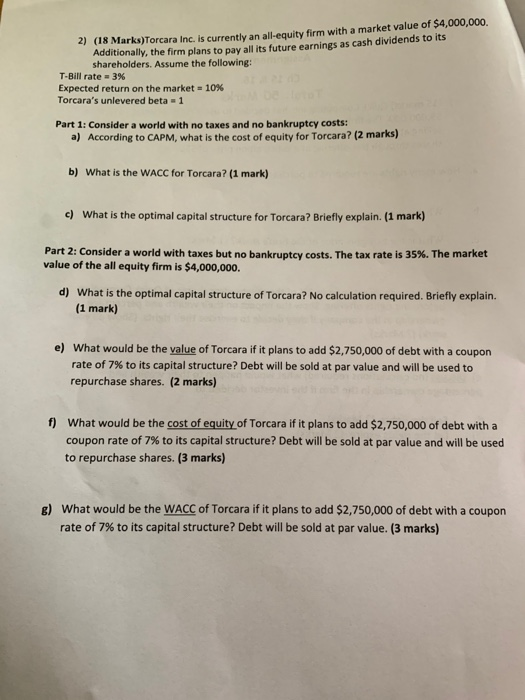

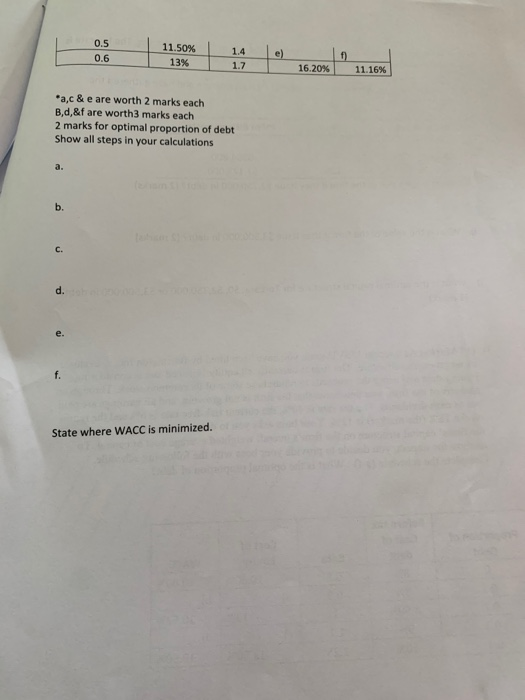

2) (18 Marks)Torcara Inc. is currently an all-equity firm with a market value of $4,000,000. Additionally, the firm plans to pay all its future earnings as cash dividends to its shareholders. Assume the following: T-Bill rate = 3% Expected return on the market = 10% Torcara's unlevered beta = 1 Part 1: Consider a world with no taxes and no bankruptcy costs: a) According to CAPM, what is the cost of equity for Torcara? (2 marks) b) What is the WACC for Torcara? (1 mark) c) What is the optimal capital structure for Torcara? Briefly explain. (1 mark) Part 2: Consider a world with taxes but no bankruptcy costs. The tax rate is 35%. The market value of the all equity firm is $4,000,000. d) What is the optimal capital structure of Torcara? No calculation required. Briefly explain. (1 mark) e) What would be the value of Torcara if it plans to add $2,750,000 of debt with a coupon rate of 7% to its capital structure? Debt will be sold at par value and will be used to repurchase shares. (2 marks) f) What would be the cost of equity of Torcara if it plans to add $2,750,000 of debt with a coupon rate of 7% to its capital structure? Debt will be sold at par value and will be used to repurchase shares. (3 marks) g) What would be the WACC of Torcara if it plans to add $2,750,000 of debt with a coupon rate of 7% to its capital structure? Debt will be sold at par value. (3 marks) 0.5 0.6 11.50% 13% e) 1.4 1.7 16.20% 11.16% *a,c& e are worth 2 marks each B,D,&f are worth3 marks each 2 marks for optimal proportion of debt Show all steps in your calculations State where WACC is minimized. 2) (18 Marks)Torcara Inc. is currently an all-equity firm with a market value of $4,000,000. Additionally, the firm plans to pay all its future earnings as cash dividends to its shareholders. Assume the following: T-Bill rate = 3% Expected return on the market = 10% Torcara's unlevered beta = 1 Part 1: Consider a world with no taxes and no bankruptcy costs: a) According to CAPM, what is the cost of equity for Torcara? (2 marks) b) What is the WACC for Torcara? (1 mark) c) What is the optimal capital structure for Torcara? Briefly explain. (1 mark) Part 2: Consider a world with taxes but no bankruptcy costs. The tax rate is 35%. The market value of the all equity firm is $4,000,000. d) What is the optimal capital structure of Torcara? No calculation required. Briefly explain. (1 mark) e) What would be the value of Torcara if it plans to add $2,750,000 of debt with a coupon rate of 7% to its capital structure? Debt will be sold at par value and will be used to repurchase shares. (2 marks) f) What would be the cost of equity of Torcara if it plans to add $2,750,000 of debt with a coupon rate of 7% to its capital structure? Debt will be sold at par value and will be used to repurchase shares. (3 marks) g) What would be the WACC of Torcara if it plans to add $2,750,000 of debt with a coupon rate of 7% to its capital structure? Debt will be sold at par value. (3 marks) 0.5 0.6 11.50% 13% e) 1.4 1.7 16.20% 11.16% *a,c& e are worth 2 marks each B,D,&f are worth3 marks each 2 marks for optimal proportion of debt Show all steps in your calculations State where WACC is minimized