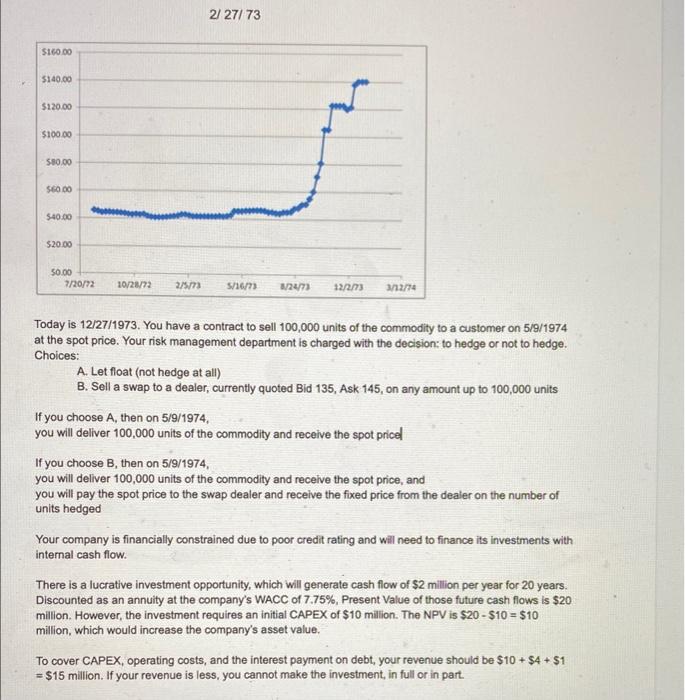

2/ 27/73 $160.00 $140.00 $120.00 $100.00 S80.00 $60.00 $40.00 $20.00 50.00 7/20/72 10/28/72 2/5773 5/16/7) 1247 32/2/3 3/12/14 Today is 12/27/1973. You have a contract to sell 100,000 units of the commodity to a customer on 5/9/1974 at the spot price. Your risk management department is charged with the decision: to hedge or not to hedge. Choices: A. Let float (not hedge at all) B. Sell a swap to a dealer, currently quoted Bid 135, Ask 145, on any amount up to 100,000 units If you choose A, then on 5/9/1974, you will deliver 100,000 units of the commodity and receive the spot priced If you choose B, then on 5/9/1974, you will deliver 100,000 units of the commodity and receive the spot price, and you will pay the spot price to the swap dealer and receive the fixed price from the dealer on the number of units hedged Your company is financially constrained due to poor credit rating and will need to finance its investments with internal cash flow. There is a lucrative investment opportunity, which will generate cash flow of $2 million per year for 20 years. Discounted as an annuity at the company's WACC of 7.75%, Present Value of those future cash flows is $20 y million. However, the investment requires an initial CAPEX of $10 million. The NPV is $20 - $10 = $10 million, which would increase the company's asset value. To cover CAPEX, operating costs, and the interest payment on debt, your revenue should be $10+ $4 + $1 = $15 million. If your revenue is less, you cannot make the investment, in full or in part. 2/ 27/73 $160.00 $140.00 $120.00 $100.00 S80.00 $60.00 $40.00 $20.00 50.00 7/20/72 10/28/72 2/5773 5/16/7) 1247 32/2/3 3/12/14 Today is 12/27/1973. You have a contract to sell 100,000 units of the commodity to a customer on 5/9/1974 at the spot price. Your risk management department is charged with the decision: to hedge or not to hedge. Choices: A. Let float (not hedge at all) B. Sell a swap to a dealer, currently quoted Bid 135, Ask 145, on any amount up to 100,000 units If you choose A, then on 5/9/1974, you will deliver 100,000 units of the commodity and receive the spot priced If you choose B, then on 5/9/1974, you will deliver 100,000 units of the commodity and receive the spot price, and you will pay the spot price to the swap dealer and receive the fixed price from the dealer on the number of units hedged Your company is financially constrained due to poor credit rating and will need to finance its investments with internal cash flow. There is a lucrative investment opportunity, which will generate cash flow of $2 million per year for 20 years. Discounted as an annuity at the company's WACC of 7.75%, Present Value of those future cash flows is $20 y million. However, the investment requires an initial CAPEX of $10 million. The NPV is $20 - $10 = $10 million, which would increase the company's asset value. To cover CAPEX, operating costs, and the interest payment on debt, your revenue should be $10+ $4 + $1 = $15 million. If your revenue is less, you cannot make the investment, in full or in part