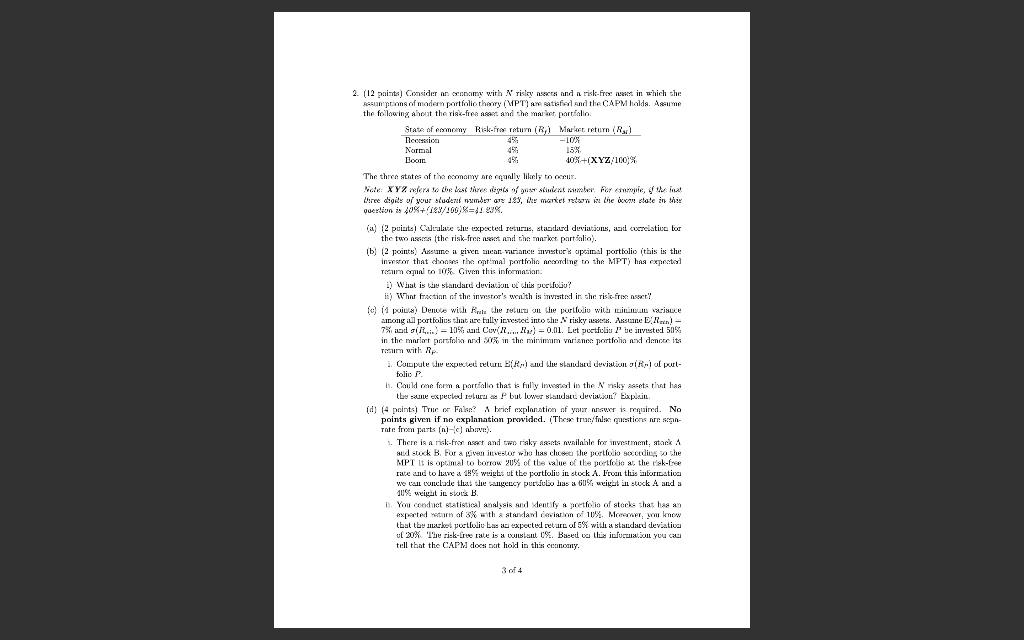

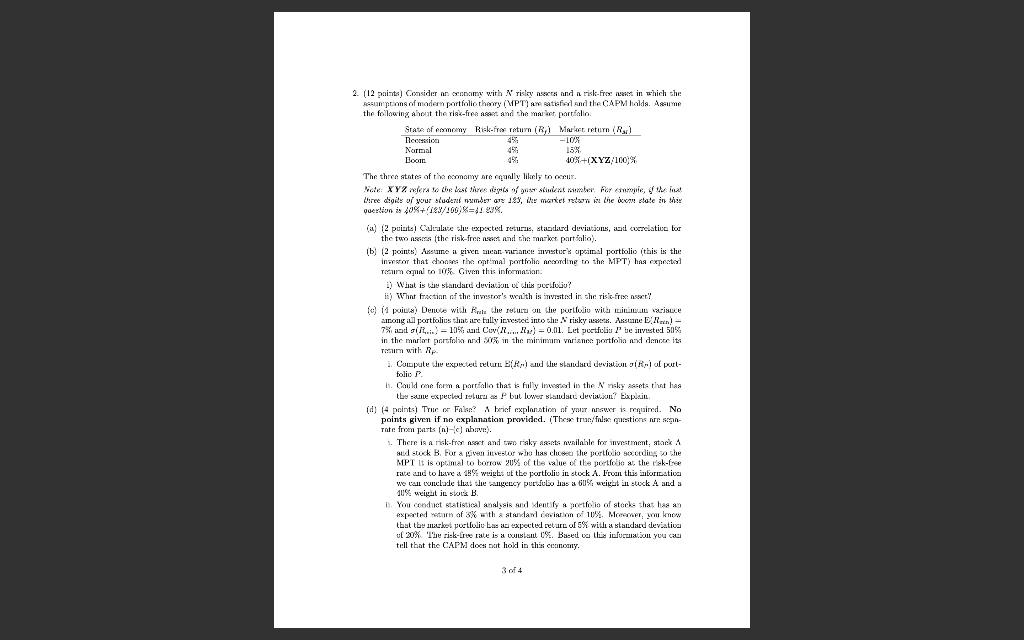

2. (12 points) Consider an cecamy with risky next and n risk-free rest in which the Resom poms of modern portfolio thay (MPT) and the CAPM halda. Asume the following about the risic-free set and the market portfolio State of comcey Rak-frer return (R) Maker return (R) conscica -1078 Normal 44 15% Loon 40%+(XYZ/100 % The three states of the commonly aroqually likely to our Note: XYZ refers to the best le dessutent number for crownie, of inst Lisree dits of your studezi mder GUY 183, ike martes a lhe a state in this Querlioni 40%+188/960) WX. a) 12 points Carlate su uxpected returns, stabdard deviations, and coerclative for the two news (the risk-free it and the marker portfolia). b) 12 points) Ansune i giver mean-variance instur's optimal porttolio (this is the In that changes the contimal portfolio Acerding to the MPT) has exportal Temalt 101% Given this informacion ) What is to standard deviation is proefoliu? ii) What fraction of the investor's wealth is invested in the risk-free net! le 11 poil Dewe will rate Wie rout on the portfolio with Lyrisce anong al portfolios that are fully invested into the riskywek. Ansune EN- 7% od ul.) - 10%. Cuv......:) = 0.01. Let portfoliu l' te invested 50%. in the marit portfolsa and 21 in the minimum variance portfolio and dance its Tum with Rp 1. Colupute de expected retur BER and blue standard deviation IR of purt- folio P. h. Could one forma portfolio that is fully inwester in the N roky assets that has the same expected rulur a P but lower blandt devia.o? Expain (d) (4 points True or Fake? berief explanation of your newer is ruired. No points given if no explanation provided. These true/fase guestions are sean- Tate from parts (nl-c) nove). 1. There is a risk-front and risky Assets nilable for investment, atack and lock B Porvenilestor who has close the portfolio socoding to the MPT It is optimal to borrow 20% of the value of the portfolio ar, the sk-free rate and to live a 10% weighs of the portfoliu in stock A. Froan this inforicativa we call conclude that the agency purvulo has a 60% weight in stock A and a 10% weight in slova B You conduct statistical analysis and Kentify a portfolio of stocks that has an exported return of 3% with a standard deviation of 10X. Morermew that the short poetboliv bas expected reture of 5% with a standard deviativa u 20%. The risk-free rate is a visu 0%. Based va tlex iufuru.on you cao tell that the