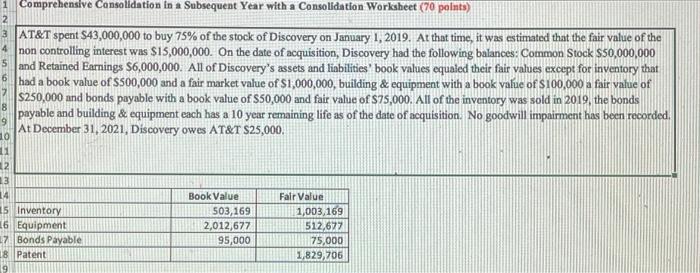

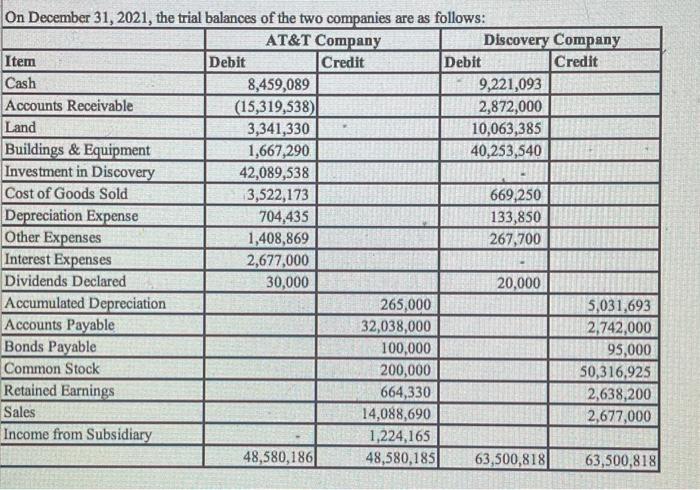

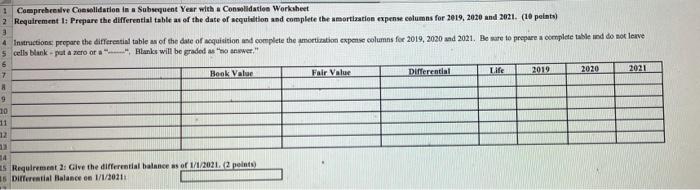

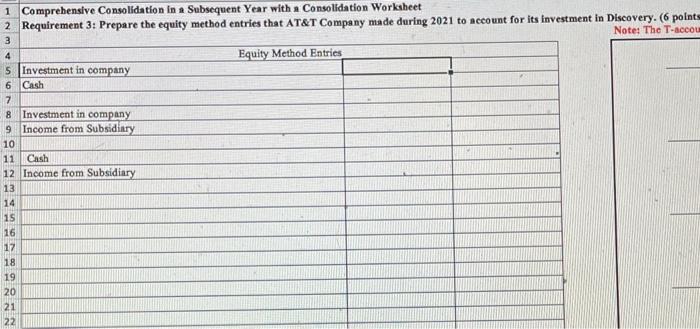

2 6 8 1 Comprehensive Consolidation in a Subsequent Year with a Consolidation Worksheet (70 points AT&T spent $43,000,000 to buy 75% of the stock of Discovery on January 1, 2019. At that time, it was estimated that the fair value of the A non controlling interest was $15,000,000. On the date of acquisition, Discovery had the following balances: Common Stock 50,000,000 and Retained Earnings $6,000,000. All of Discovery's assets and liabilities' book values equaled their fair values except for inventory that had a book value of $500,000 and a fair market value of $1,000,000, building & equipment with a book value of $100.000 a fair value of $250,000 and bonds payable with a book value of $50,000 and fair value of $75,000. All of the inventory was sold in 2019, the bonds payable and building & equipment cach has a 10 year remaining life as of the date of nequisition. No goodwill impairment has been recorded. At December 31, 2021, Discovery owes AT&T $25,000. 10 11 2 13 14 Book Value Fair Value 15 Inventory 503,169 1,003,169 16 Equipment 2,012,677 512,677 17 Bonds Payable 95,000 175,000 18 Patent 1,829,706 On December 31, 2021, the trial balances of the two companies are as follows: AT&T Company Discovery Company Item Debit Credit Debit Credit Cash 8,459,089 9,221,093 Accounts Receivable (15,319,538) 2,872,000 Land 3,341,330 10,063,385 Buildings & Equipment 1,667,290 40,253,540 Investment in Discovery 42,089,538 Cost of Goods Sold 3,522,173 669,250 Depreciation Expense 704,435 133,850 Other Expenses 1,408,869 267,700 Interest Expenses 2,677,000 Dividends Declared 30,000 20,000 Accumulated Depreciation 265,000 5,031,693 Accounts Payable 32,038,000 2,742,000 Bonds Payable 100,000 95,000 Common Stock 200,000 50,316,925 Retained Earnings 664,330 2,638,200 Sales 14,088,690 2,677,000 Income from Subsidiary 1,224,165 48,580,186 48,580,185 63,500,818 63,500,818 1 Comprehensive Consolidation is a Subsquent Year with Consolidation Worksheet 2 Requirement I: Prepare the differential table of the date of equation and complete the amortization expense columns for 2019, 2020 and 2021. (10 points) Instructions prepare the differential table of the date of equisition and complete the most expense columns for 2019, 2020 and 2021. Be sure to prepare a complete table and do not leave s cells blankprat a zero or a Blanks will be graded as onswer." ra 6 7 Hook Value Fair Value Differential Life 2019 2020 2021 8 9 10 11 12 Es Requirement 2: Give the differential balance as of 1/1/2021, 2 points) 36 Differential Balance on 1/1/2011 1 Comprehensive Consolidation in a Subsequent Year with a Consolidation Worksheet 2 Requirement 3: Prepare the equity method entries that AT&T Company made during 2021 to account for its investment in Discovery. (6 points 3 Note: The T-SCOL 4 Equity Method Entries 5 Investment in company 6 Cash 7 8 Investment in company 9 Income from Subsidiary 10 11 Cash 12 Income from Subsidiary 13 14 15 16 17 18 19 20 21 22