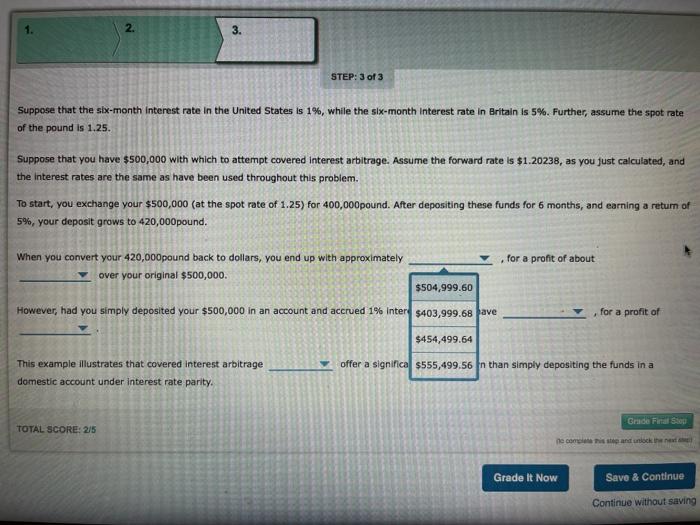

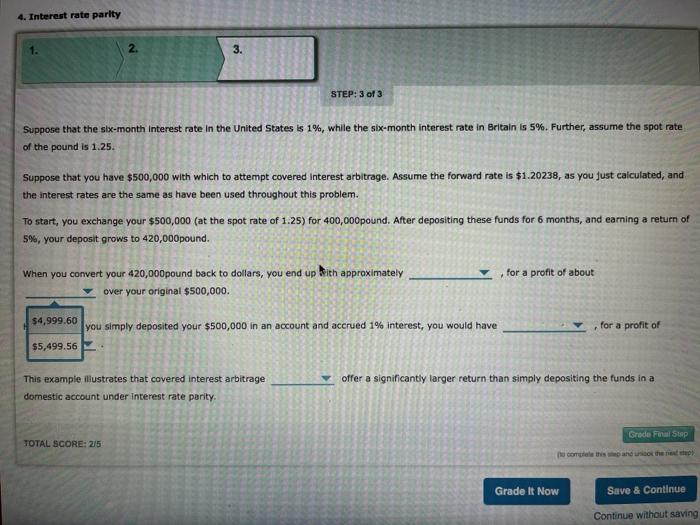

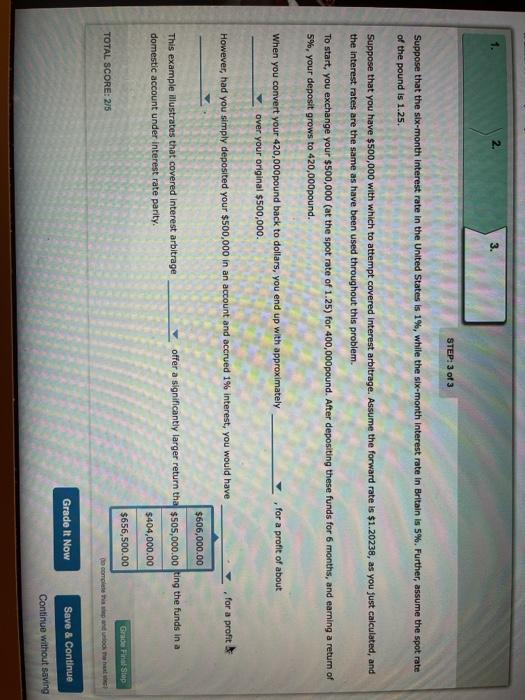

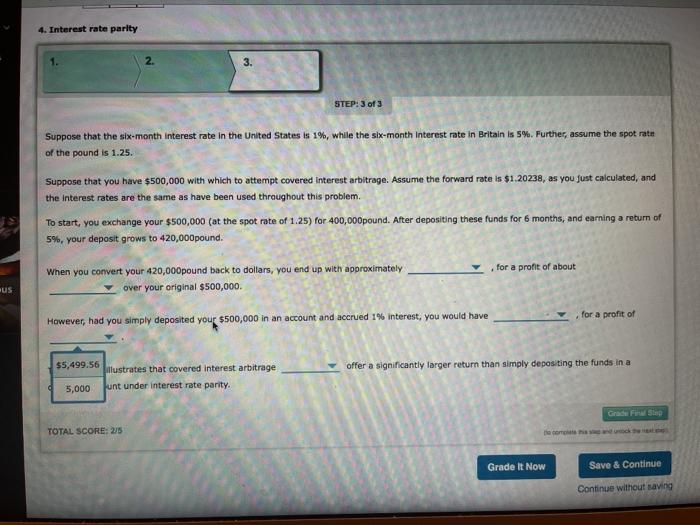

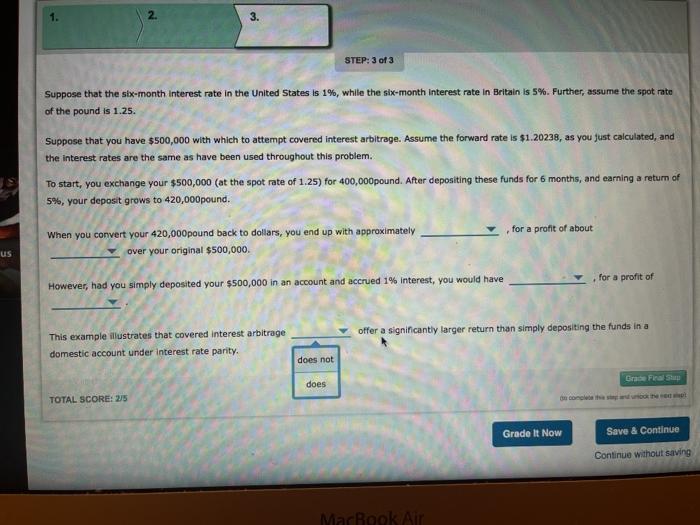

2. 3 STEP: 3 of 3 Suppose that the six-month interest rate in the United States is 1%, while the six-month Interest rate in Britain is 5%. Further, assume the spot rate of the pound is 1.25. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $1.20238, as you just calculated and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of 1.25) for 400,000 pound. After depositing these funds for 6 months, and earning a return of 5%, your deposit grows to 420,000pound. When you convert your 420,000 pound back to dollars, you end up with approximately over your original $500,000. for a profit of about $504,999.60 However, had you simply deposited your $500,000 in an account and accrued 1% Intere 5403,999.68 pave for a profit of $454,499.64 This example illustrates that covered interest arbitrage domestic account under interest rate parity. offer a significa $555,499.56 In than simply depositing the funds in a Grade Final Show TOTAL SCORE: 2/5 ne come this stand unlock the Grade It Now Save & Continue Continue without saving 4. Interest rate parity 2. 3. STEP: 3 of 3 Suppose that the six-month interest rate in the United States is 1%, while the six-month interest rate in Britain is 5%. Further, assume the spot rate of the pound is 1.25. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $1.20238, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of 1.25) for 400,000 pound. After depositing these funds for 6 months, and earning a return of 5%, your deposit grows to 420,000pound. for a profit of about When you convert your 420,000pound back to dollars, you end up Sith approximately over your original $500,000. $4,999.60 for a profit of you simply deposited your $500,000 in an account and accrued 1% interest, you would have $5,499.56 This example illustrates that covered interest arbitrage domestic account under interest rate parity. offer a significantly larger return than simply depositing the funds in a Grade Final Step TOTAL SCORE: 2/5 Grade It Now Save & Continue Continue without saving 3. STEP: 3 of 3 Suppose that the six-month interest rate in the United States is 1%, while the six-month interest rate in Britain is 5%. Further, assume the spot rate of the pound is 1.25. