Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. 3. Builder's (B) contract specifies consideration of $1 million and total costs of $700,000. B incurs costs of $420,000 in year 1. Assuming

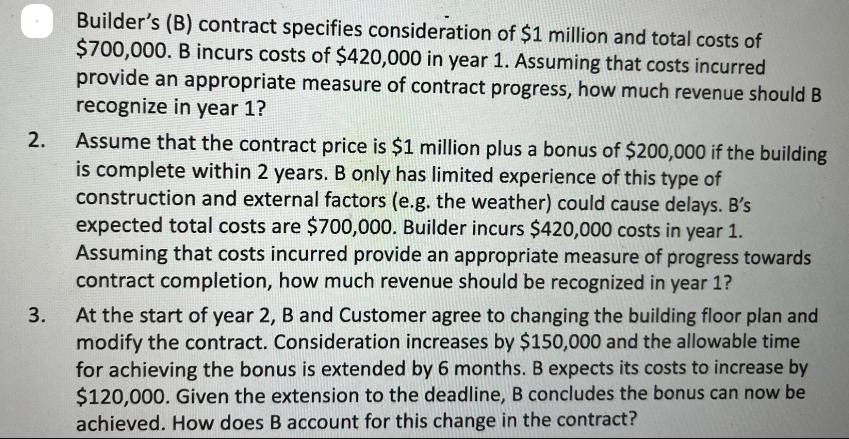

2. 3. Builder's (B) contract specifies consideration of $1 million and total costs of $700,000. B incurs costs of $420,000 in year 1. Assuming that costs incurred provide an appropriate measure of contract progress, how much revenue should B recognize in year 1? Assume that the contract price is $1 million plus a bonus of $200,000 if the building is complete within 2 years. B only has limited experience of this type of construction and external factors (e.g. the weather) could cause delays. B's expected total costs are $700,000. Builder incurs $420,000 costs in year 1. Assuming that costs incurred provide an appropriate measure of progress towards contract completion, how much revenue should be recognized in year 1? At the start of year 2, B and Customer agree to changing the building floor plan and modify the contract. Consideration increases by $150,000 and the allowable time for achieving the bonus is extended by 6 months. B expects its costs to increase by $120,000. Given the extension to the deadline, B concludes the bonus can now be achieved. How does B account for this change in the contract?

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 In this scenario the contract specifies a consideration of 1 million and total costs of 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started