Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 5 Table Tools FA.docx- Word Tell me what you want to d ew View EndNote X8 ACROBAT Design Layout Heading 3 1 Normal 1

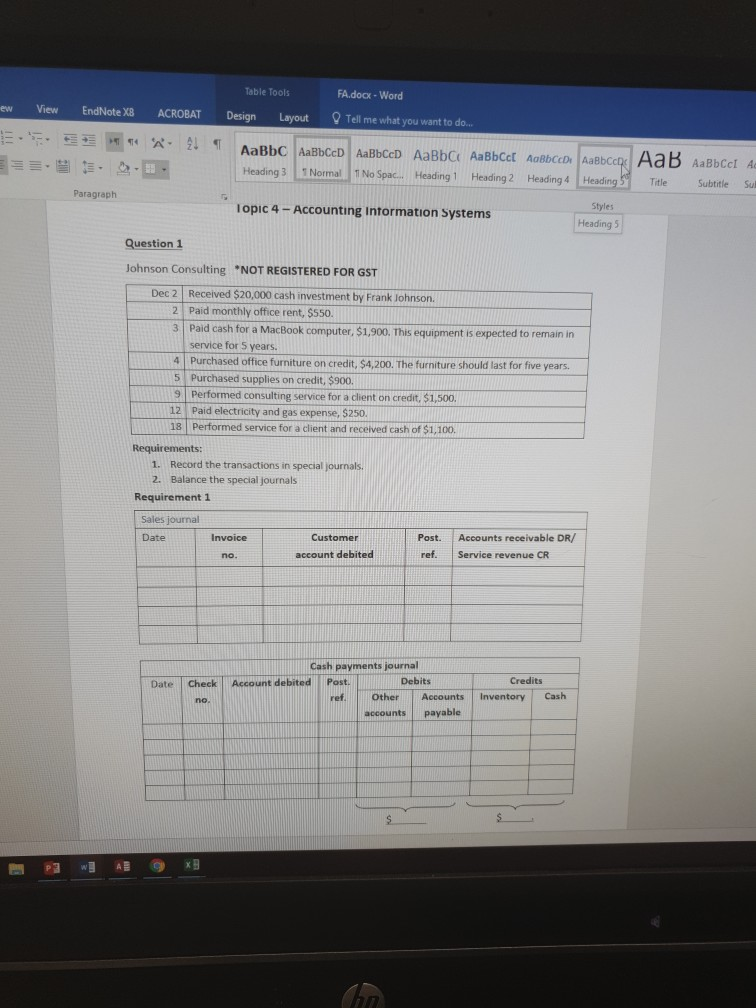

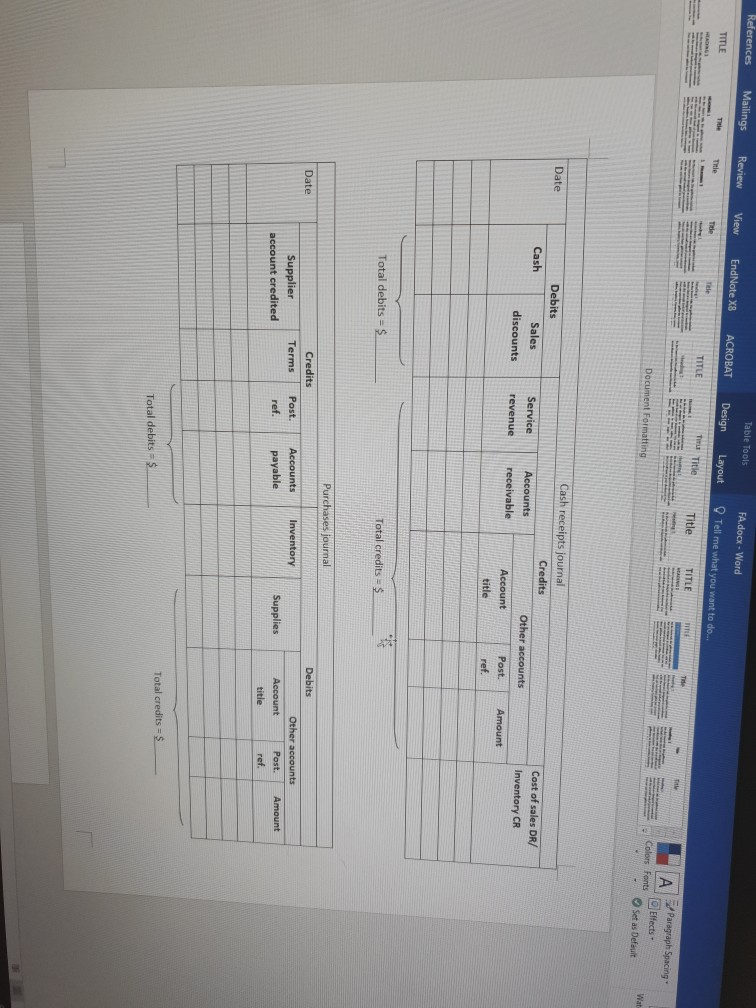

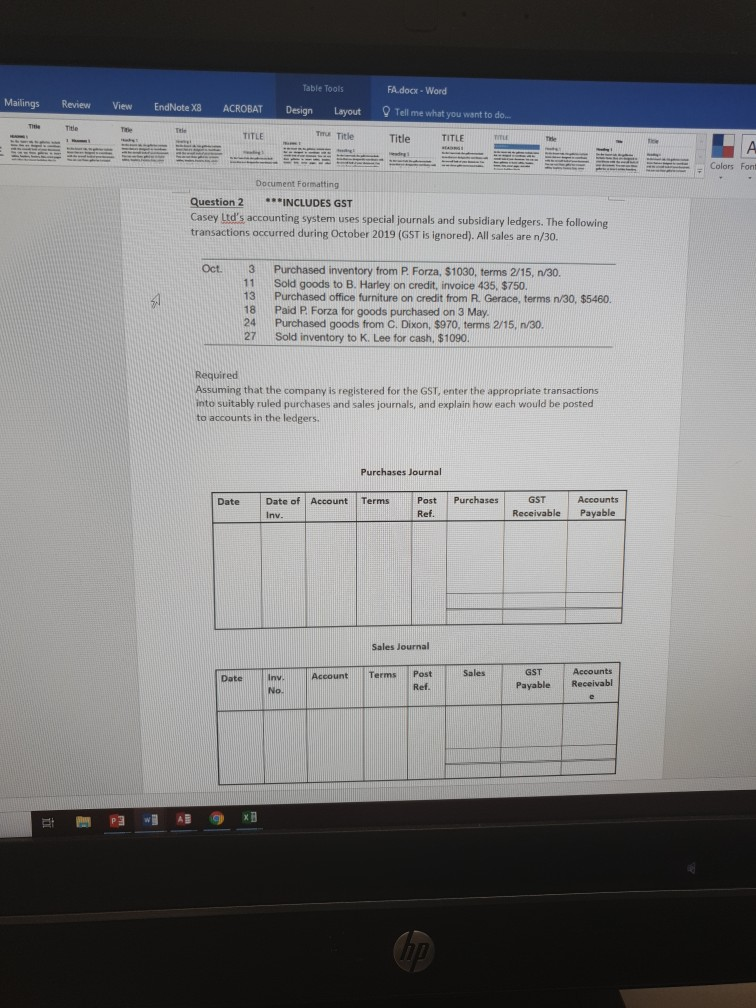

2 5 Table Tools FA.docx- Word Tell me what you want to d ew View EndNote X8 ACROBAT Design Layout Heading 3 1 Normal 1 No Spac.. Heading 1 Heading2 Heading4 Title Subtitle Sul Paragraph Styles Heading 5 lopic 4 -Accounting Intormation Systems Question 1 Johnson Consulting "NOT REGISTERED FOR GST Dec 2 Recelved $20,000 cash investment by Frank Johnson. Paid monthly office rent, $550. 3 Paid cash for a N service for 5 years. 4Purchased office furniture on credit. $4.200. The furniture should last for five years Purchased supplies on credit, $900. Performed consulting service for a client on credit, $1,500. 12 Paid electricity and gas expense, $250 18 Performed service for a client and received cash of $1,100 Requirements: 1. Record the transactions in special journals 2. Balance the special journals Requirement 1 Sales journal Date Post. Accounts receivable DR/ ref. Service revenue CR Invoice Customer account debited Cash payments journal Date Check Account debited Post Debits Credits refOther Accounts InventoryCash accounts payable able Tools FA.docx- Word e X8 TITLE TITLE Title TITLE Fonts Effects Set as Defauit Date Debits Sales ServiceAccounts discountsrevenuereceivable AccountPost. Amount Cash Inventory CR