Answered step by step

Verified Expert Solution

Question

1 Approved Answer

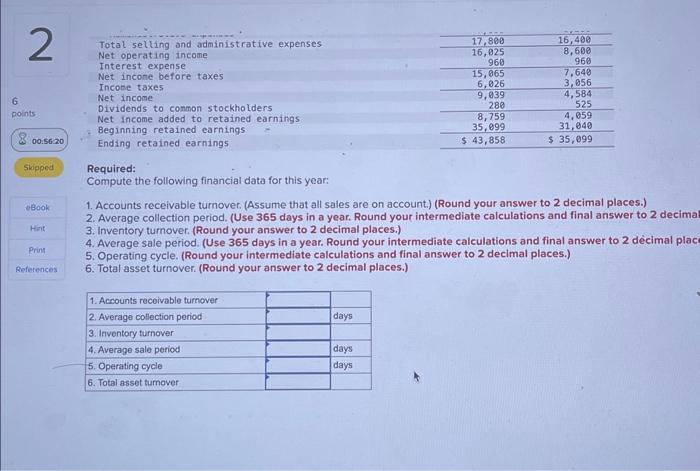

2 6 points Total selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes Net income Dividends to common

2 6 points Total selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes Net income Dividends to common stockholders Net income added to retained earnings Beginning retained earnings 800.5620) Ending retained earnings Skipped Required: Compute the following financial data for this year: 17,800 16,025 16,400 8,600 960 960 15,065 7,640 6,026 3,056 9,039 4,584 280 525 8,759 4,059 35,099 31,040 $ 43,858. $ 35,099 eBook Hint Print References 1. Accounts receivable turnover. (Assume that all sales are on account.) (Round your answer to 2 decimal places.) 2. Average collection period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal 3. Inventory turnover. (Round your answer to 2 decimal places.) 4. Average sale period. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 dcimal place 5. Operating cycle. (Round your intermediate calculations and final answer to 2 decimal places.) 6. Total asset turnover. (Round your answer to 2 decimal places.) 1. Accounts receivable turnover 2. Average collection period 3. Inventory turnover 4. Average sale period 5. Operating cycle 6. Total asset turnover days days days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the requested financial data I will use the information provided in the income statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started