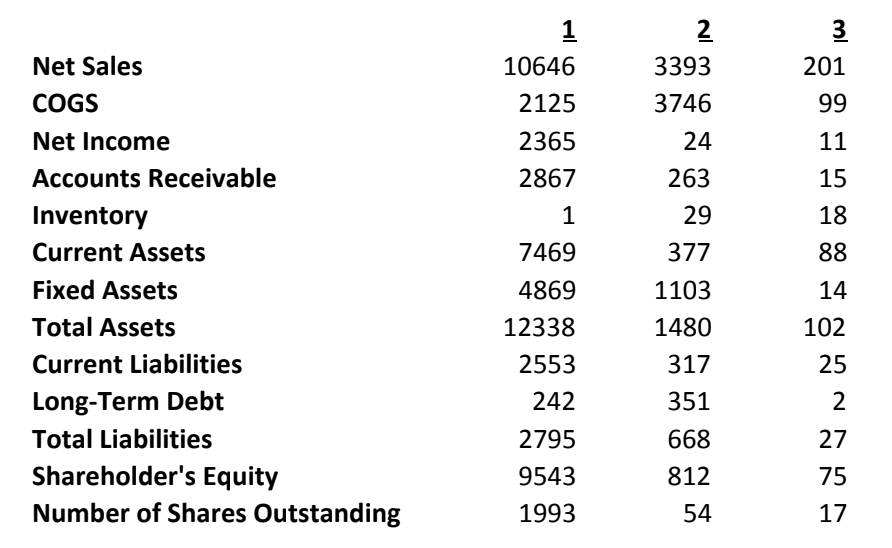

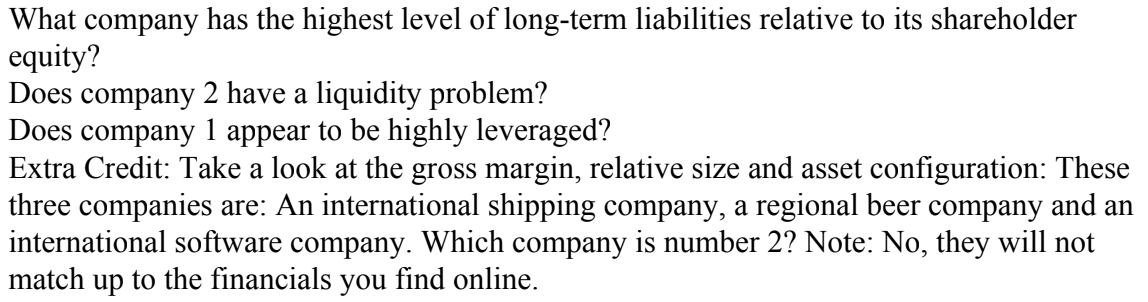

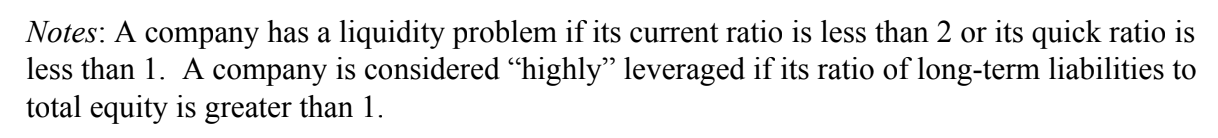

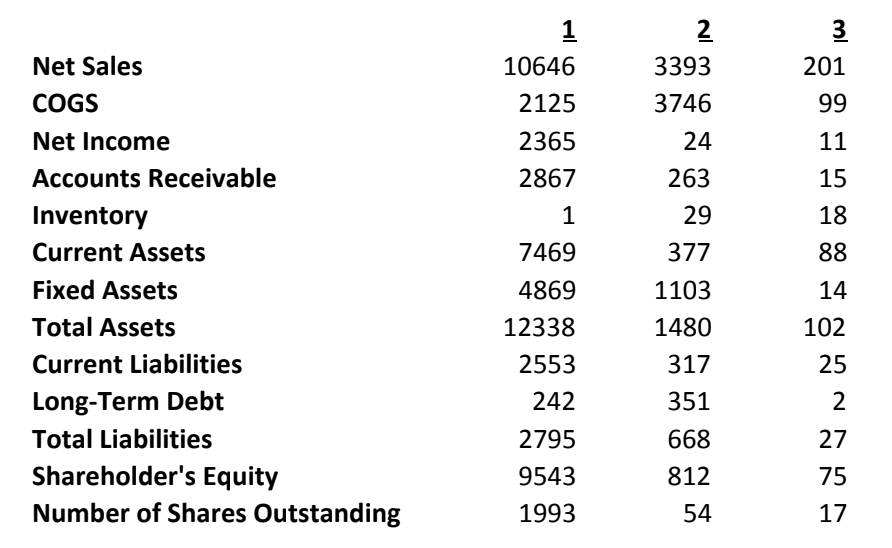

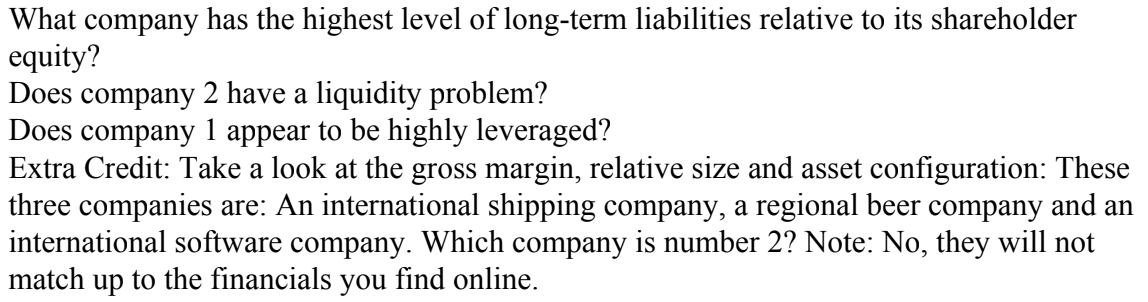

2 3393 3746 24 263 10646 2125 2365 2867 201 99 PP 29 Net Sales COGS Net Income Accounts Receivable Inventory Current Assets Fixed Assets Total Assets Current Liabilities Long-Term Debt Total Liabilities Shareholder's Equity Number of Shares Outstanding 14 7469 4869 12338 2553 242 2795 9543 1993 377 1103 1480 317 351 668 812 102 25 75 17 54 What company has the highest level of long-term liabilities relative to its shareholder equity? Does company 2 have a liquidity problem? Does company 1 appear to be highly leveraged? Extra Credit: Take a look at the gross margin, relative size and asset configuration: These three companies are: An international shipping company, a regional beer company and an international software company. Which company is number 2? Note: No, they will not match up to the financials you find online. Notes: A company has a liquidity problem if its current ratio is less than 2 or its quick ratio is less than 1. A company is considered highly leveraged if its ratio of long-term liabilities to total equity is greater than 1. 2 3393 3746 24 263 10646 2125 2365 2867 201 99 PP 29 Net Sales COGS Net Income Accounts Receivable Inventory Current Assets Fixed Assets Total Assets Current Liabilities Long-Term Debt Total Liabilities Shareholder's Equity Number of Shares Outstanding 14 7469 4869 12338 2553 242 2795 9543 1993 377 1103 1480 317 351 668 812 102 25 75 17 54 What company has the highest level of long-term liabilities relative to its shareholder equity? Does company 2 have a liquidity problem? Does company 1 appear to be highly leveraged? Extra Credit: Take a look at the gross margin, relative size and asset configuration: These three companies are: An international shipping company, a regional beer company and an international software company. Which company is number 2? Note: No, they will not match up to the financials you find online. Notes: A company has a liquidity problem if its current ratio is less than 2 or its quick ratio is less than 1. A company is considered highly leveraged if its ratio of long-term liabilities to total equity is greater than 1