2.

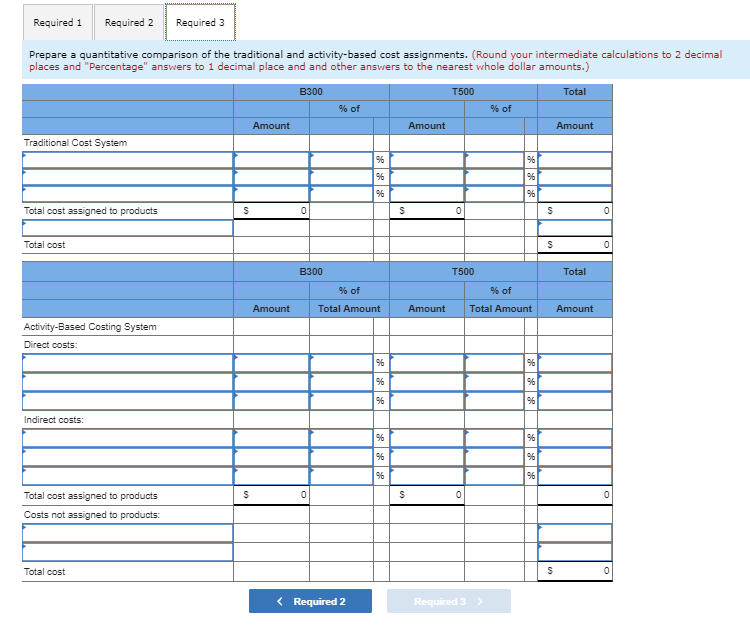

3.

