Answered step by step

Verified Expert Solution

Question

1 Approved Answer

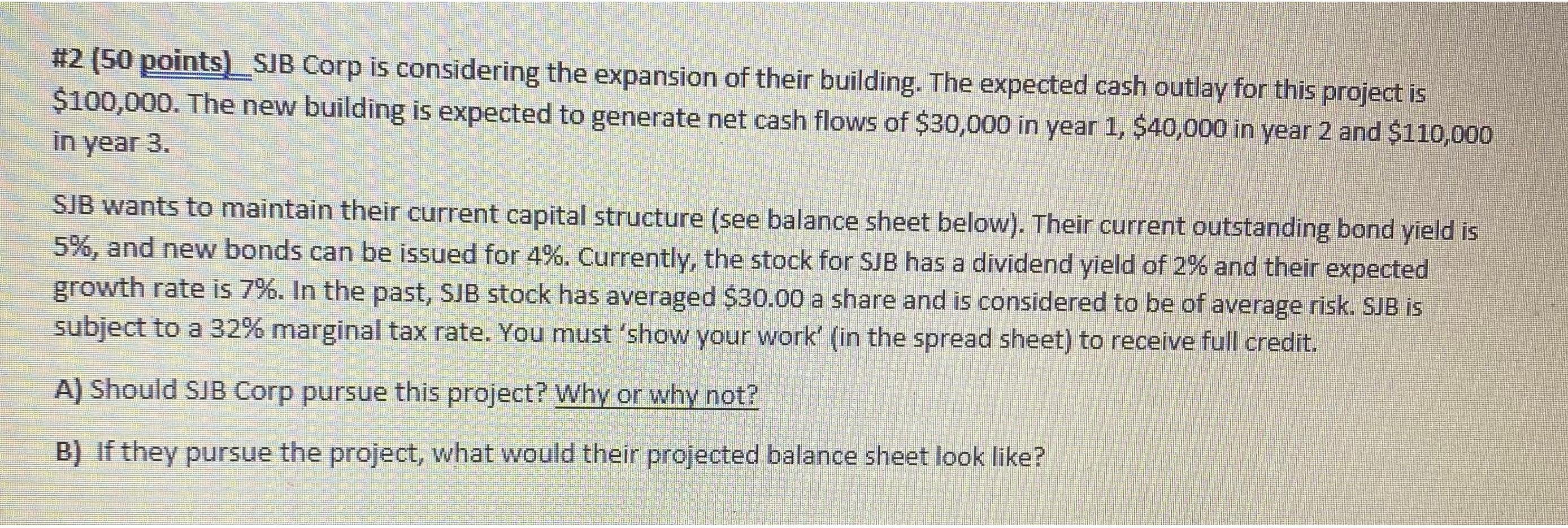

# 2 ( 5 0 points ) _ SJB Corp is considering the expansion of their building. The expected cash outlay for this project is

# pointsSJB Corp is considering the expansion of their building. The expected cash outlay for this project is $ The new building is expected to generate net cash flows of $ in year $ in year and $ in year

SJB wants to maintain their current capital structure see balance sheet below Their current outstanding bond yield is and new bonds can be issued for Currently, the stock for SJB has a dividend yield of and their expected growth rate is In the past, SJB stock has averaged $ a share and is considered to be of average risk. SJB is subject to a marginal tax rate. You must 'show your work' in the spread sheet to receive full credit.

A Should SJB Corp pursue this project? Why or why not?

B If they pursue the project, what would their projected balance sheet look like?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started