Answered step by step

Verified Expert Solution

Question

1 Approved Answer

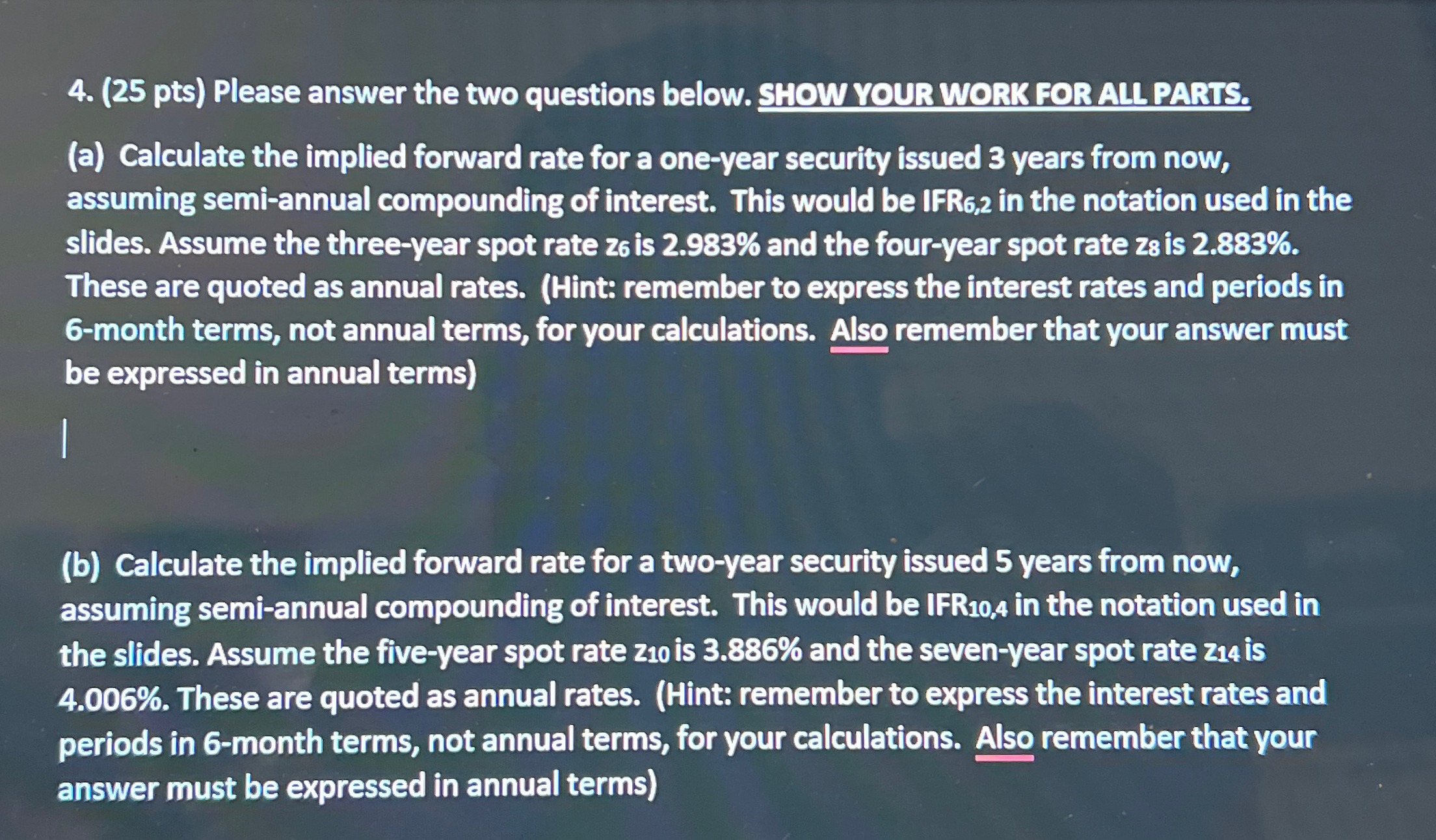

( 2 5 pts ) Please answer the two questions below. SHOW YOUR WORK FOR ALL PARTS. ( a ) Calculate the implied forward rate

pts Please answer the two questions below. SHOW YOUR WORK FOR ALL PARTS.

a Calculate the implied forward rate for a oneyear security issued years from now, assuming semiannual compounding of interest. This would be IFR in the notation used in the slides. Assume the threeyear spot rate is and the fouryear spot rate is These are quoted as annual rates. Hint: remember to express the interest rates and periods in month terms, not annual terms, for your calculations. Also remember that your answer must be expressed in annual terms

b Calculate the implied forward rate for a twoyear security issued years from now, assuming semiannual compounding of interest. This would be IFR in the notation used in the slides. Assume the fiveyear spot rate is and the sevenyear spot rate is These are quoted as annual rates. Hint: remember to express the interest rates and periods in month terms, not annual terms, for your calculations. Also remember that your answer must be expressed in annual terms

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started