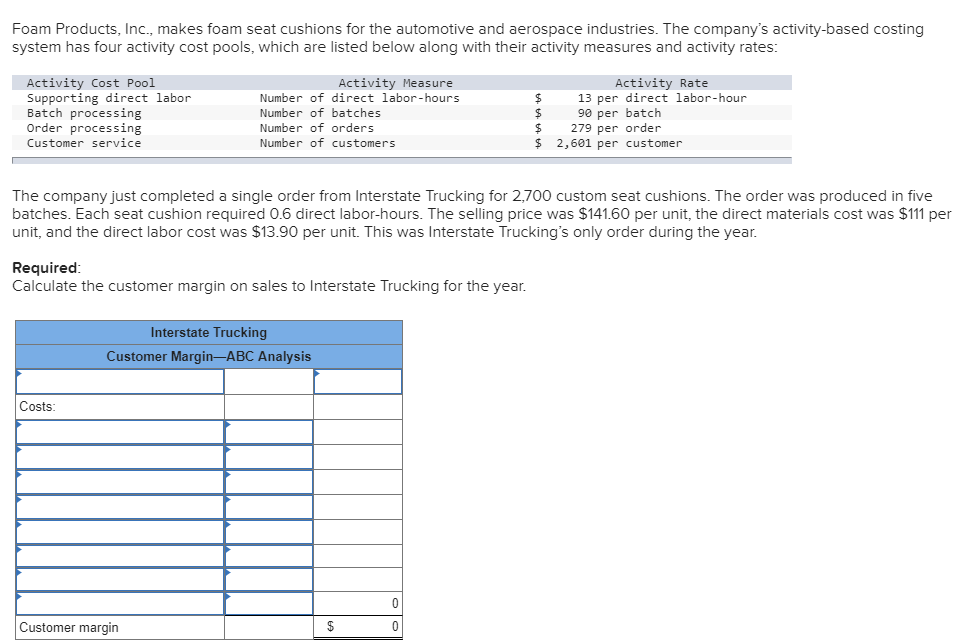

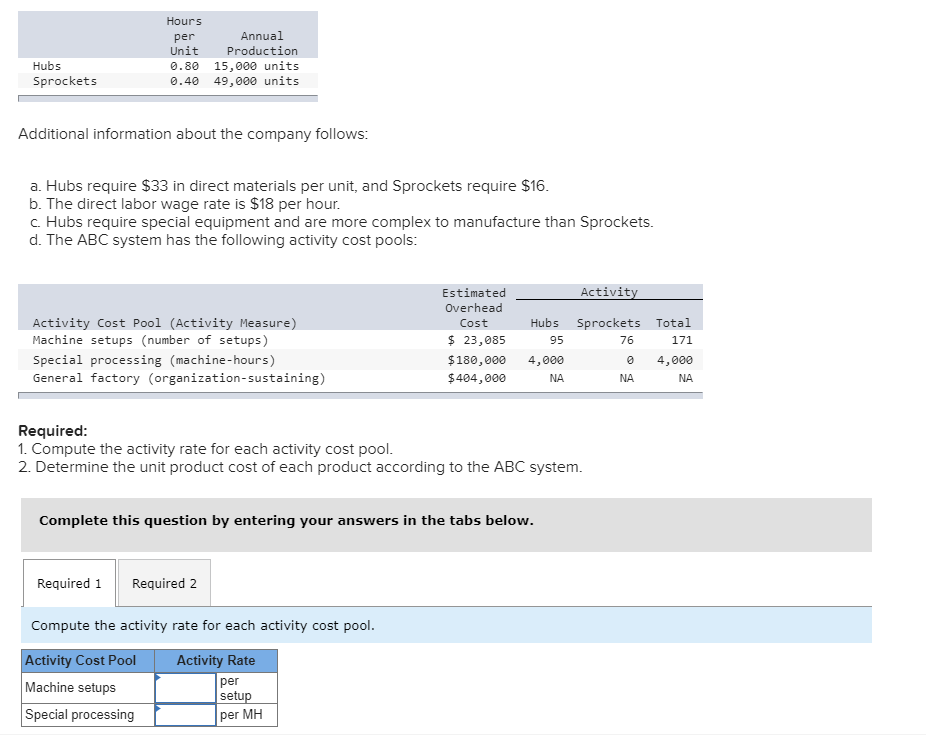

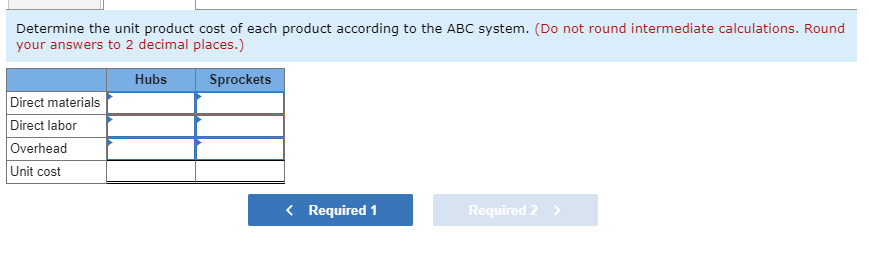

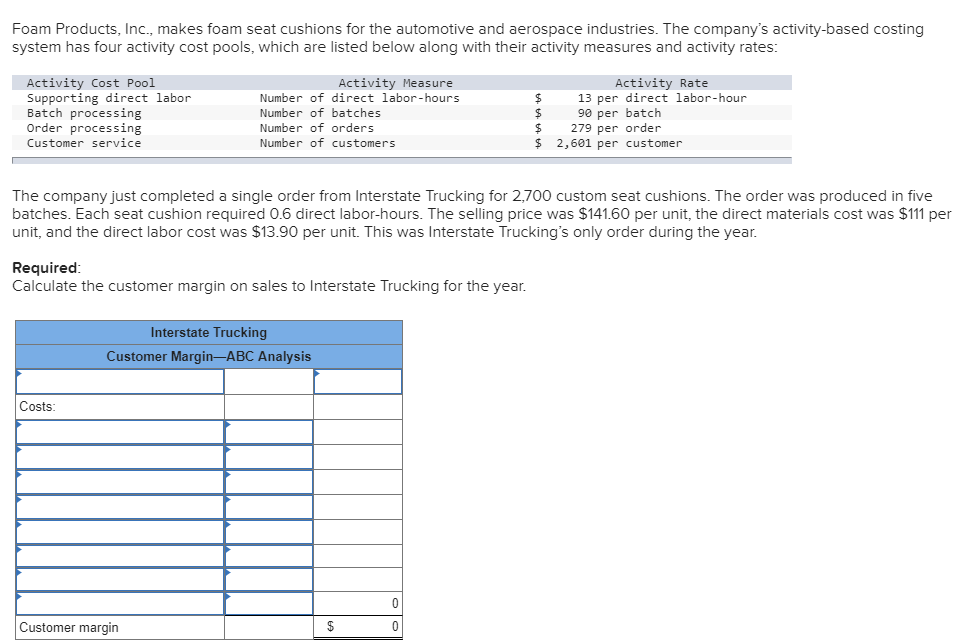

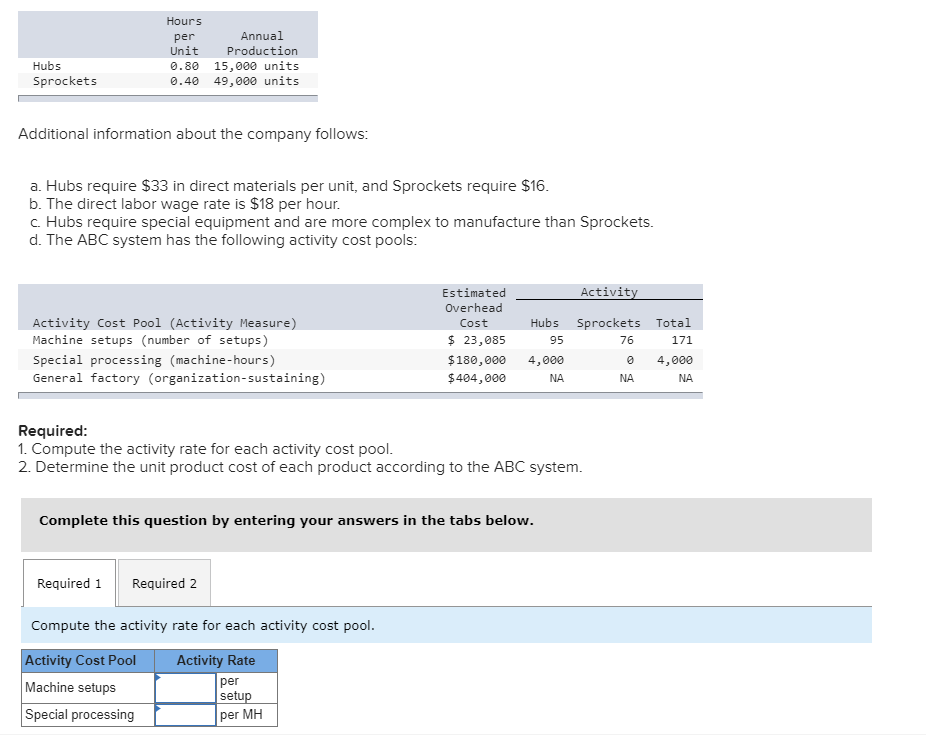

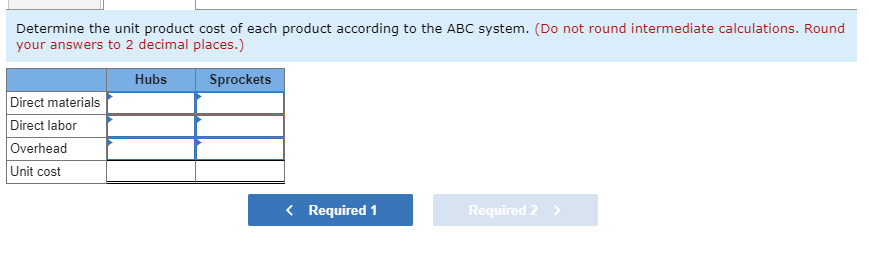

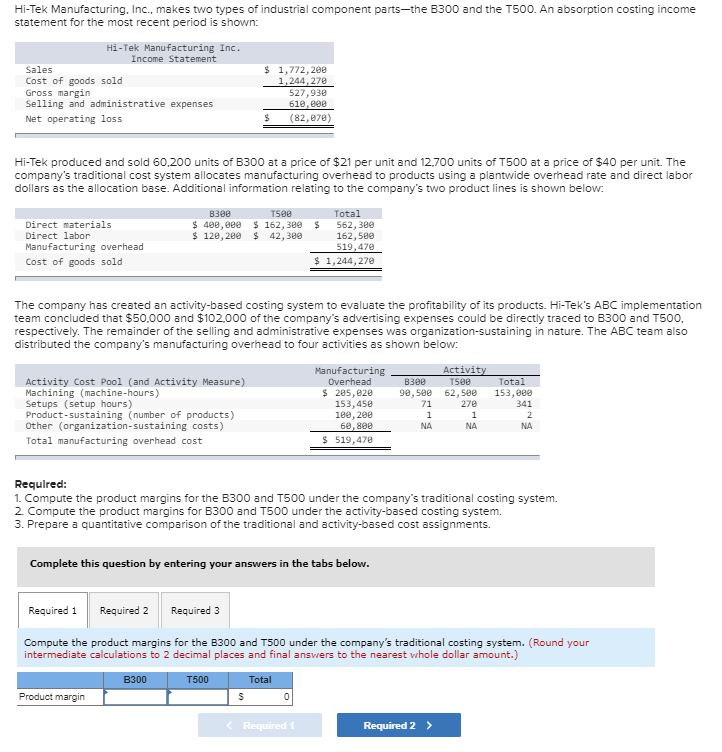

Foam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Activity Measure Number of direct labor-hours Activity Rate 13 per direct labor-hour 90 per batch Number of batches Number of orders $ 279 per order Customer service Number of customers 2,601 per customer The company just completed a single order from Interstate Trucking for 2,700 custom seat cushions. The order was produced in five batches. Each seat cushion required 0.6 direct labor-hours. The selling price was $141.60 per unit, the direct materials cost was $111 per unit, and the direct labor cost was $13.90 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the year. Interstate Trucking Customer Margin-ABC Analysis Costs Customer margin Hours Annual per Unit Production 15,000 units 49,000 units Hubs 0.80 Sprockets 0.40 Additional information about the company follows: a. Hubs require $33 in direct materials per unit, and Sprockets require $16 b. The direct labor wage rate is $18 per hour. c. Hubs require special equipment and are more complex to manufacture than Sprockets. d. The ABC system has the following activity cost pools: Activity Estimated Overhead Activity Cost Pool (Activity Measure) Machine setups (number of setups) Hubs Sprockets Total Cost 23,085 95 76 171 Special processing (machine-hours) General factory (organization-sustaining) $180,000 4,000 4,000 $404,000 NA NA NA Required: 1. Compute the activity rate for each activity cost pool. 2. Determine the unit product cost of each product according to the ABC system. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the activity rate for each activity cost pool. Activity Cost Pool Activity Rate per Machine setups setup Special processing per MH Determine the unit product cost of each product according to the ABC system. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Hubs Sprockets Direct materials Direct labor Overhead Unit cost

