Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The GreenBall Inc. is evaluating the possibility of entering the golf ball manufacturing business. Last month the company spent $15m to rent the equipment

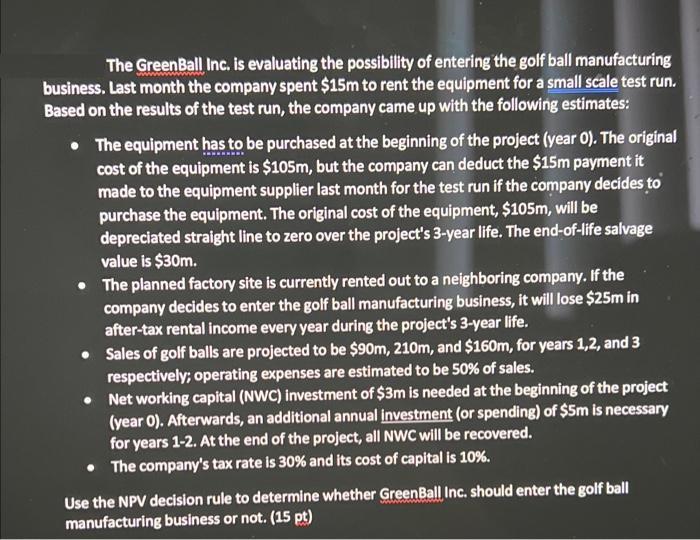

The GreenBall Inc. is evaluating the possibility of entering the golf ball manufacturing business. Last month the company spent $15m to rent the equipment for a small scale test run. Based on the results of the test run, the company came up with the following estimates: wwwwwww. The equipment has to be purchased at the beginning of the project (year 0). The original cost of the equipment is $105m, but the company can deduct the $15m payment it made to the equipment supplier last month for the test run if the company decides to purchase the equipment. The original cost of the equipment, $105m, will be depreciated straight line to zero over the project's 3-year life. The end-of-life salvage value is $30m. The planned factory site is currently rented out to a neighboring company. If the company decides to enter the golf ball manufacturing business, it will lose $25m in after-tax rental income every year during the project's 3-year life. Sales of golf balls are projected to be $90m, 210m, and $160m, for years 1,2, and 3 respectively; operating expenses are estimated to be 50% of sales. Net working capital (NWC) investment of $3m is needed at the beginning of the project (year 0). Afterwards, an additional annual investment (or spending) of $5m is necessary for years 1-2. At the end of the project, all NWC will be recovered. The company's tax rate is 30% and its cost of capital is 10%. Use the NPV decision rule to determine whether GreenBall Inc. should enter the golf ball manufacturing business or not. (15 pt)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine whether GreenBall Inc should enter the golf ball manufacturing business or not we will calculate the Net Present Value NPV of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started