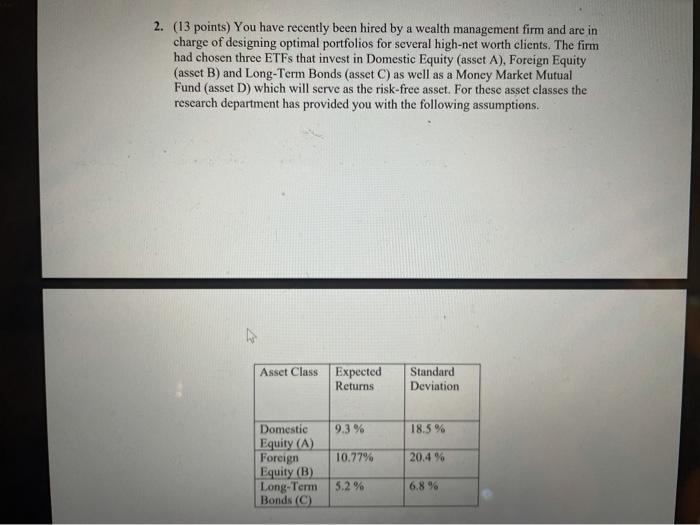

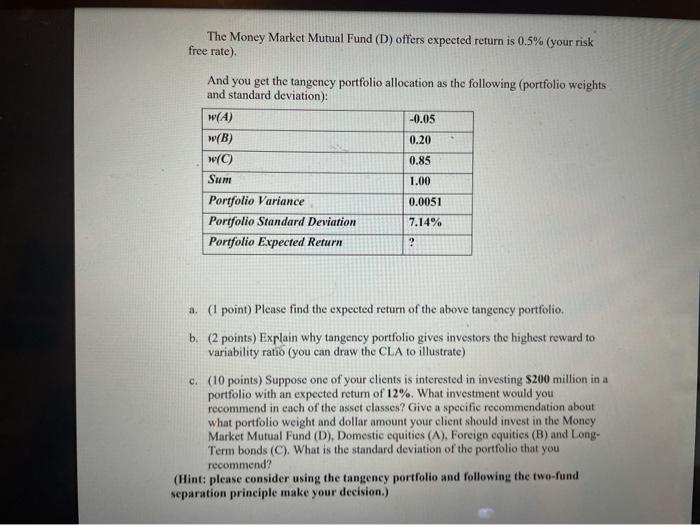

2. (13 points) You have recently been hired by a wealth management firm and are in charge of designing optimal portfolios for several high-net worth clients. The firm had chosen three ETFs that invest in Domestic Equity (asset A), Foreign Equity (asset B) and Long-Term Bonds (asset C) as well as a Money Market Mutual Fund (asset D) which will serve as the risk-free asset. For these asset classes the research department has provided you with the following assumptions. Asset Class Expected Returns Standard Deviation 9.3 % 18.5% 10.77% 20.4% Domestic Equity (A) Foreign Equity (B) Long-Term Bonds (C) 5.2 % 6.8% The Money Market Mutual Fund (D) offers expected return is 0.5% (your risk free rate) And you get the tangency portfolio allocation as the following (portfolio weights and standard deviation): w(A) -0.05 w(B) 0.20 w(C) 0.85 Sum 1.00 Portfolio Variance 0.0051 Portfolio Standard Deviation 7.14% Portfolio Expected Return 2 a. (1 point) Please find the expected return of the above tangency portfolio b. (2 points) Explain why tangency portfolio gives investors the highest reward to variability ratio (you can draw the CLA to illustrate) c. (10 points) Suppose one of your clients is interested in investing $200 million in a portfolio with an expected return of 12%. What investment would you recommend in each of the asset classes? Give a specific recommendation about what portfolio weight and dollar amount your client should invest in the Money Market Mutual Fund (D), Domestic equities (A), Foreign equities (B) and Long- Term bonds (C). What is the standard deviation of the portfolio that you recommend? (Hint: please consider using the tangency portfolio and following the two-fund separation principle make your decision.) 2. (13 points) You have recently been hired by a wealth management firm and are in charge of designing optimal portfolios for several high-net worth clients. The firm had chosen three ETFs that invest in Domestic Equity (asset A), Foreign Equity (asset B) and Long-Term Bonds (asset C) as well as a Money Market Mutual Fund (asset D) which will serve as the risk-free asset. For these asset classes the research department has provided you with the following assumptions. Asset Class Expected Returns Standard Deviation 9.3 % 18.5% 10.77% 20.4% Domestic Equity (A) Foreign Equity (B) Long-Term Bonds (C) 5.2 % 6.8% The Money Market Mutual Fund (D) offers expected return is 0.5% (your risk free rate) And you get the tangency portfolio allocation as the following (portfolio weights and standard deviation): w(A) -0.05 w(B) 0.20 w(C) 0.85 Sum 1.00 Portfolio Variance 0.0051 Portfolio Standard Deviation 7.14% Portfolio Expected Return 2 a. (1 point) Please find the expected return of the above tangency portfolio b. (2 points) Explain why tangency portfolio gives investors the highest reward to variability ratio (you can draw the CLA to illustrate) c. (10 points) Suppose one of your clients is interested in investing $200 million in a portfolio with an expected return of 12%. What investment would you recommend in each of the asset classes? Give a specific recommendation about what portfolio weight and dollar amount your client should invest in the Money Market Mutual Fund (D), Domestic equities (A), Foreign equities (B) and Long- Term bonds (C). What is the standard deviation of the portfolio that you recommend? (Hint: please consider using the tangency portfolio and following the two-fund separation principle make your decision.)