Answered step by step

Verified Expert Solution

Question

1 Approved Answer

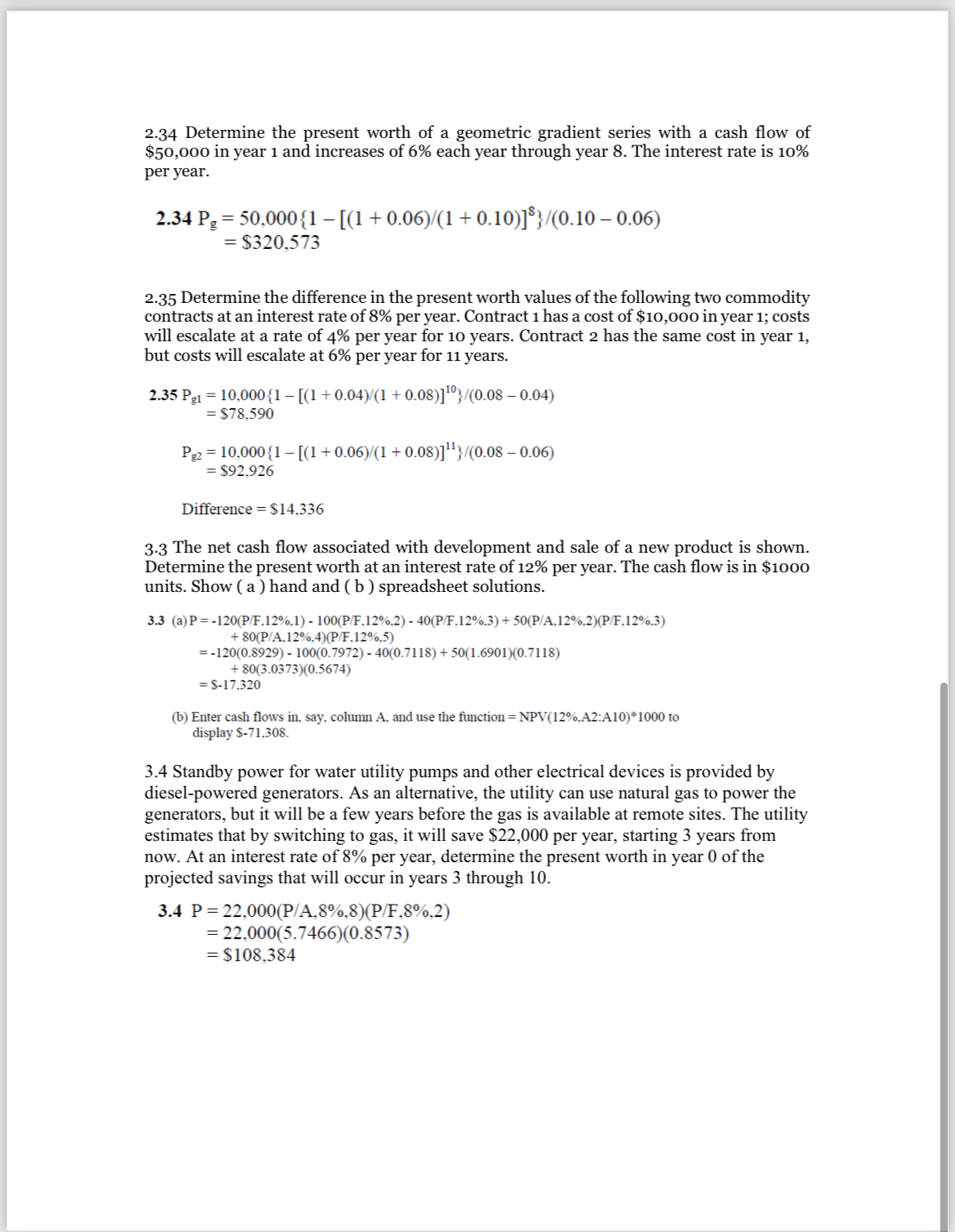

2 . 3 4 Determine the present worth of a geometric gradient series with a cash flow of $ 5 0 , 0 0 0

Determine the present worth of a geometric gradient series with a cash flow of $ in year and increases of each year through year The interest rate is per year.

$

Determine the difference in the present worth values of the following two commodity contracts at an interest rate of per year. Contract has a cost of $ in year ; costs will escalate at a rate of per year for years. Contract has the same cost in year but costs will escalate at per year for years.

$

$

Difference $

The net cash flow associated with development and sale of a new product is shown. Determine the present worth at an interest rate of per year. The cash flow is in $ units. Show a hand and b spreadsheet solutions.

b Enter cash flows in say, column A and use the function : to display $

Standby power for water utility pumps and other electrical devices is provided by dieselpowered generators. As an alternative, the utility can use natural gas to power the generators, but it will be a few years before the gas is available at remote sites. The utility estimates that by switching to gas, it will save $ per year, starting years from now. At an interest rate of per year, determine the present worth in year of the projected savings that will occur in years through

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started