Answered step by step

Verified Expert Solution

Question

1 Approved Answer

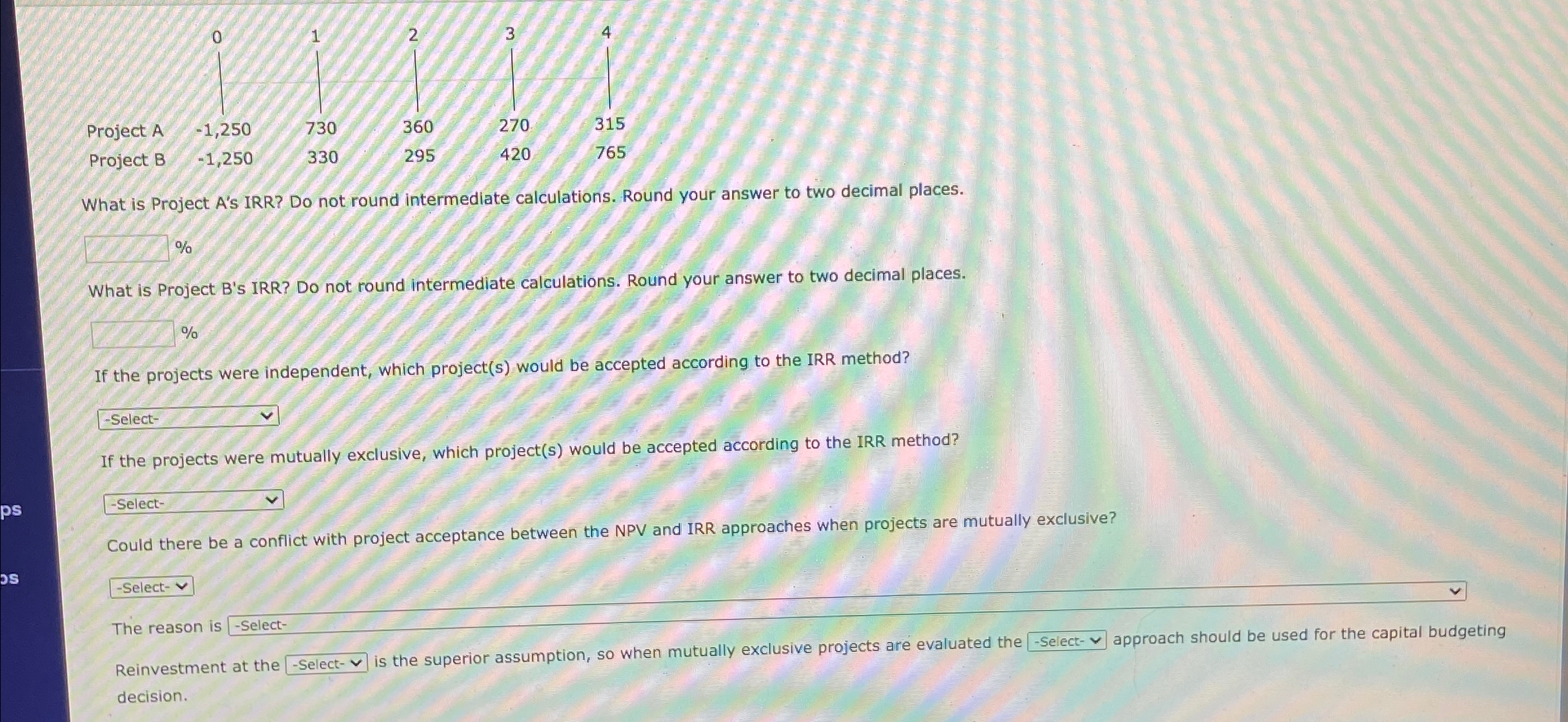

2 3 Project A Project B -1,250 -1,250 730 360 270 330 295 420 315 765 What is Project A's IRR? Do not round

2 3 Project A Project B -1,250 -1,250 730 360 270 330 295 420 315 765 What is Project A's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % ps What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? -Select- If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? -Select- Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? OS -Select- v The reason is -Select- Reinvestment at the -Select- is the superior assumption, so when mutually exclusive projects are evaluated the -Select- approach should be used for the capital budgeting decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started