Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 3 Better Builders has 1500 shares outstanding at a market price of $34.55 per share. Arbitrary Construction has 5,000 shares outstanding at a

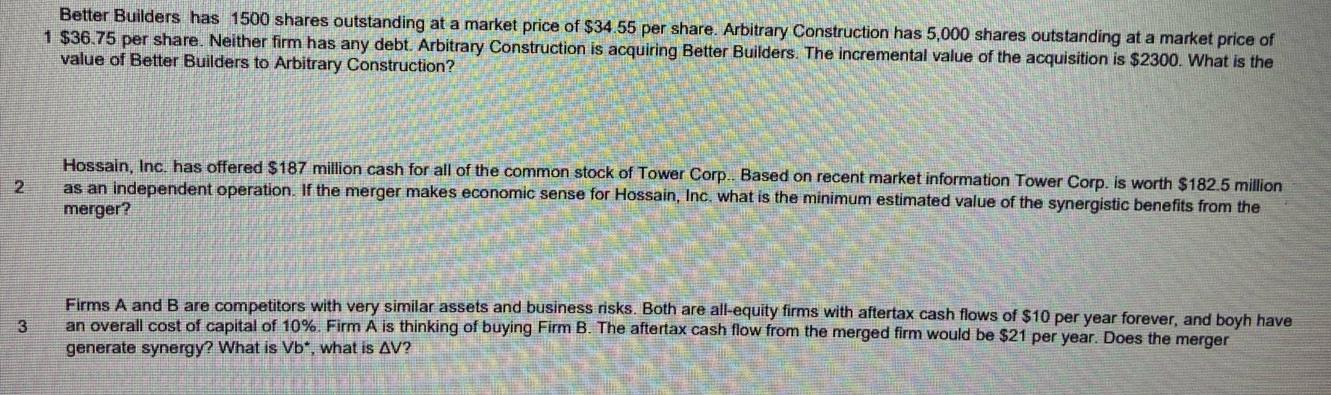

2 3 Better Builders has 1500 shares outstanding at a market price of $34.55 per share. Arbitrary Construction has 5,000 shares outstanding at a market price of 1 $36.75 per share. Neither firm has any debt. Arbitrary Construction is acquiring Better Builders. The incremental value of the acquisition is $2300. What is the value of Better Builders to Arbitrary Construction? Hossain, Inc. has offered $187 million cash for all the common stock of Tower Corp.. Based on recent market information Tower Corp. is worth $182.5 million as an independent operation. If the merger makes economic sense for Hossain, Inc. what is the minimum estimated value of the synergistic benefits from the merger? Firms A and B are competitors with very similar assets and business risks. Both are all-equity firms with aftertax cash flows of $10 per year forever, and boyh have an overall cost of capital of 10%. Firm A is thinking of buying Firm B. The aftertax cash flow from the merged firm would be $21 per year. Does the merger generate synergy? What is Vb*, what is AV?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Better Builders has 1500 shares outstanding at a market price of 3455 per share So its market valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started