1,315 Week 5 12,852 1,344 Week 6 12,791 1,344 Week 7 12,940 1,361 Week 8 12,993 1,365 Week 9 12,968 1,369 Week 10 12,912 1,372 Week 11 13,243 1,403 Week 12 13,091 1,398 Week 13 13,202 1,407 Week 14 13,070 1,397 Week 15 12,860 1,371 ASK YOUR TEACHER PRACTICE ANOTHER The Dow Jones Industrial Average (DJIA) and the Standard & Poor's 500 (S&P 500) indexes are used as measures of overall movement in the stock market. The DJIA is based on the price movements of 30 large companies; the 5&P 500 is an index composed of 500 stocks. Some say the 5&P 500 is a better measure of stock market performance because it is broader based. Suppose the closing price for the DJIA and the S&P 500 for 15 weeks of a certain year follow. (a) Develop a scatter chart for these data with DJIA as the independent variable. What does the scatter chart indicate about the relationship between DJIA and S&P 500? O The scatter chart indicates there may be a negative linear relationship between DJIA and S&P 500. O The scatter chart indicates there may be no noticeable linear relationship between DJIA and S&P 500. O The scatter chart indicates there may be a positive linear relationship between DJIA and S&P 500. (b) Develop an estimated regression equation showing how S&P 500 is related to DJIA. What is the estimated regression model? (Round your numerical values to four decimal places.) 9 = S (c) What is the 95% confidence interval for the regression parameter [11? (Round your answers to three decimal places.) to l Based on this interval, what conclusion can you make about the hypotheses that the regression parameter [)1 is equal to zero? Because this interval include zero, we _the hypothesis that #1 = 0. (d) What is the 95% confidence interval for the regression parameter 130? (Round your answers to three decimal places.) to Based on this interval, what conclusion can you make about the hypotheses that the regression parameter #0 is equal to zero? Because this interval include zero, we Select- v the hypothesis that #0 = 0. (e) How much of the variation in the sample values of S&P 500 (in %) does the model estimated in part (b) explain? (Round your answer to two decimal places.) % (f) Suppose that the closing price for the DJIA is 13,600. Estimate the closing price for the S&P 500. (Round your answer to the nearest integer.) (9) Should we be concerned that the DJIA value of 13,600 used to predict the S&P 500 value in part (f) is beyond the range of the DJIA used to develop the estimated regression equation? The maximum DJIA in the sample data is 13,243, so when the DJIA value of 13,600 is used to predict the S&P 500 value in part (f) the regression model has extrapolated beyond the experimental region of the data, so you should ---Seleot-v concerned about this prediction