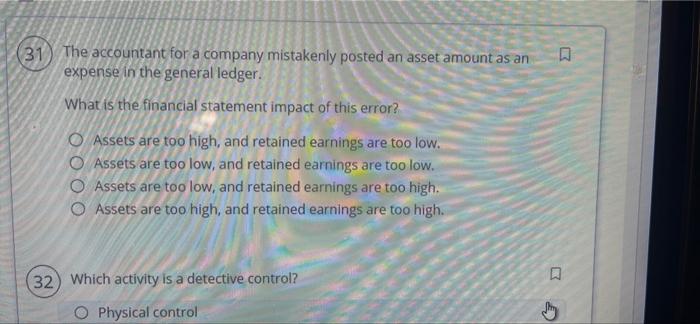

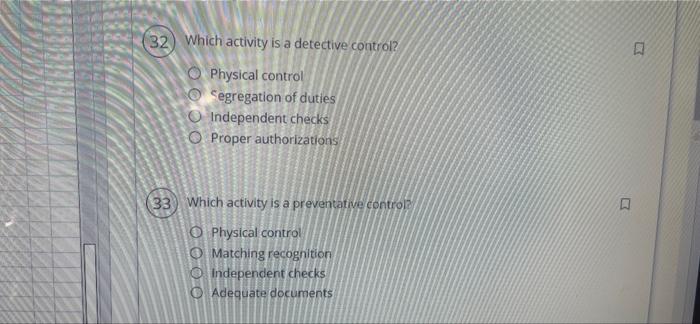

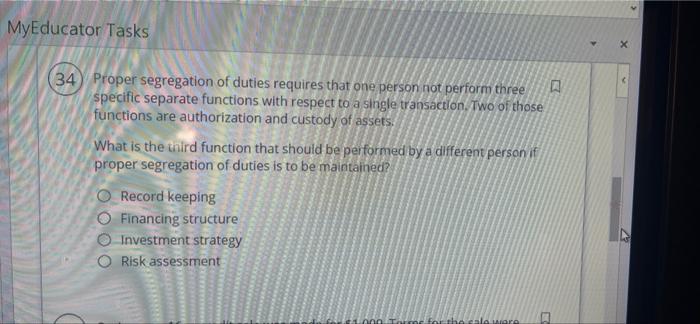

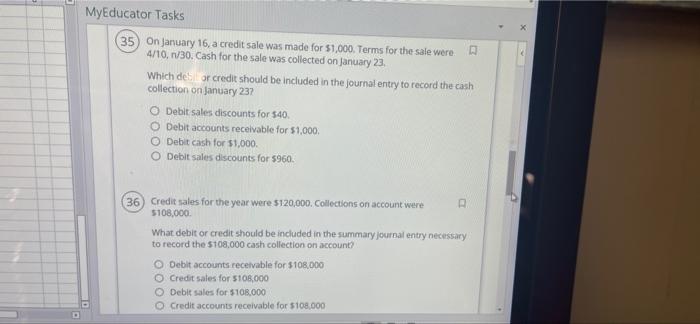

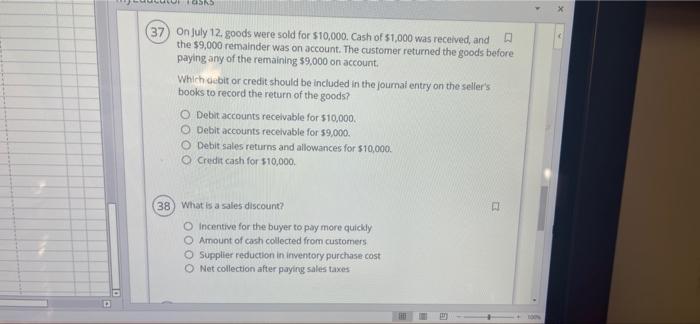

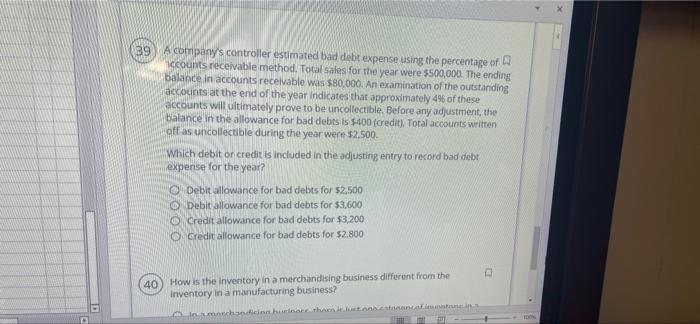

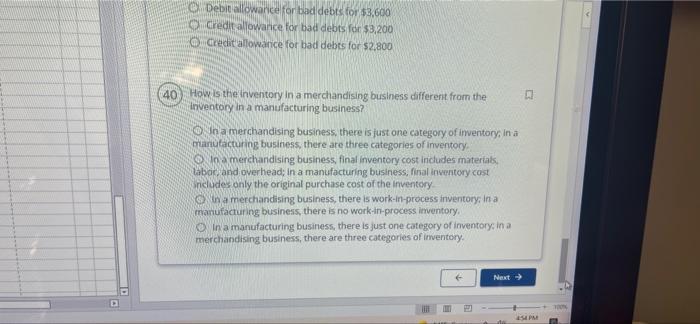

2 (31) The accountant for a company mistakenly posted an asset amount as an expense in the general ledger. What is the financial statement impact of this error? O Assets are too high, and retained earnings are too low. Assets are too low, and retained earnings are too low. Assets are too low, and retained earnings are too high. O Assets are too high, and retained earnings are too high. (32) Which activity is a detective control? Physical control 32 Which activity is a detective control Physical control O Segregation of duties O Independent checks O Proper authorizations 2 33) Which activity is a preventative control O Physical control O Matching recognition o Independent checks Adeguate documents MyEducator Tasks (34) Proper segregation of duties requires that one person not perform three specific separate functions with respect to a single transaction. Two of those functions are authorization and custody of assets. What is the third function that should be performed by a different person if proper segregation of duties is to be maintained? Record keeping O Financing structure Investment strategy Risk assessment For the la MyEducator Tasks 35 On January 16, a credit sale was made for 51,000. Terms for the sale were 4/10. 30. Cash for the sale was collected on January 23 Which des or credit should be included in the journal entry to record the cash collection on January 237 O Debit sales discounts for $40 O Debit accounts receivable for $1,000 O Debit cash for $1,000 Debit sales discounts for 5960 36 Credit sales for the year were $120,000. Collections on account were 5108,000 What debitor credit should be included in the summary journal entry necessary to record the $108,000 cash collection on account? O Debit accounts receivable for $108.000 Credit sales for 5108,000 O Debit sales for $100.000 Credit accounts receivable for $108,000 AND 37) On July 12 goods were sold for $10,000. Cash of $1,000 was received, and the $9,000 remainder was on account. The customer returned