Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you solve all questions and show all work Your favorite athlete has just been offered a $25 million, 7-year contract. Their salary for the

Can you solve all questions and show all work

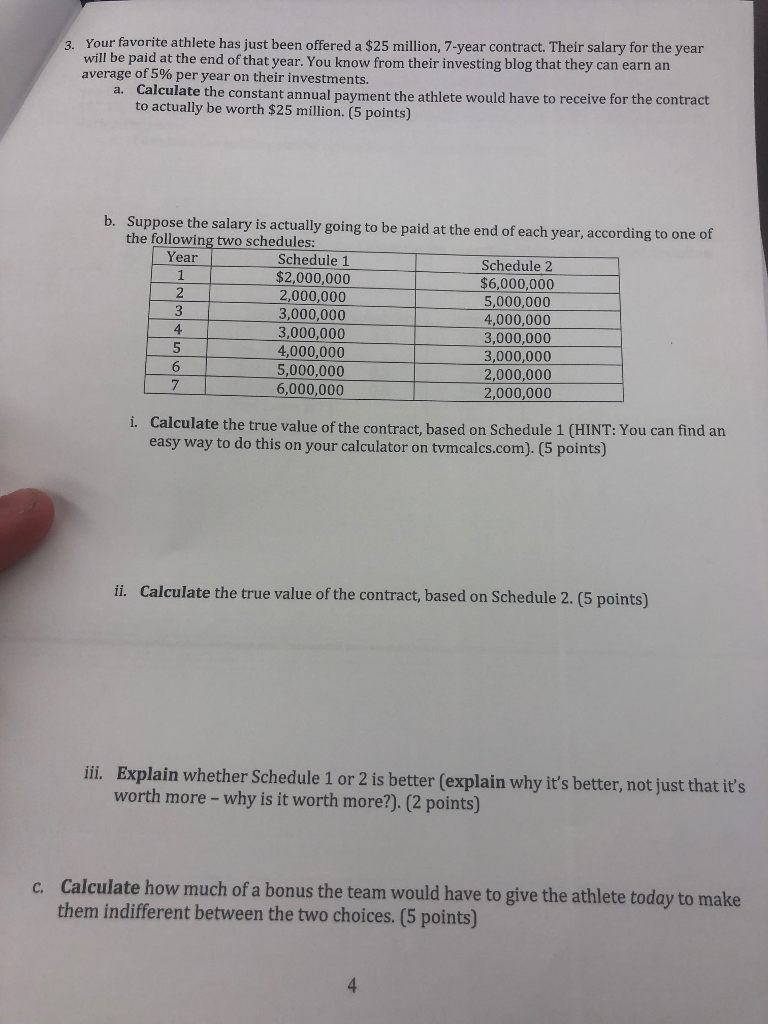

Your favorite athlete has just been offered a $25 million, 7-year contract. Their salary for the year will be paid at the end of that year. You know from their investing blog that they can earn an average of 5% per year on their investments. 3. Calculate the constant annual payment the athlete would have to receive for the contract to actually be worth $25 million. (5 points) a. b. Suppose the salary is actually going to be paid at the end of each year, according to one of the following two schedules: Year Schedule 1 $2,000,000 2,000,000 3,000,000 3,000,000 4,000,000 5,000,000 6,000,000 Schedule 2 $6,000,000 5,000,000 4,000,000 3,000,000 3,000,000 2,000,000 2,000,000 4 Calculate the true value of the contract, based on Schedule 1 (HINT: You can find an easy way to do this on your calculator on tvmcalcs.com). (5 points) i. il. Calculate the true value of the contract, based on Schedule 2. (5 points) ifl. Explain whether Schedule 1 or 2 is better (explain why it's better, not just that it's worth more - why is it worth more?). (2 points) Calculate how much of a bonus the team would have to give the athlete today to make them indifferent between the two choices. (5 points) c. 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started