Answered step by step

Verified Expert Solution

Question

1 Approved Answer

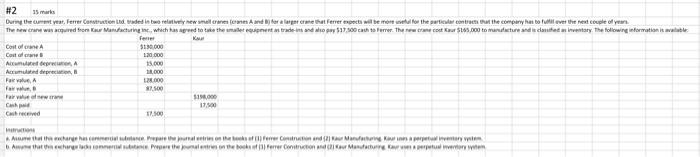

#2 15 marks During the current year, Ferrer Construction Ltd. traded in two relatively new small cranes (cranes A and B) for a larger

#2 15 marks During the current year, Ferrer Construction Ltd. traded in two relatively new small cranes (cranes A and B) for a larger crane that Ferrer expects will be more useful for the particular contracts that the company has to fulfil over the next couple of years The new crane was acquired from Kaur Manufacturing Inc., which has agreed to take the smaller equipment as trade-ins and also pay $17,500 cash to Ferrer. The new crane cost Kaur $165,000 to manufacture and is classed as inventory. The following information is available Fener Cost of crane A Cost of crane Accumulated depreciation, A Accumulated depreciation Cash Cash received $130,000 120.000 15.000 18,000 128,000 $7,500 17,500 17.500 Assume that this exchange has commercial subtance Prepare the journal entries on the books of (1) Femer Construction and (2) Kaur Manufacturing Kaur is a perpetual inventory system Ame that the charge lads commercial substance Prepare the journal entries on the books of (3) Ferrer Construction and (2) Kaur Manufacturing Kaur perpetual inventory system

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started