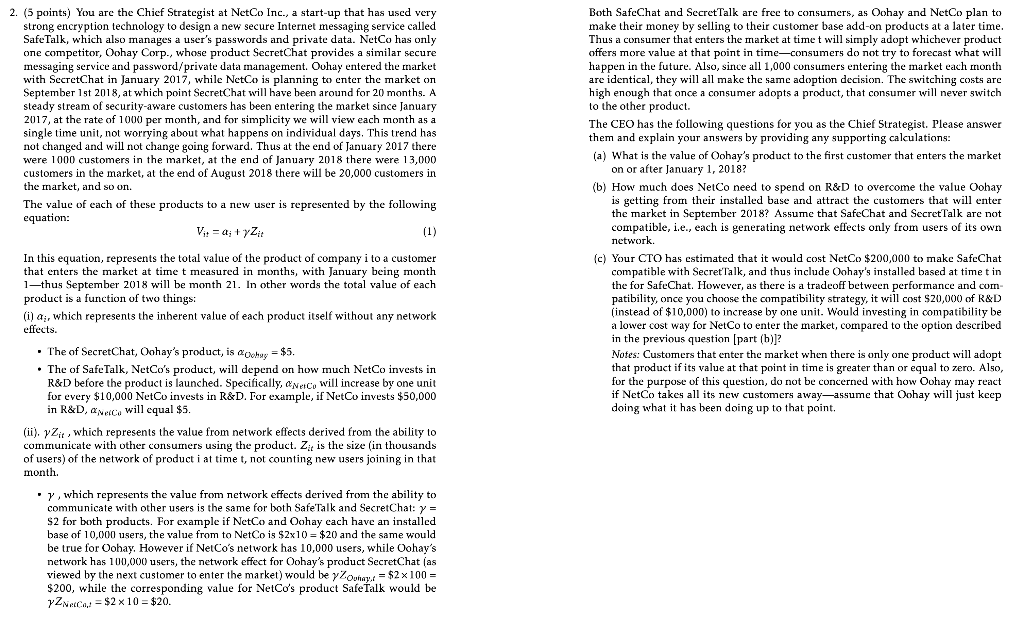

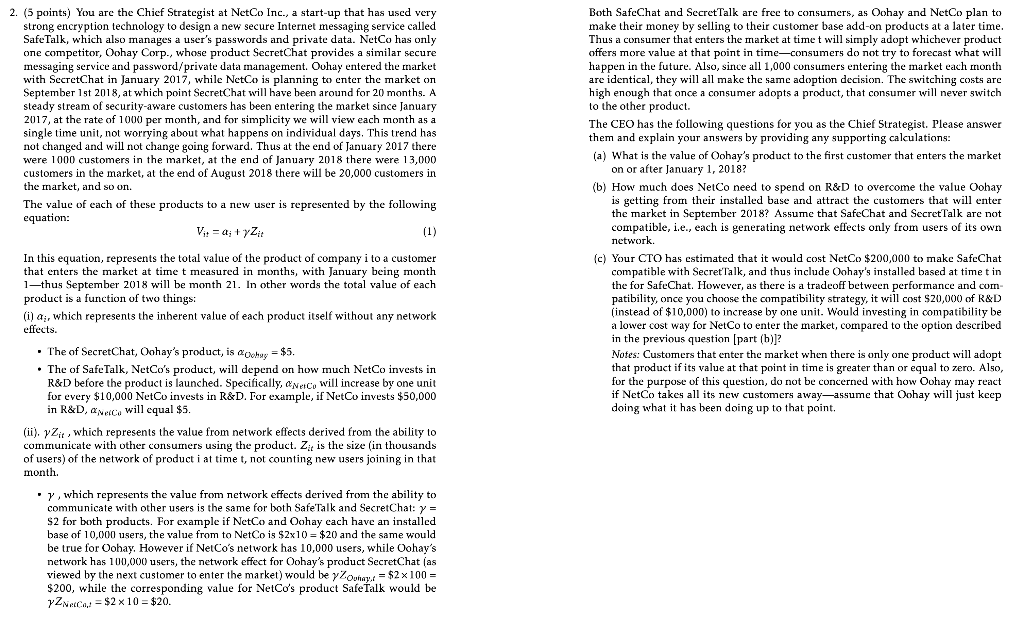

2. (5 points) You are the Chief Strategist at NetCo Inc., a start-up that has used very strong encryption technology to design a new secure Internet messaging service called SafeTalk, which also manages a user's passwords and private data. NetCo has only one competitor, Oohay Corp., whose product SecretChat provides a similar secure messaging service and password/private data management. Ouhay entered the market with SecretChat in January 2017, while NetCo is planning to enter the market on September 1st 2018, at which point SecretChat will have been around for 20 months. A steady stream of security-aware customers has been entering the market since January 2017, at the rate of 1000 per month, and for simplicity we will view each month as a single time unit, not worrying about what happens on individual days. This trend has not changed and will not change going forward. Thus at the end of January 2017 there were 1000 customers in the market, at the end of January 2018 there were 13,000 customers in the market, at the end of August 2018 there will be 20,000 customers in the market, and so on. The value of each these products to a new user is represented by the following equation: Vi: = a; + YZ. In this equation, represents the total value of the product of company i to a customer that enters the market at time t measured in months, with January being month 1-thus September 2018 will be month 21. In other words the total value of each product is a function of two things: (i) a;, which represents the inherent value of each product itself without any network effects. The of SecretChat, Onhay's product, is hy = $5. The of SafeTalk, NetCo's product, will depend on how much NetCo invests in R&D before the product is launched. Specifically, anesco will increase by one unit for every $10,000 NetCo invests in R&D. Tor example, if NetCo invests $50,000 in R&D, aneca will equal $5. (ii). y Zit, which represents the value from network effects derived from the ability to communicate with other consumers using the product. Zic is the size (in thousands of users) of the network of product i at time t, not counting new users joining in that month. . y, which represents the value from network effects derived from the ability to communicate with other users is the same for both SafeTalk and SecretChat: y = $2 for both products. For example if NetCo and Oohay cach have an installed base of 10,000 users, the value from to NetCo is $2x10 = $20 and the same would be true for Oohay. However if NetCo's network has 10,000 users, while Oohay's network has 100,000 users, the network effect for Oohay's product SecretChat (as viewed by the next customer to enter the market) would be y Zouhay.x = $2 x 100 = $200, while the corresponding value for NetCo's product Safe Talk would be Zeca, = $2 x 10 = $20. Both SafeChat and SecretTalk are free to consumers, as Oohay and NetCo plan to make their money by selling to their customer base add-on products at a later time. Thus a consumer that enters the market at time t will simply adopt whichever product offers more value at that point in time-consumers do not try to forecast what will happen in the future. Also, since all 1,000 consumers