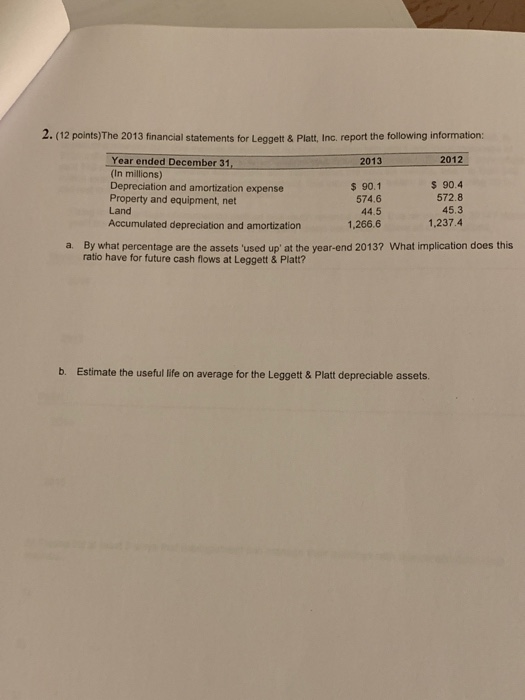

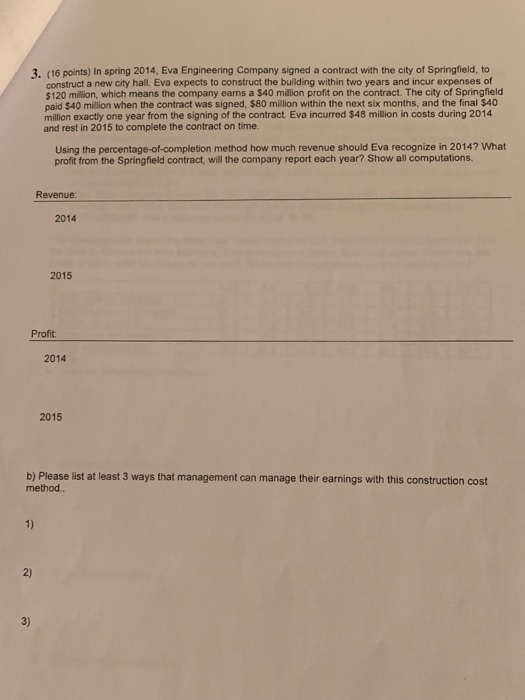

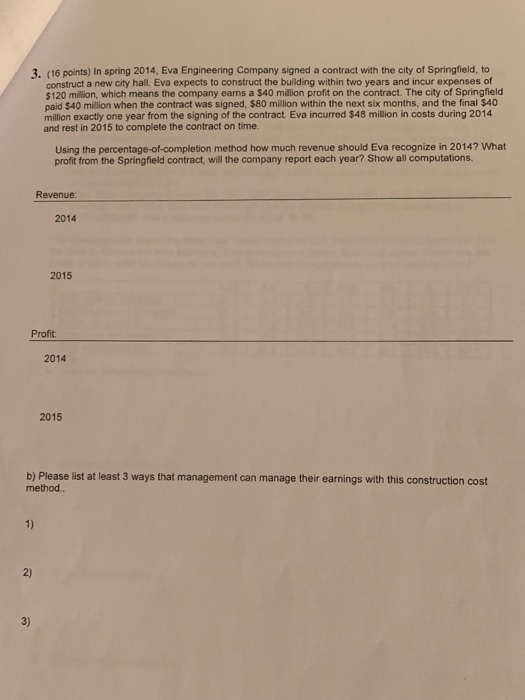

2. (12 points)The 2013 financial statements for Legget&Platt, Inc. report the following information: Year ended December 31 In millions) Depreciation and amortization expense Property and equipment, net Land Accumulated depreciation and amortization 2012 2013 S 90.4 572.8 45.3 1,237.4 $ 90.1 574.6 44.5 1,266.6 By what percentage are the assets 'used up' at the year-end 2013? What implication does this ratio have for future cash flows at Leggett & Platt? a. b. Estimate the useful life on average for the Leggett & Platt depreciable assets. 3. (16 points) In spring 2014, Eva Engineering Company signed a contract with the city of Springfield, to construct a new city hall. Eva expects to construct the building within two years and incur expenses of $120 milion, which means the company earns a $40 million profit on the contract. The city of Springfield paid $40 million when the contract was signed, $80 million within the next six months, and the final $40 million exactly one year from the signing of the contract. Eva incurred $48 million in costs during 2014 and rest in 2015 to complete the contract on time Using the percentage-of-completion method how much revenue should Eva recognize in 2014? What profit from the Springfield contract, will the company report each year? Show all computations Revenue 2014 2015 Profit 2014 2015 b) Please ist t least 3 ways that management can manage their earnings with this construction cost method. 2) 3) 2. (12 points)The 2013 financial statements for Legget&Platt, Inc. report the following information: Year ended December 31 In millions) Depreciation and amortization expense Property and equipment, net Land Accumulated depreciation and amortization 2012 2013 S 90.4 572.8 45.3 1,237.4 $ 90.1 574.6 44.5 1,266.6 By what percentage are the assets 'used up' at the year-end 2013? What implication does this ratio have for future cash flows at Leggett & Platt? a. b. Estimate the useful life on average for the Leggett & Platt depreciable assets. 3. (16 points) In spring 2014, Eva Engineering Company signed a contract with the city of Springfield, to construct a new city hall. Eva expects to construct the building within two years and incur expenses of $120 milion, which means the company earns a $40 million profit on the contract. The city of Springfield paid $40 million when the contract was signed, $80 million within the next six months, and the final $40 million exactly one year from the signing of the contract. Eva incurred $48 million in costs during 2014 and rest in 2015 to complete the contract on time Using the percentage-of-completion method how much revenue should Eva recognize in 2014? What profit from the Springfield contract, will the company report each year? Show all computations Revenue 2014 2015 Profit 2014 2015 b) Please ist t least 3 ways that management can manage their earnings with this construction cost method. 2) 3)