CAPM does not hokl in this concy, 3 of 4 2. (12 points) Consider an cecamy with risky next and n risk-free rest in which the Resom poms of modern portfolio thay (MPT) and the CAPM halda. Asume the following about the risic-free set and the market portfolio State of comcey Rak-frer return (R) Maker return (R) conscica -1078 Normal 44 15% Loon 40%+(XYZ/100 % The three states of the commonly aroqually likely to our Note: XYZ refers to the best le dessutent number for crownie, of inst Lisree dits of your studezi mder GUY 183, ike martes a lhe a state in this Querlioni 40%+188/960) WX. a) 12 points Carlate su uxpected returns, stabdard deviations, and coerclative for the two news (the risk-free it and the marker portfolia). b) 12 points) Ansune i giver mean-variance instur's optimal porttolio (this is the In that changes the contimal portfolio Acerding to the MPT) has exportal Temalt 101% Given this informacion ) What is to standard deviation is proefoliu? ii) What fraction of the investor's wealth is invested in the risk-free net! le 11 poil Dewe will rate Wie rout on the portfolio with Lyrisce anong al portfolios that are fully invested into the riskywek. Ansune EN- 7% od ul.) - 10%. Cuv......:) = 0.01. Let portfoliu l' te invested 50%. in the marit portfolsa and 21 in the minimum variance portfolio and dance its Tum with Rp 1. Colupute de expected retur BER and blue standard deviation IR of purt- folio P. h. Could one forma portfolio that is fully inwester in the N roky assets that has the same expected rulur a P but lower blandt devia.o? Expain (d) (4 points True or Fake? berief explanation of your newer is ruired. No points given if no explanation provided. These true/fase guestions are sean- Tate from parts (nl-c) nove). 1. There is a risk-front and risky Assets nilable for investment, atack and lock B Porvenilestor who has close the portfolio socoding to the MPT It is optimal to borrow 20% of the value of the portfolio ar, the sk-free rate and to live a 10% weighs of the portfoliu in stock A. Froan this inforicativa we call conclude that the agency purvulo has a 60% weight in stock A and a 10% weight in slova B You conduct statistical analysis and Kentify a portfolio of stocks that has an exported return of 3% with a standard deviation of 10X. Morermew that the short poetboliv bas expected reture of 5% with a standard deviativa u 20%. The risk-free rate is a visu 0%. Based va tlex iufuru.on you cao tell that the CAPM does not hokl in this concy, 3 of 4