entering the market each month are identical, they will all make the same adoption decision. The switching costs are high enough that once a consumer adopts a product, that consumer will never switch to the other product. The CEO has the following questions for you as the Chief Strategist. Please answer them and explain your answers by providing any supporting calculations: (a) What is the value of Oohay's product to the first customer that enters the market on or after January 1, 2018? (b) How much does NetCo need to spend on R&D to overcome the value Oohay is getting from their installed base and attract the customers that will enter the market in September 2018? Assume that SafeChat and Secret Talk are not compatible, i.e., each is generating network effects only from users of its own network (c) Your CTO has estimated that would cost NetCo $200,000 to make SafeChat compatible with SecretTalk, and thus include Oohay's installed based time t in the for SafeChat. However, as there is a tradeoff between performance and com- patibility, once you choose the compatibility strategy, it will cost $20,000 of R&D instead of $10,000) to increase by one unit. Would investing in compatibility be a lower cost way for NetCo to enter the market, compared to the option described in the previous question (part (h)]? Notes: Customers that enter the market when there is only one product will adopt that product if its value at that point in time is greater than or equal to zero. Also, for the purpose of this question, do not be concerned with how Ouhay may react if NetCo takes all its new customers awayassume that Oohay will just keep doing what it has been doing up to that point. 2. (5 points) You are the Chief Strategist at NetCo Inc., a start-up that has used very strong encryption technology to design a new secure Internet messaging service called SafeTalk, which also manages a user's passwords and private data. NetCo has only one competitor, Oohay Corp., whose product SecretChat provides a similar secure messaging service and password/private data management. Ouhay entered the market with SecretChat in January 2017, while NetCo is planning to enter the market on September 1st 2018, at which point SecretChat will have been around for 20 months. A steady stream of security-aware customers has been entering the market since January 2017, at the rate of 1000 per month, and for simplicity we will view each month as a single time unit, not worrying about what happens on individual days. This trend has not changed and will not change going forward. Thus at the end of January 2017 there were 1000 customers in the market, at the end of January 2018 there were 13,000 customers in the market, at the end of August 2018 there will be 20,000 customers in the market, and so on. The value of each these products to a new user is represented by the following equation: Vi: = a; + YZ. In this equation, represents the total value of the product of company i to a customer that enters the market at time t measured in months, with January being month 1-thus September 2018 will be month 21. In other words the total value of each product is a function of two things: (i) a;, which represents the inherent value of each product itself without any network effects. The of