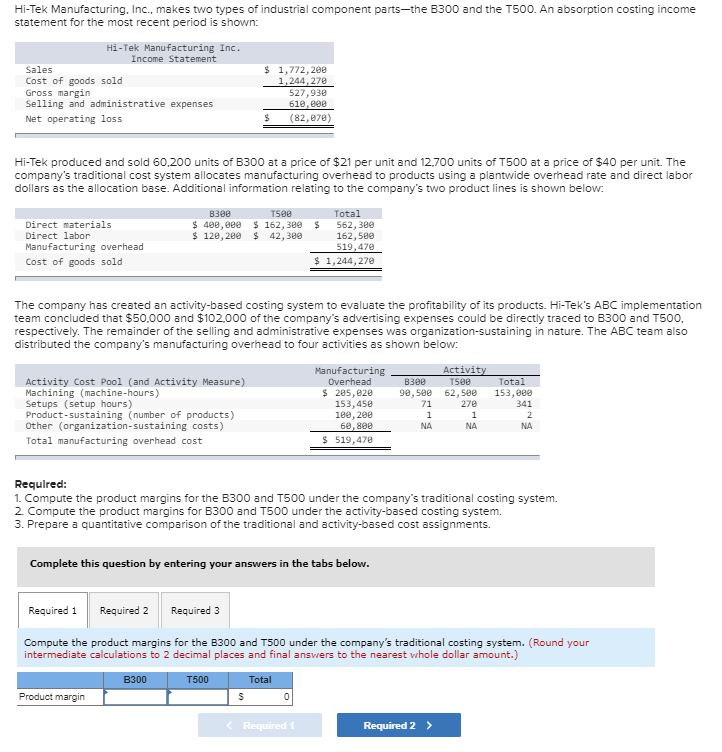

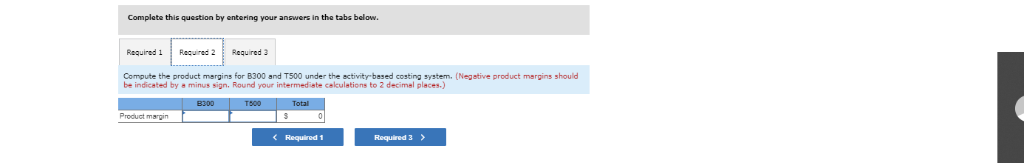

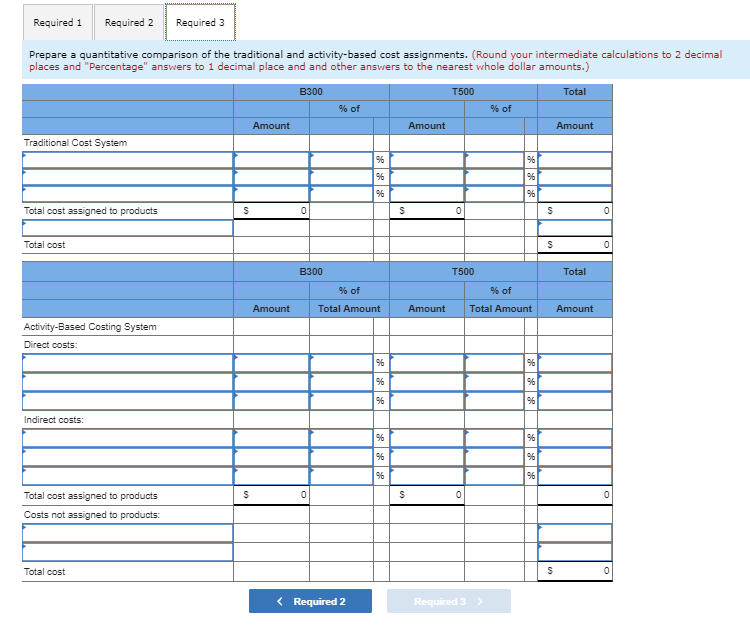

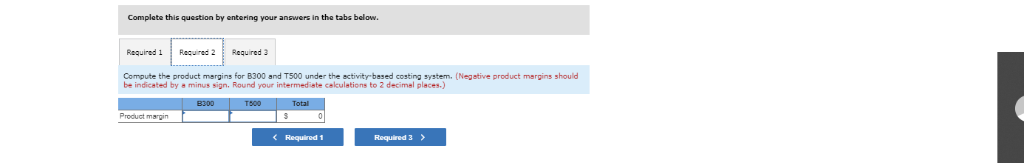

Complate this question I entering your answers in the tabs below Required 1 Required 2 Required 3 Compute the product marains for B300 and T500 under the activitcbased costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate celculations to 2 decimal places.) Total B300 T500 Product margin