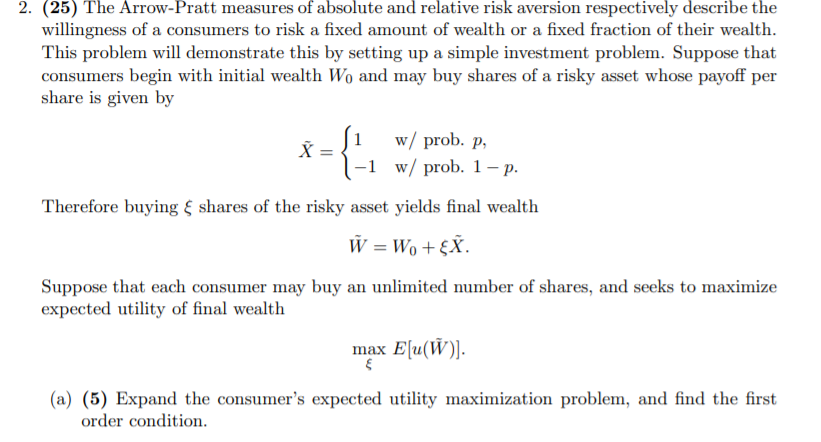

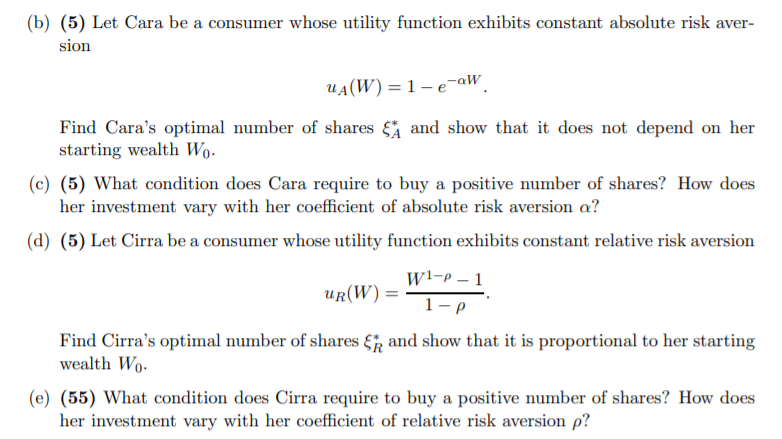

2. (25) The Arrow-Pratt measures of absolute and relative risk aversion respectively describe the willingness of a consumers to risk a fixed amount of wealth or a fixed fraction of their wealth. This problem will demonstrate this by setting up a simple investment problem. Suppose that consumers begin with initial wealth W, and may buy shares of a risky asset whose payoff per share is given by w/ prob. p. -1 w/ prob. 1-p. Therefore buying & shares of the risky asset yields final wealth W = W. +EX Suppose that each consumer may buy an unlimited number of shares, and seeks to maximize expected utility of final wealth max E[u(W)] $ (a) (5) Expand the consumer's expected utility maximization problem, and find the first order condition. (b) (5) Let Cara be a consumer whose utility function exhibits constant absolute risk aver- sion UA(W)=1-e-W Find Cara's optimal number of shares & and show that it does not depend on her starting wealth Wo. (c) (5) What condition does Cara require to buy a positive number of shares? How does her investment vary with her coefficient of absolute risk aversion a? (d) (5) Let Cirra be a consumer whose utility function exhibits constant relative risk aversion W1-P-1 UR(W) = 1- Find Cirra's optimal number of shares &R and show that it is proportional to her starting wealth Wo. (e) (55) What condition does Cirra require to buy a positive number of shares? How does her investment vary with her coefficient of relative risk aversion p? 2. (25) The Arrow-Pratt measures of absolute and relative risk aversion respectively describe the willingness of a consumers to risk a fixed amount of wealth or a fixed fraction of their wealth. This problem will demonstrate this by setting up a simple investment problem. Suppose that consumers begin with initial wealth W, and may buy shares of a risky asset whose payoff per share is given by w/ prob. p. -1 w/ prob. 1-p. Therefore buying & shares of the risky asset yields final wealth W = W. +EX Suppose that each consumer may buy an unlimited number of shares, and seeks to maximize expected utility of final wealth max E[u(W)] $ (a) (5) Expand the consumer's expected utility maximization problem, and find the first order condition. (b) (5) Let Cara be a consumer whose utility function exhibits constant absolute risk aver- sion UA(W)=1-e-W Find Cara's optimal number of shares & and show that it does not depend on her starting wealth Wo. (c) (5) What condition does Cara require to buy a positive number of shares? How does her investment vary with her coefficient of absolute risk aversion a? (d) (5) Let Cirra be a consumer whose utility function exhibits constant relative risk aversion W1-P-1 UR(W) = 1- Find Cirra's optimal number of shares &R and show that it is proportional to her starting wealth Wo. (e) (55) What condition does Cirra require to buy a positive number of shares? How does her investment vary with her coefficient of relative risk aversion p