Answered step by step

Verified Expert Solution

Question

1 Approved Answer

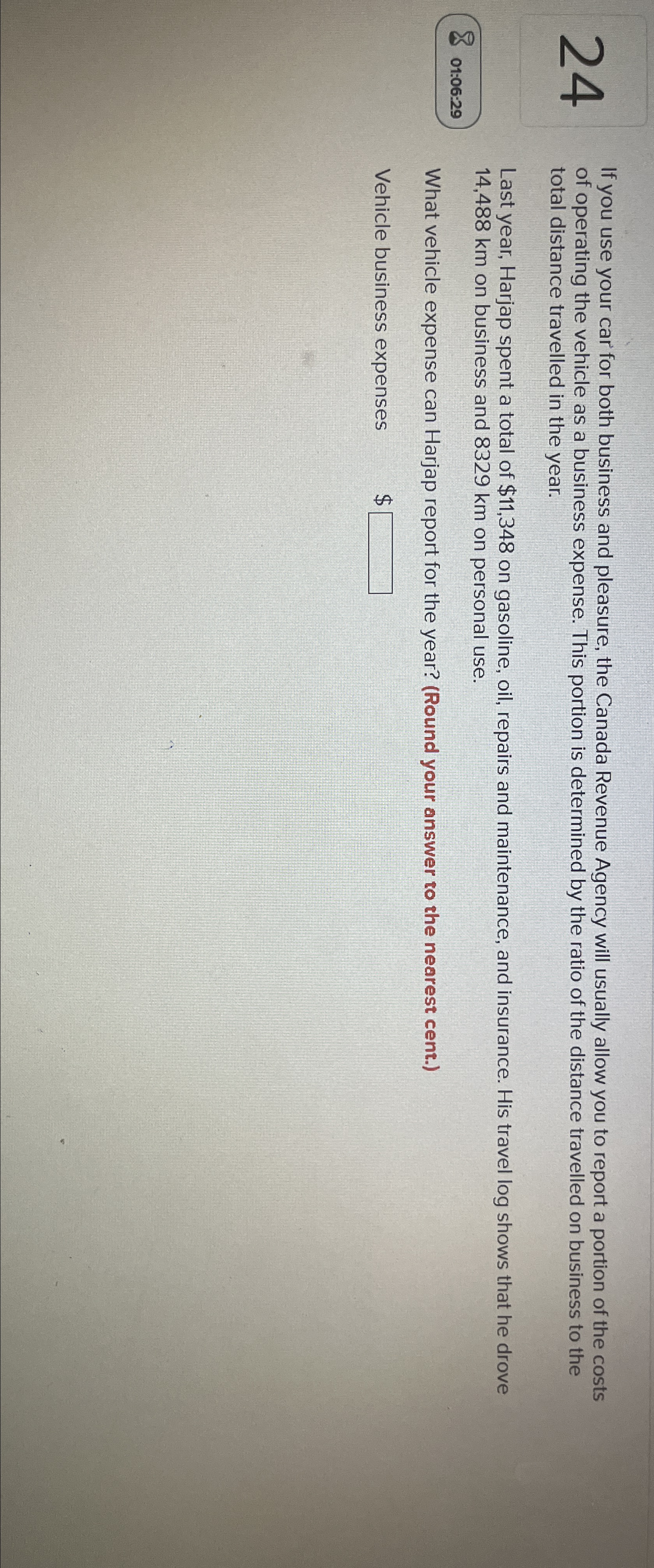

2 4 If you use your car for both business and pleasure, the Canada Revenue Agency will usually allow you to report a portion of

If you use your car for both business and pleasure, the Canada Revenue Agency will usually allow you to report a portion of the costs of operating the vehicle as a business expense. This portion is determined by the ratio of the distance travelled on business to the total distance travelled in the year.

Last year, Harjap spent a total of $ on gasoline, oil, repairs and maintenance, and insurance. His travel log shows that he drove on business and on personal use.

What vehicle expense can Harjap report for the year? Round your answer to the nearest cent.

Vehicle business expenses

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started