Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. 3. 4. 5. 6. 7. lans to continue to (DDM) Bogey, Inc. has recently paid an annual cash dividend of $1.50 grow its

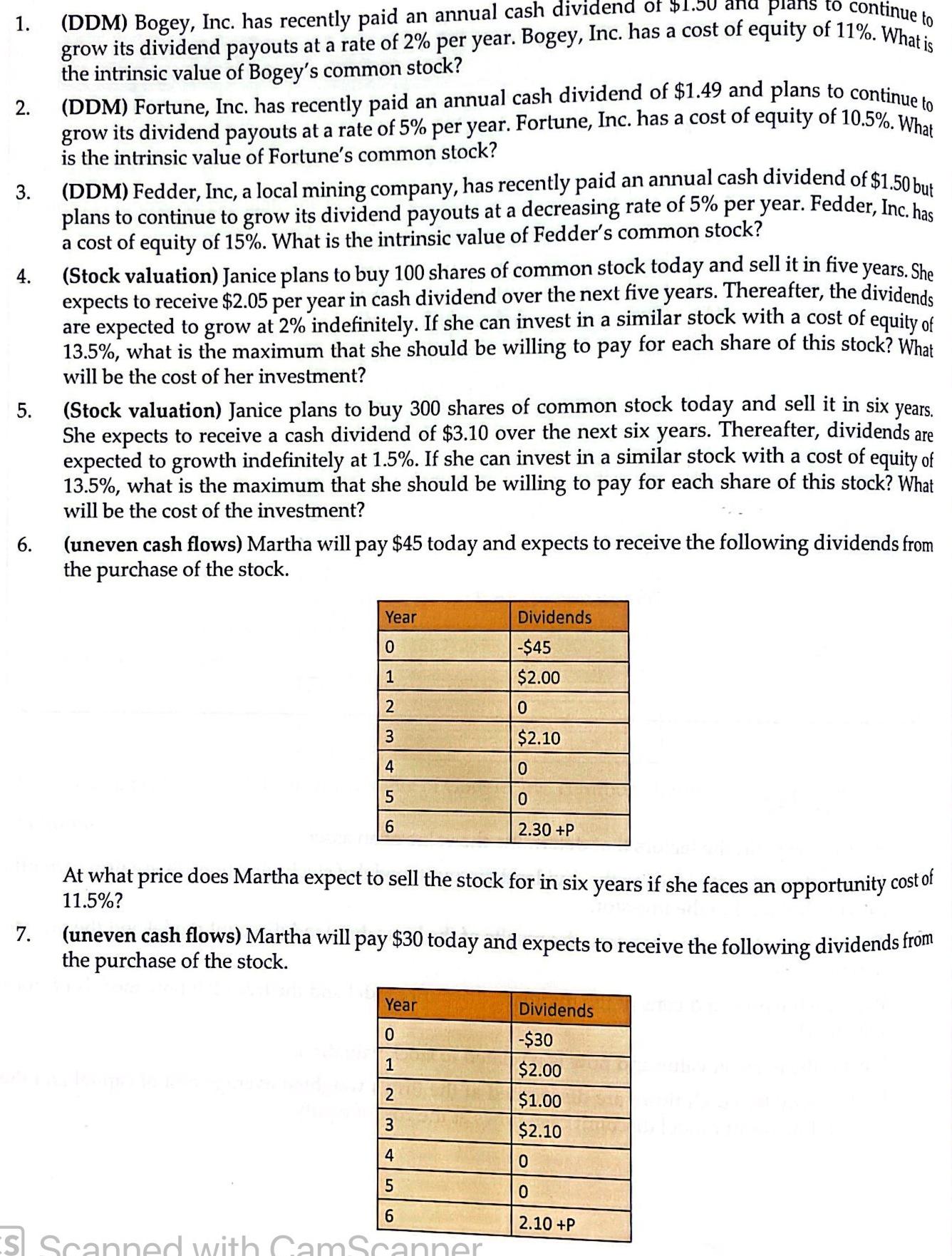

2. 3. 4. 5. 6. 7. lans to continue to (DDM) Bogey, Inc. has recently paid an annual cash dividend of $1.50 grow its dividend payouts at a rate of 2% per year. Bogey, Inc. has a cost of equity of 11%. What is the intrinsic value of Bogey's common stock? (DDM) Fortune, Inc. has recently paid an annual cash dividend of $1.49 and plans to continue to grow its dividend payouts at a rate of 5% per year. Fortune, Inc. has a cost of equity of 10.5%. What is the intrinsic value of Fortune's common stock? (DDM) Fedder, Inc, a local mining company, has recently paid an annual cash dividend of $1.50 but plans to continue to grow its dividend payouts at a decreasing rate of 5% per year. Fedder, Inc. has a cost of equity of 15%. What is the intrinsic value of Fedder's common stock? (Stock valuation) Janice plans to buy 100 shares of common stock today and sell it in five years. She expects to receive $2.05 per year in cash dividend over the next five years. Thereafter, the dividends are expected to grow at 2% indefinitely. If she can invest in a similar stock with a cost of equity of 13.5%, what is the maximum that she should be willing to pay for each share of this stock? What will be the cost of her investment? (Stock valuation) Janice plans to buy 300 shares of common stock today and sell it in six years. She expects to receive a cash dividend of $3.10 over the next six years. Thereafter, dividends are expected to growth indefinitely at 1.5%. If she can invest in a similar stock with a cost of equity of 13.5%, what is the maximum that she should be willing to pay for each share of this stock? What will be the cost of the investment? (uneven cash flows) Martha will pay $45 today and expects to receive the following dividends from the purchase of the stock. Year 0 1 2 3 4 5 6 Dividends -$45 $2.00 0 $2.10 0 0 2.30 +P At what price does Martha expect to sell the stock for in six years if she faces an opportunity cost of 11.5%? (uneven cash flows) Martha will pay $30 today and expects to receive the following dividends from the purchase of the stock. Year 0 1 2 3 4 5 6 ES Scanned with CamScanner Dividends -$30 $2.00 $1.00 $2.10 0 0 2.10 +P

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 DDM formula Intrinsic value Annual dividend Cost of equity Growth rate 150 011 002 150 009 1667 2 DDM formula Intrinsic value Annual dividend Cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started