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $1.20238, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of 1.25) for 400,000pound. After depositing these funds for 6 months, and earning a return of 5%, your deposit grows to 420,000pound. for a profit of about When you convert your 420,000 pound back to dollars, you end up with approximately over your original $500,000. However, had you simply deposited your $500,000 in an account and accrued 1% Interest, you would have for a profit $606,000.00 offer a significantly larger return the $505,000.00 ting the funds in a This example illustrates that covered interest arbitrage domestic account under interest rate parity. $404,000.00 $656,500.00 Grade Fine Stop TOTAL SCORE: 2/5 come and what Grade It Now Save & Continue Continue without saving 4. Interest rate parity 3. STEP: 3 of 3 Suppose that the six-month Interest rate in the United States is 1%, while the six-month interest rate in Britain is 5%. Further, assume the spot rate of the pound is 1.25. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $1.20238, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of 1.25) for 400,000pound. After depositing these funds for 6 months, and earning a return of 5%, your deposit grows to 420,000pound. for a profit of about When you convert your 420,000pound back to dollars, you end up with approximately over your original $500,000. US for a profit of However, had you simply deposited your $500,000 in an account and accrued 1% interest, you would have $5,499.56 offer a significantly larger return than simply depositing the funds in a illustrates that covered interest arbitrage unt under interest rate parity. 5,000 Grade Fow Smp TOTAL SCORE: 2/5 Grade It Now Save & Continue Continue without saving 2. 3. STEP: 3 of 3 Suppose that the six-month interest rate in the United States is 1%, while the six-month interest rate in Britain is 5%. Further, assume the spot rate of the pound is 1.25. Suppose that you have $500,000 with which to attempt covered interest arbitrage. Assume the forward rate is $1.20238, as you just calculated, and the interest rates are the same as have been used throughout this problem. To start, you exchange your $500,000 (at the spot rate of 1.25) for 400,000pound. After depositing these funds for 6 months, and earning a return of 5%, your deposit grows to 420,000pound. for a profit of about When you convert your 420,000pound back to dollars, you end up with approximate over your original $500,000. US for a profit of However, had you simply deposited your $500,000 in an account and accrued 1% Interest, you would have offer a significantly larger return than simply depositing the funds in a This example illustrates that covered interest arbitrage domestic account under interest rate parity. does not Grate Final Sup does TOTAL SCORE: 2/5 Grade It Now Save & Continue Continue without saving MacBook Air