Answered step by step

Verified Expert Solution

Question

1 Approved Answer

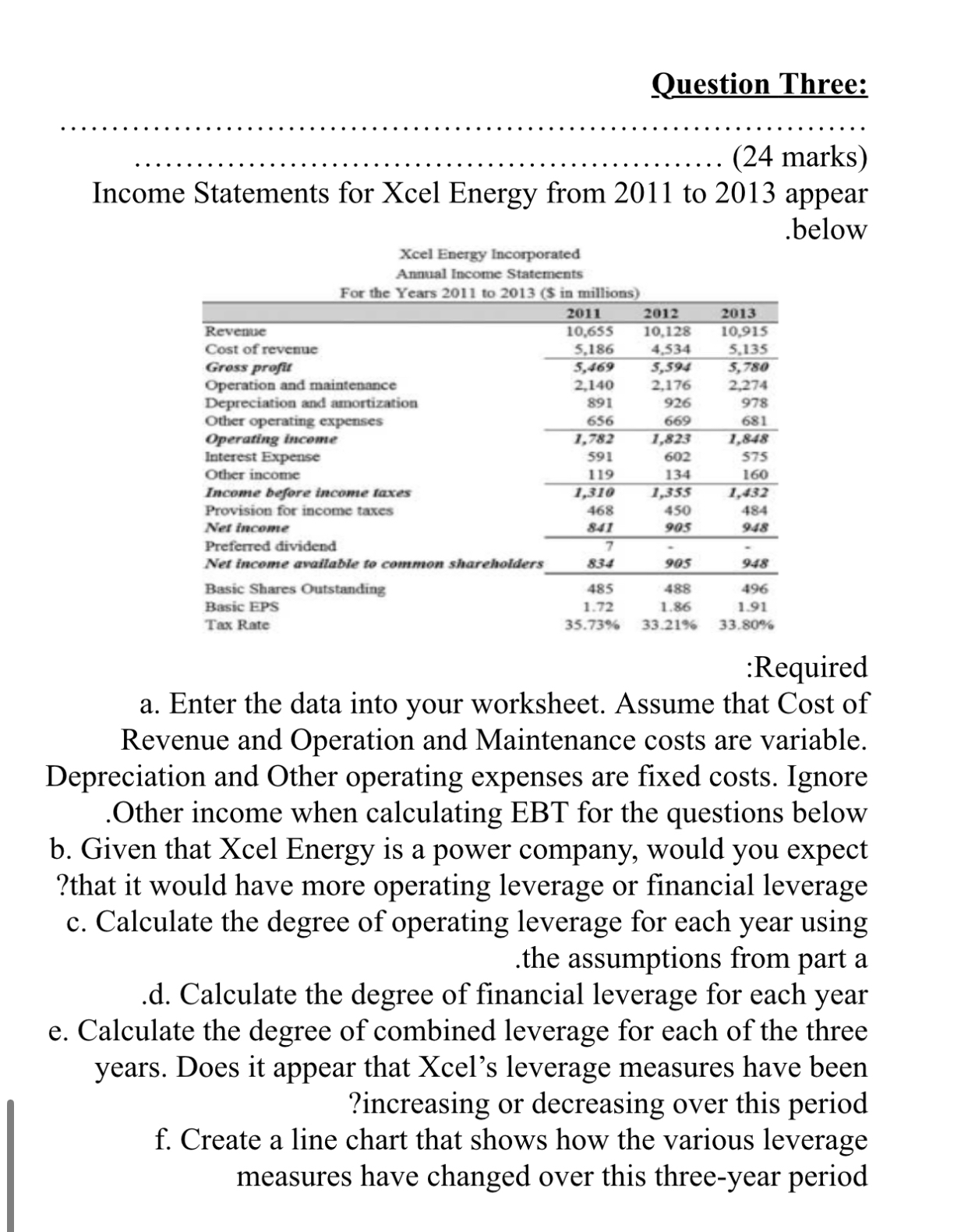

( 2 4 marks ) Income Statements for Xcel Energy from 2 0 1 1 to 2 0 1 3 appear . below Xcel Energy

marks

Income Statements for Xcel Energy from to appear

below

Xcel Energy Incorporated

Annual Income Statements

For the Years to $ in millions

: Required

a Enter the data into your worksheet. Assume that Cost of

Revenue and Operation and Maintenance costs are variable.

Depreciation and Other operating expenses are fixed costs. Ignore

Other income when calculating EBT for the questions below

b Given that Xcel Energy is a power company, would you expect

that it would have more operating leverage or financial leverage

c Calculate the degree of operating leverage for each year using

the assumptions from part a

d Calculate the degree of financial leverage for each year

e Calculate the degree of combined leverage for each of the three

years. Does it appear that Xcel's leverage measures have been

increasing or decreasing over this period

f Create a line chart that shows how the various leverage

measures have changed over this threeyear period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started