Answered step by step

Verified Expert Solution

Question

1 Approved Answer

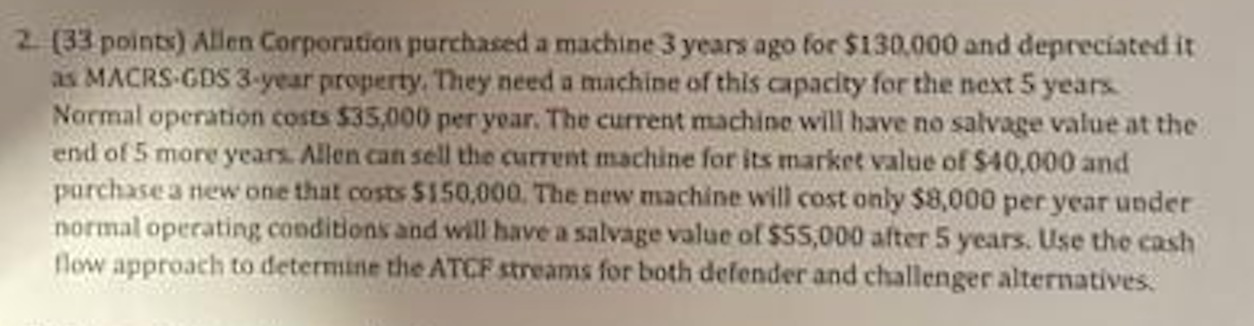

2. (33 points) Allen Corporation purchased a machine 3 years ago for ( $ 130.000 ) and depreciated it as MACRS. GDS 3-year property, They

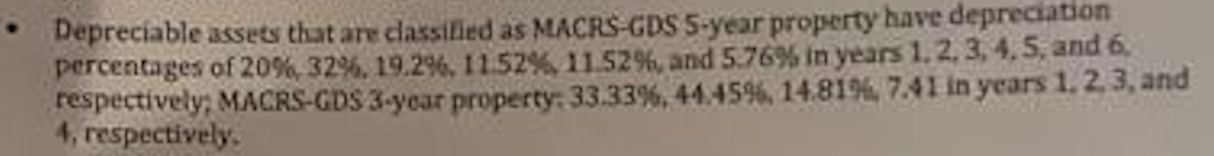

2. (33 points) Allen Corporation purchased a machine 3 years ago for \\( \\$ 130.000 \\) and depreciated it as MACRS. GDS 3-year property, They need a machine of this apacity for the next 5 years Normal operation costs \\( \\$ 35,000 \\) per year. The current machine will have no salvage value at the end of 5 more years. Allen can sell the current machine for its market valte of \\( \\$ 40,000 \\) and parchase a new one that cost 5150,000 , The new machine will cost only \\( \\$ 8,000 \\) per year under normal opecating condibions and will have a salvage value of \\( \\$ 55,000 \\) after 5 years. Use the cash flow approach to deternitie the ATCF streams for both defender and challenger alternatives. Depreciable assets that are dassified as MACRS-GDS S-year property have depreciation percentages of \20 and \5.76 in years \\( 1.2,3,4,5 \\), and 6 . respectively, MACRS-CDS 3 -year property \=33.33 in years \\( 1,2,3 \\), and 4, respectively

2. (33 points) Allen Corporation purchased a machine 3 years ago for \\( \\$ 130.000 \\) and depreciated it as MACRS. GDS 3-year property, They need a machine of this apacity for the next 5 years Normal operation costs \\( \\$ 35,000 \\) per year. The current machine will have no salvage value at the end of 5 more years. Allen can sell the current machine for its market valte of \\( \\$ 40,000 \\) and parchase a new one that cost 5150,000 , The new machine will cost only \\( \\$ 8,000 \\) per year under normal opecating condibions and will have a salvage value of \\( \\$ 55,000 \\) after 5 years. Use the cash flow approach to deternitie the ATCF streams for both defender and challenger alternatives. Depreciable assets that are dassified as MACRS-GDS S-year property have depreciation percentages of \20 and \5.76 in years \\( 1.2,3,4,5 \\), and 6 . respectively, MACRS-CDS 3 -year property \=33.33 in years \\( 1,2,3 \\), and 4, respectively Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started