Question

2. (23 points total) The article Muni Bonds Seem Immune ... WSJ 3/7/19 p. B12 (attached at the end of the exam) describes the situation

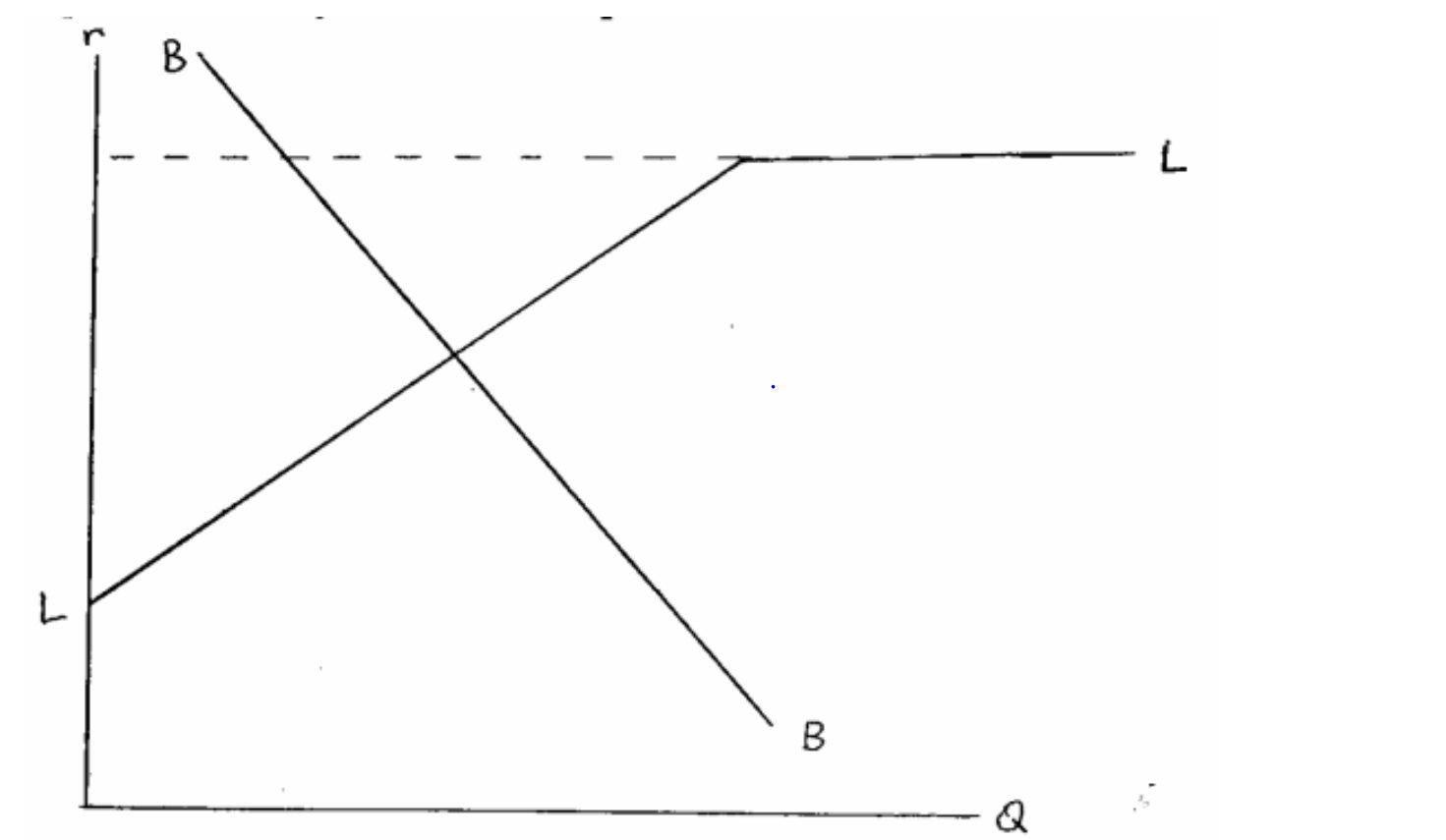

2. (23 points total) The article Muni Bonds Seem Immune ... WSJ 3/7/19 p. B12 (attached at the end of the exam) describes the situation in the municipal bond market at that time.The diagram below depicts equilibrium in the market for tax-exempt bonds.

a. (5 points) On this diagram indicate i) the equilibrium tax-exempt yield, ii) the quantity of tax-exempt securities issued, iii) the location of high tax tax bracket individual or institutional investors, iv) the location of low tax tax bracket individual or institutional investors, v) the location of the investor in the break-even (implied marginal) tax bracket.

b. (8 points) The article notes that the key feature of the 2017 tax law change was to lower corporate and individual income tax rates. Use the diagram above to analyze the impact this tax policy change would have on the municipal bond market. If a curve in the diagram would shift, explain why it would shift the way it does based on the impact of this policy change on a factorin the model. In addition, indicate or explain the effect on: i. the yield of tax exempt bonds, RE, ii. the quantity issued, QE, and iii. the implied marginal tax bracket TM,

c. (6 points) In addition, the article notes the 2017 tax changes also severely limit the extent to which state and local tax payments can be used as a deduction to reduce income subject to federal taxation. Consider the lenders curve (demand for municipal bonds or supply of municipal loans) generated by residents of a high-tax state like California. How, if at all, will the loss of the state tax deduction affect the lenders curve? Explain: i) why this happens, andii) what effect this has on the yield of municipal bonds?

d. (4 points) Near the end, the article mentions that, investors often weigh relative yields of munis and treasuries to determine where to place their cash. How would an investor use this ratio (RE/ RT) to decide whether to buy a muni or a comparable taxable bond?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started