Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. [16 Marks] Futures Contracts Adam, a speculator is convinced that the stock market will fall significantly in the forthcoming months. The current market index

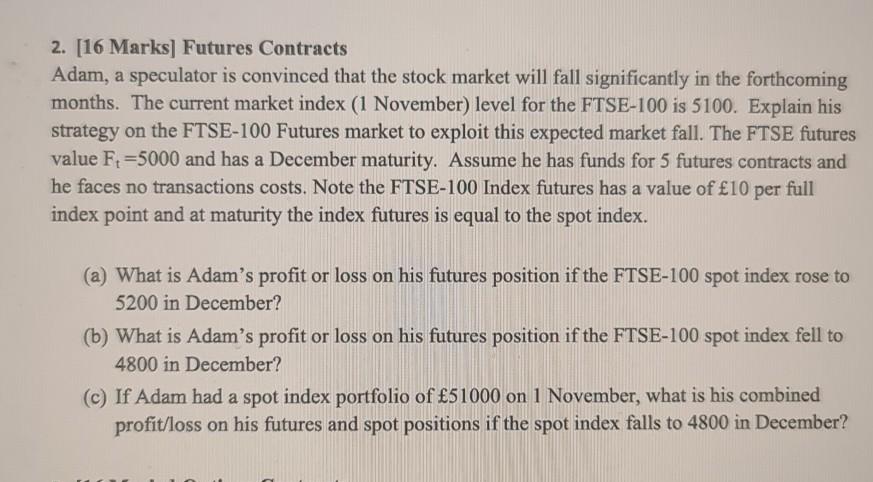

2. [16 Marks] Futures Contracts Adam, a speculator is convinced that the stock market will fall significantly in the forthcoming months. The current market index (1 November) level for the FTSE-100 is 5100. Explain his strategy on the FTSE-100 Futures market to exploit this expected market fall. The FTSE futures value F =5000 and has a December maturity. Assume he has funds for 5 futures contracts and he faces no transactions costs. Note the FTSE-100 Index futures has a value of 10 per full index point and at maturity the index futures is equal to the spot index. (a) What is Adam's profit or loss on his futures position if the FTSE-100 spot index rose to 5200 in December? (b) What is Adam's profit or loss on his futures position if the FTSE-100 spot index fell to 4800 in December? (C) If Adam had a spot index portfolio of 51000 on 1 November, what is his combined profit/loss on his futures and spot positions if the spot index falls to 4800 in December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started