Answered step by step

Verified Expert Solution

Question

1 Approved Answer

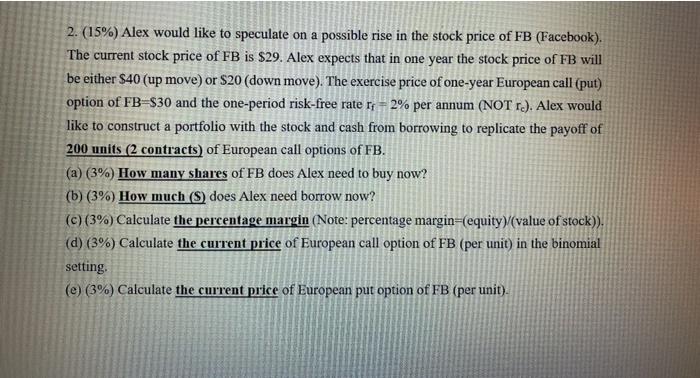

. 2. (15%) Alex would like to speculate on a possible rise in the stock price of FB (Facebook). The current stock price of FB

.

2. (15%) Alex would like to speculate on a possible rise in the stock price of FB (Facebook). The current stock price of FB is $29. Alex expects that in one year the stock price of FB will be either $40 (up move) or $20 (down move). The exercise price of one-year European call (put) option of FB-$30 and the one-period risk-free rate rr = 2% per annum (NOT re). Alex would like to construct a portfolio with the stock and cash from borrowing to replicate the payoff of 200 units (2 contracts) of European call options of FB. (a) (3%) How many shares of FB does Alex need to buy now? (b) (3%) How much (S) does Alex need borrow now? (c)(3%) Calculate the percentage margin (Note: percentage margin=(equity)/(value of stock)) (d) (3%) Calculate the current price of European call option of FB (per unit) in the binomial setting (e) (3%) Calculate the current price of European put option of FB (per unit). 2. (15%) Alex would like to speculate on a possible rise in the stock price of FB (Facebook). The current stock price of FB is $29. Alex expects that in one year the stock price of FB will be either $40 (up move) or $20 (down move). The exercise price of one-year European call (put) option of FB-$30 and the one-period risk-free rate rr = 2% per annum (NOT re). Alex would like to construct a portfolio with the stock and cash from borrowing to replicate the payoff of 200 units (2 contracts) of European call options of FB. (a) (3%) How many shares of FB does Alex need to buy now? (b) (3%) How much (S) does Alex need borrow now? (c)(3%) Calculate the percentage margin (Note: percentage margin=(equity)/(value of stock)) (d) (3%) Calculate the current price of European call option of FB (per unit) in the binomial setting (e) (3%) Calculate the current price of European put option of FB (per unit) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started