the goods before paying any of the remaining $9,000 on account Which debitor credit should be included in the journal entry on the seller's books to record the return of the goods? O Debit accounts receivable for $10,000 Debit accounts receivable for 59,000. O Debit sales returns and allowances for $10,000 o credit cash for $10,000 38) What is a sales discount? Incentive for the buyer to pay more quickly O Amount of cash collected from customers Supplier reduction in inventory purchase cost Net collection after paying sales taxes D 39 A company's controller estimated bad debt expense using the percentage of A accounts receivable method. Total sales for the year were $500,000. The ending balance in accounts receivable was $80.000. An examination of the outstanding accounts at the end of the year indicates that approximately 4% of these accounts will ultimately prove to be uncollectible. Before any adjustment, the Balance in the allowance for bad debts is $400 (credits. Total accounts written off as uncollectible during the year were $2.500 Which debitor credit is included in the adjusting entry to record bad debt expense for the year? O Debit allowance for bad debts for $2,500 Debit allowance for bad debts for $3,600 Credit allowance for bad debts for $3,200 O Credit allowance for bad debts for $2.800 40 How is the inventory in a merchandising business different from the Inventory in a manufacturing business? chance that Debit allowance for bad debts for $3,600 credit allowance for bad debts for $3,200 O Credit allowance for bad debts for $2,800 40 How is the inventory in a merchandising business different from the Inventory in a manufacturing business? on a merchandising business, there is just one category of inventory, in a murtutacturing business, there are three categories of inventory In a merchandising business, final inventory cost includes materials, labor and overhead: In a manufacturing business, final inventory cost ndudes only the original purchase cost of the inventory na merchandising business, there is work-in-process inventory, in a manufacturing business, there is no work-in-process inventory Ona manufacturing business, there is just one category of inventory in a merchandising business, there are three categories of inventory. Next > 1PM