Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b) Sonar sensors are being purchased for use in loading docks to help trucks back up safely. The cost of purchasing and installing these

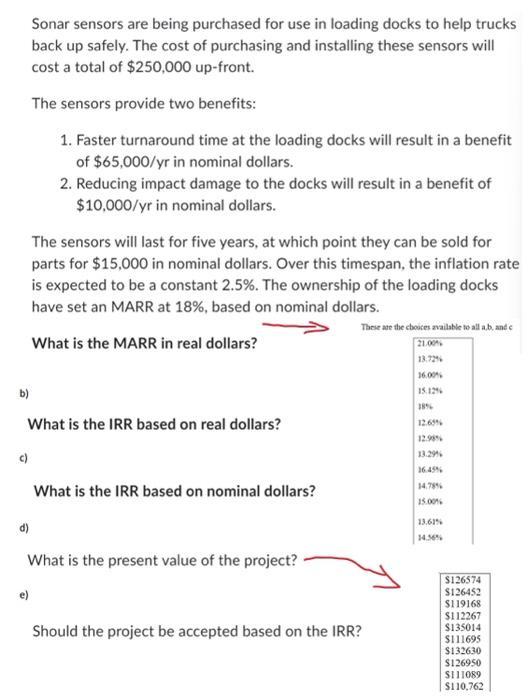

b) Sonar sensors are being purchased for use in loading docks to help trucks back up safely. The cost of purchasing and installing these sensors will cost a total of $250,000 up-front. The sensors provide two benefits: 1. Faster turnaround time at the loading docks will result in a benefit of $65,000/yr in nominal dollars. 2. Reducing impact damage to the docks will result in a benefit of $10,000/yr in nominal dollars. The sensors will last for five years, at which point they can be sold for parts for $15,000 in nominal dollars. Over this timespan, the inflation rate is expected to be a constant 2.5%. The ownership of the loading docks have set an MARR at 18%, based on nominal dollars. What is the MARR in real dollars? What is the IRR based on real dollars? e) What is the IRR based on nominal dollars? What is the present value of the project? These are the choices available to all ab, and c 21.00% Should the project be accepted based on the IRR? 16.00% 15.12% 18% 12.98% 13.29% 16.45% 14.78% 15.00% 13.61% 14.36% $126574 $126452 $119168 $112267 $135014 $111695 $132630 $126950 $111089 $110,762

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The MARR given is 18 in nominal dollars To convert to real dollars we subtract the e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started