Answered step by step

Verified Expert Solution

Question

1 Approved Answer

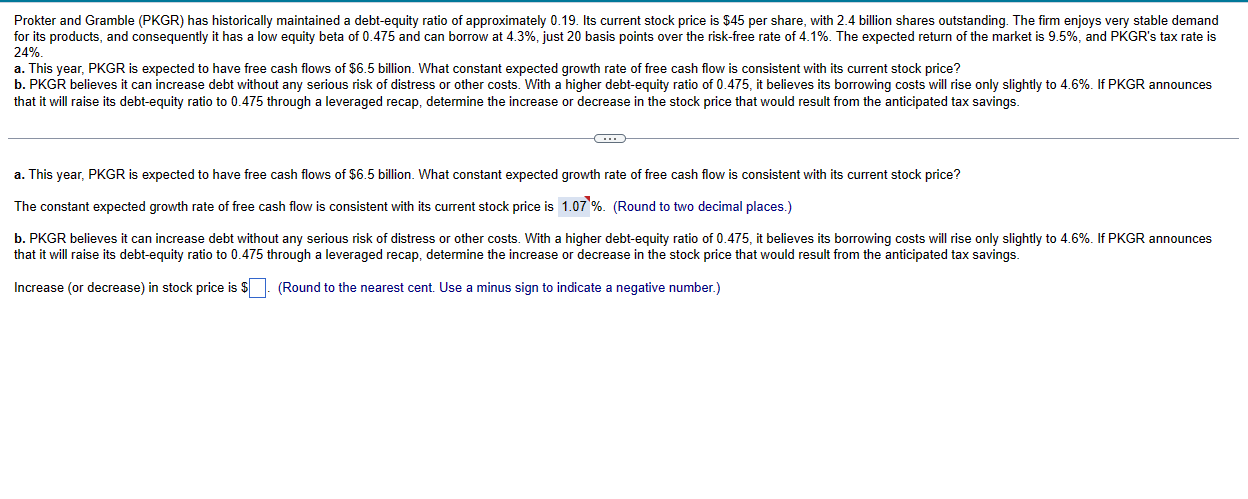

2 4 % . a . This year, PKGR is expected to have free cash flows of $ 6 . 5 billion. What constant expected

a This year, PKGR is expected to have free cash flows of $ billion. What constant expected growth rate of free cash flow is consistent with its current stock

that it will raise its debtequity ratio to through a leveraged recap, determine the increase or decrease in the stock price that would result from the anticipated tax savings.

a This year, PKGR is expected to have free cash flows of $ billion. What constant expected growth rate of free cash flow is consistent with its current stock

The constant expected growth rate of free cash flow is consistent with its current stock price is Round to two decimal places.

that it will raise its debtequity ratio to through a leveraged recap, determine the increase or decrease in the stock price that would result from the anticipated tax savings.

Increase or decrease in stock price is $Round to the nearest cent. Use a minus sign to indicate a negative number.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started