SecretChat, Onhay's product, is hy = $5. The of SafeTalk, NetCo's product, will depend on how much NetCo invests in R&D before the product is launched. Specifically, anesco will increase by one unit for every $10,000 NetCo invests in R&D. Tor example, if NetCo invests $50,000 in R&D, aneca will equal $5. (ii). y Zit, which represents the value from network effects derived from the ability to communicate with other consumers using the product. Zic is the size (in thousands of users) of the network of product i at time t, not counting new users joining in that month. . y, which represents the value from network effects derived from the ability to communicate with other users is the same for both SafeTalk and SecretChat: y = $2 for both products. For example if NetCo and Oohay cach have an installed base of 10,000 users, the value from to NetCo is $2x10 = $20 and the same would be true for Oohay. However if NetCo's network has 10,000 users, while Oohay's network has 100,000 users, the network effect for Oohay's product SecretChat (as viewed by the next customer to enter the market) would be y Zouhay.x = $2 x 100 = $200, while the corresponding value for NetCo's product Safe Talk would be Zeca, = $2 x 10 = $20. Both SafeChat and SecretTalk are free to consumers, as Oohay and NetCo plan to make their money by selling to their customer base add-on products at a later time. Thus a consumer that enters the market at time t will simply adopt whichever product offers more value at that point in time-consumers do not try to forecast what will happen in the future. Also, since all 1,000 consumers entering the market each month are identical, they will all make the same adoption decision. The switching costs are high enough that once a consumer adopts a product, that consumer will never switch to the other product. The CEO has the following questions for you as the Chief Strategist. Please answer them and explain your answers by providing any supporting calculations: (a) What is the value of Oohay's product to the first customer that enters the market on or after January 1, 2018? (b) How much does NetCo need to spend on R&D to overcome the value Oohay is getting from their installed base and attract the customers that will enter the market in September 2018? Assume that SafeChat and Secret Talk are not compatible, i.e., each is generating network effects only from users of its own network (c) Your CTO has estimated that would cost NetCo $200,000 to make SafeChat compatible with SecretTalk, and thus include Oohay's installed based time t in the for SafeChat. However, as there is a tradeoff between performance and com- patibility, once you choose the compatibility strategy, it will cost $20,000 of R&D instead of $10,000) to increase by one unit. Would investing in compatibility be a lower cost way for NetCo to enter the market, compared to the option described in the previous question (part (h)]? Notes: Customers that enter the market when there is only one product will adopt that product if its value at that point in time is greater than or equal to zero. Also, for the purpose of this question, do not be concerned with how Ouhay may react if NetCo takes all its new customers awayassume that Oohay will just keep doing what it has been doing up to that point