title Total debits- nal Debits Credits Date Other accounts Terms Post. Accounts Inventory Supplies Account Post. Amount ref. payable title ref. Total credits-$ Total debits Table Tools FA.docx- Word Review View EndNote Xa ACROBAT Design Layout Tell me what you want to do. Title Tmu Title TITLE Colors Font Document Formatting Question 2 NCLUDES GST Casey Ltd's accounting system uses special journals and subsidiary ledgers. The following transactions occurred during October 2019 (GST is ignored). All sales are n/30. 3 11 Oct. Purchased inventory from P Forza, $1030, terms 2/15, n/30. Sold goods to B. Harley on credit, invoice 435, $750. Purchased office furniture on credit from Gerace, terms n/30, $5460. 18 Paid P. Forza for goods purchased on 3 May. 24 Purchased goods from C. Dixon, $970, terms 2/15, n/30. 27 Sold inventory to K. Lee for cash, $1090. Required Assuming that the company is registered for the GST, enter the appropriate transactions into suitably ruled purchases and sales journals, and explain how each would be posted to accounts in the ledgers. Purchases Journal Date Date of Account Terms Post Purchases GST Accounts Receivable Payable Ref. Sales Journal GST Date Inv- || Account Terms PostSales Ref Payable Receivabl Table Tools FA.docx- Word lings Review View EndNote X8 ACROBAT Design Layout Tell me what you want to d.o. Tnle Tide Title TITLE Tmx Title Title TITLE TITE Document Formatting Postings explanation: Purchases Journal: Sales Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started