Answered step by step

Verified Expert Solution

Question

1 Approved Answer

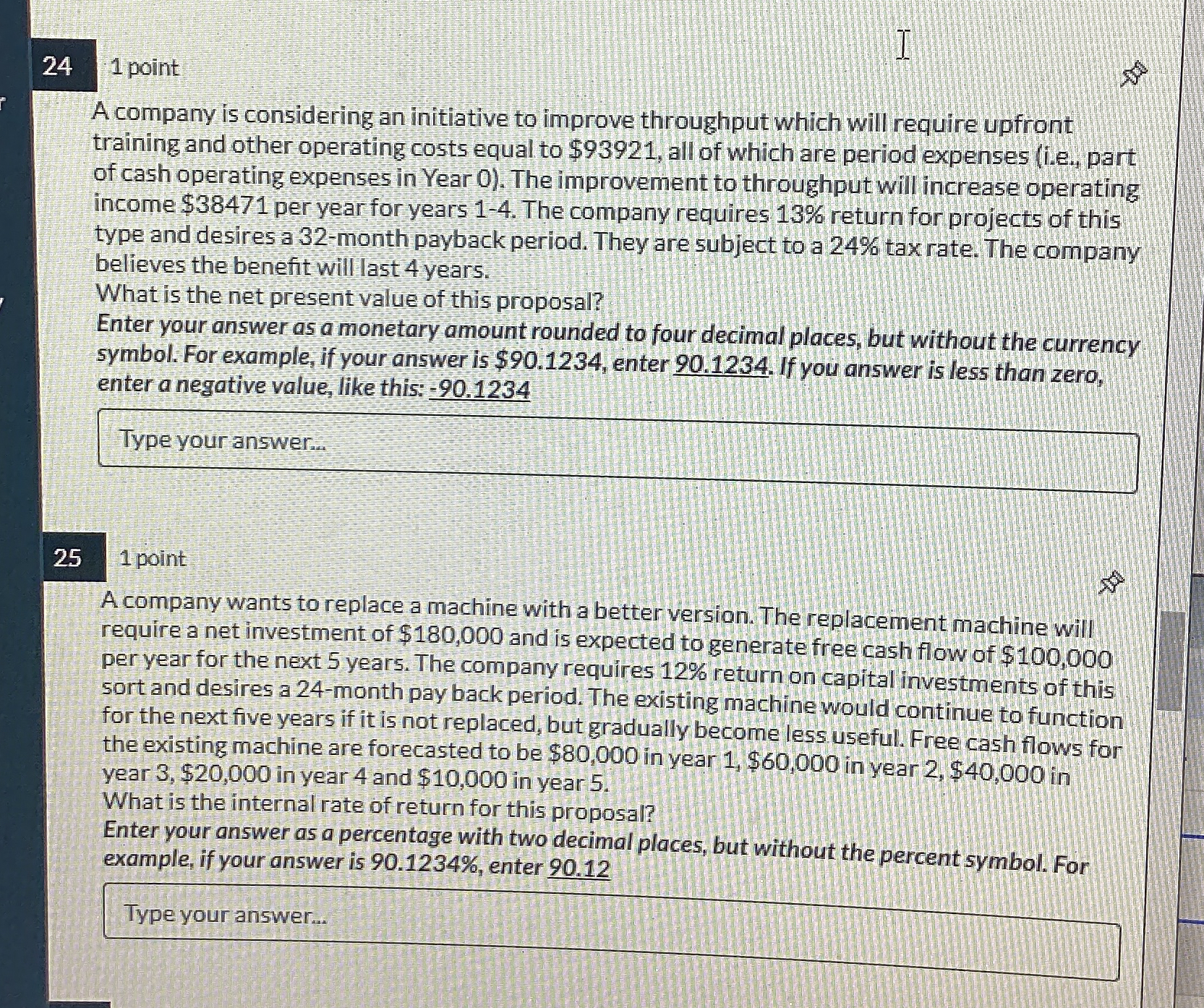

2 4 1 point A company is considering an initiative to improve throughput which will require upfront training and other operating costs equal to $

point

A company is considering an initiative to improve throughput which will require upfront training and other operating costs equal to $ all of which are period expenses ie part of cash operating expenses in Year The improvement to throughput will increase operating income $ per year for years The company requires return for projects of this type and desires a month payback period. They are subject to a tax rate. The company believes the benefit will last years.

What is the net present value of this proposal?

Enter your answer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is $ enter If you answer is less than zero, enter a negative value, like this:

point

A company wants to replace a machine with a better version. The replacement machine will require a net investment of $ and is expected to generate free cash flow of $ per year for the next years. The company requires return on capital investments of this sort and desires a month pay back period. The existing machine would continue to function for the next five years if it is not replaced, but gradually become less useful. Free cash flows for the existing machine are forecasted to be $ in year $ in year $ in year $ in year and $ in year

What is the internal rate of return for this proposal?

Enter your answer as a percentage with two decimal places, but without the percent symbol. For example, if your answer is enter

Type your answer...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started