Answered step by step

Verified Expert Solution

Question

1 Approved Answer

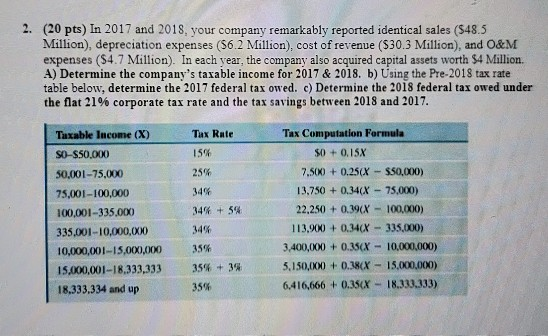

2. (20 pts) In 2017 and 2018, your company remarkably reported identical sales ($48.5 Million), depreciation expenses (56.2 Million), cost of revenue ($30.3 Million), and

2. (20 pts) In 2017 and 2018, your company remarkably reported identical sales ($48.5 Million), depreciation expenses (56.2 Million), cost of revenue ($30.3 Million), and O&M expenses ($4.7 Million). In each year, the company also acquired capital assets worth $4 Million A) Determine the company's taxable income for 2017 & 2018. b) Using the Pre-2018 tax rate table below, determine the 2017 federal tax owed. c) Determine the 2018 federal tax owed under the flat 21% corporate tax rate and the tax savings between 2018 and 2017. Taxable income (X) Tax Rate 15% 25% 34% + 5% SO-S50.000 50,001-75.000 75,001-100,000 100,001-335.000 335,001-10,000,000 10,000,001-15,000,000 15,000,001-18,333,333 18.333.334 and up Tax Computation Formula $0 + 0.15X 7.500+ 0.25(X - $50,000) 13.750 + 0.34(X - 75.000) 22.250 + 0.39CX - 100,000) 113,900 +0.34(X - 335,000) 3,400,000+ 0.35(X - 10.000.000) 5,150,000+ 0.38CX - 15.000.000) 6416,666 +0.350X - 18.333.333) 346 35% 35% + 3% 35%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started