Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) [50] FlexSteal, marketed as a miracle baldness cure, is manufactured at two plants that are struggling to keep up with the demand at the

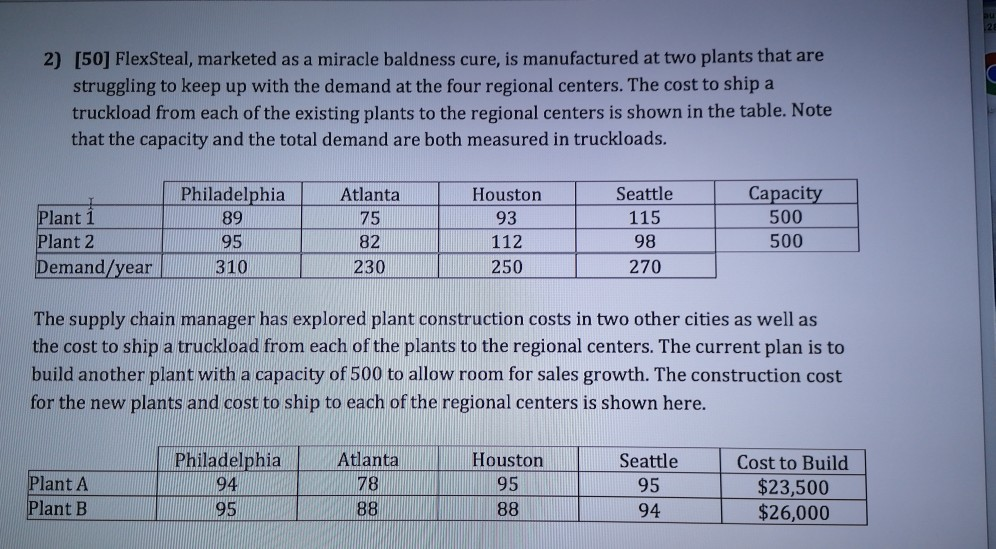

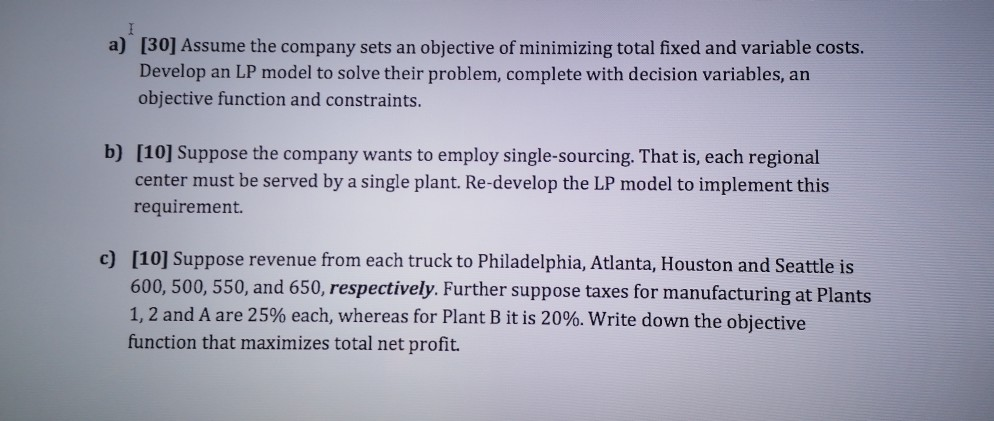

2) [50] FlexSteal, marketed as a miracle baldness cure, is manufactured at two plants that are struggling to keep up with the demand at the four regional centers. The cost to ship a truckload from each of the existing plants to the regional centers is shown in the table. Note that the capacity and the total demand are both measured in truckloads. Plant i Philadelphia 89 95 310 Atlanta 75 82 230 Houston 93 112 250 Seattle 115 98 270 Capacity 500 500 Plant 2 Demand/year The supply chain manager has explored plant construction costs in two other cities as well as the cost to ship a truckload from each of the plants to the regional centers. The current plan is to build another plant with a capacity of 500 to allow room for sales growth. The construction cost for the new plants and cost to ship to each of the regional centers is shown here. Plant A Plant B Philadelphia 94 95 Atlanta 78 88 Houston 95 88 Seattle 95 94 Cost to uild $23,500 $26,000 a) [30] Assume the company sets an objective of minimizing total fixed and variable costs. Develop an LP model to solve their problem, complete with decision variables, an objective function and constraints. b) [10] Suppose the company wants to employ single-sourcing. That is, each regional center must be served by a single plant. Re-develop the LP model to implement this requirement. c) [10] Suppose revenue from each truck to Philadelphia, Atlanta, Houston and Seattle is 600, 500, 550, and 650, respectively. Further suppose taxes for manufacturing at Plants 1, 2 and A are 25% each, whereas for Plant B it is 20%. Write down the objective function that maximizes total net profit. 2) [50] FlexSteal, marketed as a miracle baldness cure, is manufactured at two plants that are struggling to keep up with the demand at the four regional centers. The cost to ship a truckload from each of the existing plants to the regional centers is shown in the table. Note that the capacity and the total demand are both measured in truckloads. Plant i Philadelphia 89 95 310 Atlanta 75 82 230 Houston 93 112 250 Seattle 115 98 270 Capacity 500 500 Plant 2 Demand/year The supply chain manager has explored plant construction costs in two other cities as well as the cost to ship a truckload from each of the plants to the regional centers. The current plan is to build another plant with a capacity of 500 to allow room for sales growth. The construction cost for the new plants and cost to ship to each of the regional centers is shown here. Plant A Plant B Philadelphia 94 95 Atlanta 78 88 Houston 95 88 Seattle 95 94 Cost to uild $23,500 $26,000 a) [30] Assume the company sets an objective of minimizing total fixed and variable costs. Develop an LP model to solve their problem, complete with decision variables, an objective function and constraints. b) [10] Suppose the company wants to employ single-sourcing. That is, each regional center must be served by a single plant. Re-develop the LP model to implement this requirement. c) [10] Suppose revenue from each truck to Philadelphia, Atlanta, Houston and Seattle is 600, 500, 550, and 650, respectively. Further suppose taxes for manufacturing at Plants 1, 2 and A are 25% each, whereas for Plant B it is 20%. Write down the objective function that maximizes total net profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started